There are scores of writers, commentators and analysts who have declared the death of bonds. It should be noted that many of these people prematurely made the same declaration 10 years earlier in 2003-2004. Nevertheless, the overwhelming sentiment today is that an attempt to squeeze cash flow from a stone produces more risk than reward.

For the last few months, I have been challenging the latest predictions that interest rates must rise and that bond prices must fall. It is not that I believe rates will necessarily turn back the clock to revisit all-time lows; rather, the surge in the 10-year from 1.4% to 3.0% in 2013 may have represented two steps in one direction, while the stabilization or slight decline in rates may represent a probable step back here in 2014.

One thing is for certain. ETF enthusiasts are not throwing in the towel when it comes to the pursuit of higher yielding income, whether it comes from junk bonds, MLPs or multi-asset funds. Here are three high yielders that just hit 52-week highs:

1. Guggenheim International Multi-Asset Income (HGI). This exchange-traded tracker invests at least 90% in securities that constitute the Zacks International Multi-Asset Income Index. There are roughly 155 investments selected from a universe of global real estate trusts (REITs), American Depository Receipts (ADRs), master limited partnerships (MLPs), closed-end funds (CEFs), preferreds and royalty trusts. The 12-month yield of 4% is a highlight for those who have chosen to participate. However, the fund’s $30 million in assets under management and low trading volume could make it difficult for stop-limit order advocates to exit the position at a desired price point.

Guggenheim contends that HGI is geared to outperform the MSCI EAFE Index. Over the last 5 years, HGI has annualized at 13.15% whereas iShares MSCI EAFE (EFA) has compounded at 11.7% per year. Although that may sound like a venerable advantage, since HGI’s inception on 7/11/2007, both funds are even at 0%. Regardless, those that might prefer HGI should make up their own mind on the appropriateness of the comparison as well as the attractiveness of the annual cash flow.

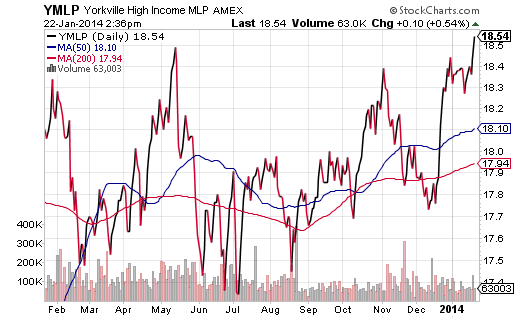

2. Yorkville High Income MLP (YMLP). It only took a few weeks last May for YMLP to fall 6% in value. From some people’s perspective, it may be difficult to get excited about an investment where most of the annualized cash flow could be wiped out in a few weeks of rapidly rising rates. Then again, with $250 million in assets under management and a distribution yield of 8.9%, there are plenty of dollars chasing the pipeline possibility.

Perhaps surprisingly, YMLP recently hit a 52-week high. If rates manage to finish 2014 where I expect them to finish — with the 10-year at 2.75% — YMLP could see a modicum of capital appreciation to add to “junk-bond-like” cash flow. Keep in mind, I am not recommending that investors hold-n-hope for a particular outcome with this price sensitive investment; rather, I am pointing out that yield chasing has not evaporated in the wake of expert predictions that rates have to go higher.

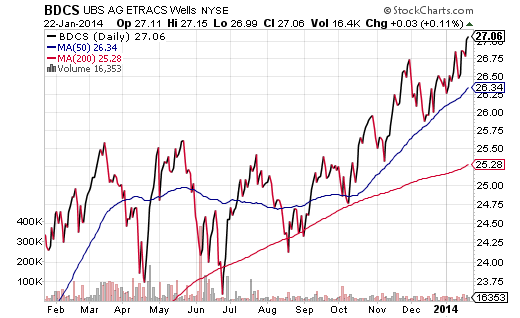

3. E-Tracs Wells Fargo Business Development Company Index ETN (BDCS). Technically, this exchange-traded note is not a fund. You pay 0.85% for the privilege of getting diversified exposure to the exact performance of the above-mentioned index. Business Development Companies, or “BDCs,” are publicly traded corporations that engage in lending at high yield rates to smaller fish. The larger entities often take equity ownership in the smaller venture, offering business acumen in addition to capital. They are similar to private equity firms, though the Securities and Exchange Commission (SEC) requires BDCs to invest 70% of assets in U.S. companies as well as to distribute at least 90% of taxable income in the form of dividends. (And that’s how BDC shareholders often get juicy 7%-9% yields!)

3. E-Tracs Wells Fargo Business Development Company Index ETN (BDCS). Technically, this exchange-traded note is not a fund. You pay 0.85% for the privilege of getting diversified exposure to the exact performance of the above-mentioned index. Business Development Companies, or “BDCs,” are publicly traded corporations that engage in lending at high yield rates to smaller fish. The larger entities often take equity ownership in the smaller venture, offering business acumen in addition to capital. They are similar to private equity firms, though the Securities and Exchange Commission (SEC) requires BDCs to invest 70% of assets in U.S. companies as well as to distribute at least 90% of taxable income in the form of dividends. (And that’s how BDC shareholders often get juicy 7%-9% yields!)

At the moment, BDCS offers about 7% annualized. Of course, investors seem to be benefiting from impressive capital appreciation as well, with the ETN hitting an all-time high.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.