In an unsuspecting lab – tucked inside an office complex somewhere near the base of the San Gabriel Mountains – Charles W. Hull developed a system for generating three-dimensional objects by “printing” several thin layers of an ultraviolet, curable material.

Or, in layman’s terms, he developed the first 3-D printer.

You can read all about it in an obscure patent filing at the U.S. Patent and Trademark Office (#4,575,330). But here’s the most important detail of all…

The filing was made way back in 1984.

That’s right. The technology at the epicenter of hype today, which some believe will usher in the next Industrial Revolution, officially launched some 30 years ago.

What the heck took so long for the technology to take off?

The same thing that’s preventing every middle-class family from purchasing a brand spanking new, fully electric, Tesla (TSLA) Model S sedan: cost.

For years, 3-D printers were prohibitively expensive, costing more than $100,000. Fast forward to today, though, and any hobbyist with a couple grand can print as many ABS and PLA plastic tchotchkes as he wants.

But will the democratization of this truly innovative technology really spurn a mega-billion-dollar revolution? And, more importantly, is it a trend we can invest in for handsome profits?

You Missed the Boat…

Pick any old cliché about being too late: You missed the boat… The train has already left the station…

They all apply.

The time to invest in 3-D printing stocks is not now. It was back in 2010.

That’s when the innovating technology was “percolating in online discussions, at conferences and among the nerdosphere,” as The New York Times put it.

Nowadays, though, awareness of 3-D printing has gone mainstream.

Case in point: The August 2013 issue of Delta Sky Magazine includes a feature story on the technology, titled “This is Just the Beginning.”

Remember, we’re talking about an airline rag here, not a forward-looking media publication like Gizmodo or Fast Company.

I don’t think any airline magazine has successfully called a trend early. Ever.

For good measure, here are three more telltale signs we’re in a 3-D printing bubble…

~3-D Printing Bubble Sign #1: Even Gartner Sees Excessive Hype

Every summer since 1995, top tech research firm, Gartner, has released its Hype Cycle Report.

Per its own billing, the “report assesses the maturity, business benefit and future direction of more than 1,900 technologies and trends.”

In this year’s report, the hype surrounding 3-D printing got so out of hand that Gartner felt compelled to break out the trend into two components – “Consumer 3-D Printing” and “Enterprise 3-D Printing.”

And guess what? The former is perched right atop the “Peak of Inflated Expectations,” which is quite instructive…

You see, most of the hype surrounding the 3-D printing space involves the belief that every office, school and home will soon own a 3-D printer.

The truth? 3-D printers probably won’t ever go mainstream. The majority will be used by enterprises. In fact, nearly half of the global revenue generated by 3-D printers comes from prototypes and other design-related work, according to Wohlers Associates.

In turn, bidding up 3-D printing stocks on the premise that they’ll be as ubiquitous as smartphones is just plain foolish.

~3-D Printing Bubble Sign #2: Market Cap Far Exceeds Market Size

Wohlers estimates that the 3-D printing industry generated $2.2 billion in global sales in 2012.

However, the market capitalizations of the two biggest 3-D printing companies – 3D Systems (DDD) and Stratasys Ltd. (SSYS) – currently checks in at a combined $13.05 billion.

Even if the two companies collectively account for 100% of the industry, which they don’t, that implies a staggering price-to-sales ratio of 5.93 for the industry.

In comparison, the average stock in the S&P 500 Index trades at just 1.6 times sales.

If pundits think the S&P 500 is in bubble territory at 1.6 times sales, 3-D printing is way beyond that point, based on the same metric.

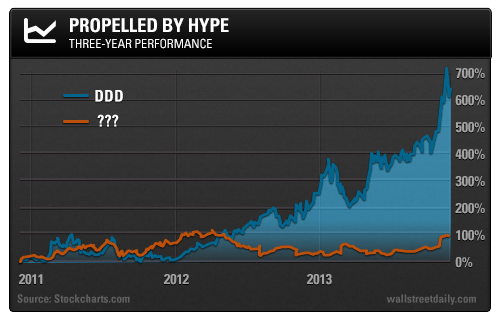

~3-D Printing Bubble Sign #3: Look At the Chart!

As John Maynard Keynes famously observed, “The market can stay irrational longer than you can stay solvent.”

If we look at the price chart for the 3-D printing pioneer, 3D Systems, it’s clear that we’ve entered the “irrational” stage.

When I first recommended the stock to WSD Insiders, shares traded hands at a split-adjusted $7.85. Now they fetch north of $72, representing a rally of more than 600%.

As you can see in the chart, a substantial portion of those profits came in 2013, too.

Bottom line: This is not the time to be buying into the 3-D printing hype. The downside far outweighs any further upside potential.

Turning Bubbles into Profits

Don’t fret, though. There’s still an indirect way to profit from the 3-D printing boom.

How? Well, if you take another look at the chart above, you’ll notice I included the performance of a mystery stock.

It hasn’t participated in the recent run-up for 3-D printing stocks. Yet it makes a device that’s vitally important to the long-term growth of the 3-D printing industry.

In tomorrow’s column, I’ll share the company’s identity – and, more importantly, why I’m convinced the stock could easily double from current prices. Stay tuned.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Irrefutable Signs We’re In A 3-D Printing Bubble

Published 11/26/2013, 05:53 AM

Updated 05/14/2017, 06:45 AM

3 Irrefutable Signs We’re In A 3-D Printing Bubble

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.