The market environment has been very challenging for the income investors. Traditional income assets currently produce miniscule yields and some even fail to deliver above-inflation returns. Search for higher yields sometimes lures investors to risky assets.

Many high-yielding investments had positive returns during the first-half of this year, as interest rates plunged despite Fed’s taper. That situation may change if interest rates start creeping up, particularly in view of rising inflation worries. Further, most of these assets now look expensive compared to their growth potential. MLPs represent an attractive investment option for income-focused investors in the current environment. In addition to high yields (~4% to 6% currently), MLPs have relatively stable cash flows and solid growth potential. Further, research suggests that there is no material correlation between interest rates and MLPs’ performance.

Energy production boom in the US remains the long-term growth driver for MLPs. With their spectacular returns of 366% during the last 10 years (Alerian MLP Index return), it is not surprising that MLPs have surged in popularity in recent years.

However MLPs are complicated structures and investors need to understand them properly before investing.

Why invest in MLPs?

Most MLPs are in involved in processing and transportation of energy commodities such as natural gas, crude oil, and refined products, under long term contracts.

As such they have relatively consistent and predictable cash flows, unlike exploration and production (E&P) companies, whose profits are highly correlated with commodity prices.

As MLPs are structured as pass-through entities—they do not pay taxes at the entity level and are thus are able to pay out most of their earnings to investors.

Further, MLPs have low correlations with many other asset classes including equities and commodities and thus add diversification benefits to the portfolios.

As the energy industry continues to evolve and grow with revolutionary developments in the field of unconventional energy, MLPs represent a great way to benefit from the growth.

MLPs and Rising Rates

Like all high income products, MLPs also tend to react negatively to rise in interest rates initially. But research shows there is no material correlation between 10-year treasury rates and Alerian MLP index performance in the longer-term.

One of the reasons is that many MLPs use fixed rate debt for majority of their borrowings. Another reason could be that investors hold MLPs for a long time due to tax consequences and thus they do not have a significant adverse reaction to rising interest rates unlike other rate sensitive assets like Utilities and REITs.

At the same time, MLP asset class does not have a long history and we have not seen materially rising interest rates since MLPs have been in existence. However, since they have been around, we have not seen any significant correlation with interest rates.

Tax Issues

MLPs come with complicated tax issues and many investors avoid investing in them only due to daunting tax requirements. MLPs issue complicated K-1s and further, since the pipelines run through several states, the investors may be required to file tax returns for all those states, in some cases.

Thankfully for the investors, some of the tax complexities can be avoided by owning them in ETP form. The payouts by the ETPs are reported as ordinary income on Form 1099, and therefore the K-1 forms are not required.

MLP ETFs or ETNs?

Funds that have more than 25% of their assets invested in MLPs are treated as C corporations for tax purposes. Further, the assets are required to be marked to market and a deferred tax liability for the unrealized gains needs to be recorded.

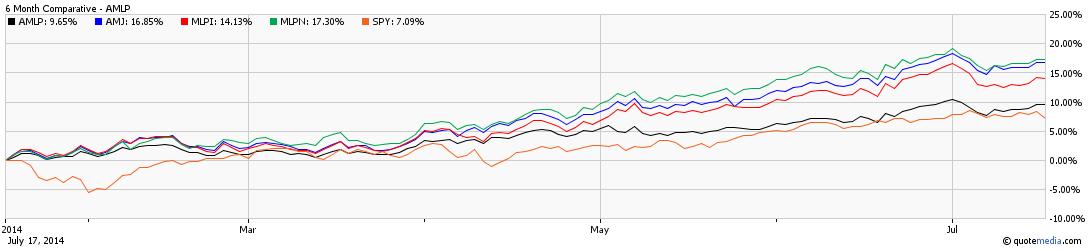

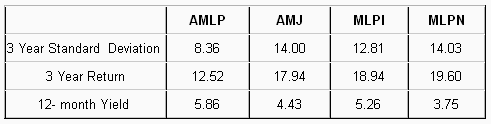

As a result, MLP ETFs have significant tracking errors. Most popular MLP ETF Alerian MLP ETF (NYSE:AMLP)) has returned 59.43% since inception, while the underlying index returned 107.13% during the same period (as of June 30, 2014).

As a result of the adverse tax issues, AMLP’s expense ratio before deferred taxes is 0.85% but gross expense ratio is extremely high at 8.56% currently.

Despite its underperformance relative to the index, investors have continued to pour money into the fund, which has accumulated more than $9 billion in AUM so far. One advantage of investing in AMLP is its lower volatility compared with MLP ETNs. Lower volatility results from its ability to reverse some of deferred tax liabilities when the market is down.

ETNs typically eliminate some of these complex tax consequences as they do actually not hold any securities. However the investors should remember than ETNs are unsecured debt instruments and carry credit risk.

Below we have highlighted three popular MLP ETNs.

JPMorgan Alerian MLP Index ETN (NYSE:AMJ)

AMJ is the most popular ETN in the MLP space with about $6.6 billion in assets under management.

Launched in April 2009, this ETN is based on the Alerian MLP Index, which tracks the performance of 50 largest companies in the energy MLP sector.

The note charges investors 85 basis points a year in fees for its services and pays out an attractive yield of 4.43% currently.

The investors should note that the ETNs are subject to maximum issuance limit and this ETN stopped issuing new notes in June 2012. Investors who buy this ETF at a premium to its NAV incur the risk of loss in case they sell when the premium is no longer present. However as of now, the ETN is trading close to its NAV.

UBS ETRACS Alerian MLP Infrastructure ETN (NYSE:MLPI)

MLPI focuses on the infrastructure space within the MLP world. The note tracks the Alerian MLP Infrastructure Index, which is comprised of 25 energy infrastructure MLPs.

The product has attracted $2.2 billion in AUM. This note also charges 85 basis points a year for expenses and pays out a yield of 5.26%.

Credit Suisse Cushing 30 MLP Index ETN (NYSE:MLPN)

MLPN tracks the Cushing 30 MLP Index, which holds MLPs owning mid-stream energy infrastructure assets in North America. It is an equal weighted index, rebalanced on a quarterly basis. The ETN was launched in April 2010.

The note has so far attracted $946 million in assets. This note also charges 85 basis points a year for expenses and pays out a yield of 3.75% currently.