Trading has been downright brutal for the mining sector in 2013. Commodity prices have fallen sharply on the year, leading the miners, who are often leveraged to the price changes of their underlying commodities, to a near collapse in year-to-date terms.

In fact, many mining ETFs are sporting year-to-date losses approaching 45%, easily outpacing both their commodity brethren, as well as broad market indexes on the downside. This trend has left many investors bearish on the space, though the segment is becoming tempting from a value perspective, assuming you are able to tolerate significant volatility levels.

This is especially true given recent moves in the space, as many metals have been bouncing off of lows, and in some cases, moving far higher. This turnaround has finally shifted perception regarding the mining space, leading to some strong performances in the metals world as a result .

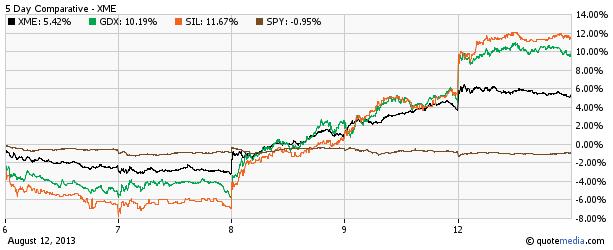

In fact, many mining ETFs are actually spiking lately, with several up more than 5% in the past week, if not more. This comes as perception on China is slowly shifting to be slightly more positive, while the U.S. economy hums along at a solid clip. Meanwhile, a more sluggish dollar as of late hasn’t hurt commodities either, further boosting demand for metals in the process.

Given this recent move, it might be worth it to take a closer look at some broad mining ETF options as possible investments in this type of climate. Below, we highlight three of the most popular choices in this space, any of which could be excellent plays for investors seeking to ride this sudden move in the metal mining space even higher:

SPDR S&P Metals & Mining ETF (XME)

This ETF looks to give investors broad exposure to the metal and mining industry, holding 40 stocks in the basket in total. This is accomplished by tracks the S&P Metals & Mining Select Industry Index, a benchmark that uses an equal weight method for assigning assets.

Steel stocks make up roughly 40% of the portfolio, followed by the broad metal and mining space (20%), and then precious metals (18%) to round out the top three. From a cap look, there is definitely a small cap focus—as is usually the case with equal weight products—as large caps only make up about 9% of assets.

XME is up roughly 5.4% in the past five days, and its price has increased by 6.6% in the past one month time frame.

Market Vectors Gold Miners ETF (GDX)

For a targeted play on gold, investors have GDX for exposure. This ETF follows the Amex Gold Miners Index, giving investors access to roughly 30 companies that are involved in some aspect of the gold mining industry.

Large and mid caps make up the vast majority of this popular cap weighted fund, while Goldcorp (GG), and Barrick Gold (ABX), combine to make up nearly 25% of the fund on their own. Meanwhile, from a country perspective, Canadian firms dominate at 64% of assets, followed by the U.S. at 17% and then South Africa at 10%.

GDX has soared by 10.2% in the past five days, pushing its one month return to 12.2%.

Global X Silver Miners ETF (SIL)

Although often overlooked in the precious metal market, silver can be an even bigger winner during up markets. One way to target this space is with SIL, an ETF that tracks the Solactive Global Silver Miners Index, a benchmark that holds roughly 30 stocks.

Small and mid caps dominate this benchmark, as large caps account for just 10% of the assets, suggesting it is well spread out from a cap perspective. However, when looking at individual stocks, Silver Wheaton (SLW), Fresnillo (FRES), and Industrias Penoles SAB dominate, as the trio combine to take up more than 30% of assets.

In the past five days, SIL has jumped by 11.7%, while the trailing one month return is now showing an 18% gain.

Bottom Line

Mining ETFs have had a horrendous year and have lagged while many other sectors have skyrocketed. And with metals facing a shaky future, some investors had little hope of a recovery in the space heading into 2014.

However, recent trends in the space have been very encouraging for the miners, as metal prices have bounced off of their lows. Now, many mining ETFs have seen double digit percentage moves to the upside in recent trading, suggesting that the worst may be over for the space.

If this turns out to be the bottom, any of the above ETFs could be solid choices that may continue to rebound higher in the weeks ahead, so long as commodity trading remains favorable. Just be prepared for significant volatility in this rocky market, as multi-percentage point moves are not uncommon in this rocky corner of the ETF market.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Mining ETFs Finally On The Upswing

Published 08/14/2013, 02:08 AM

Updated 10/23/2024, 11:45 AM

3 Mining ETFs Finally On The Upswing

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.