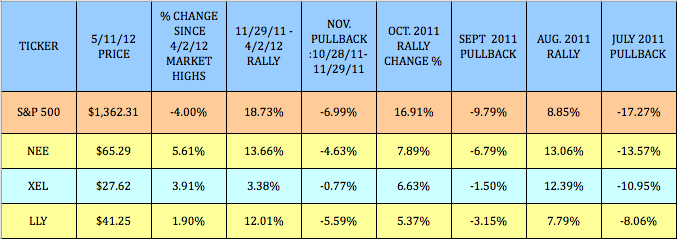

The S&P 500 has pulled back approx. 4% since its early April highs, which begs the question, are there any dividend paying stocks that have beaten the market since then? We took 3 dividend stocks from our High Dividend Stocks By Sector tables, and researched how they’ve done in all of the various rallies and pullbacks since last summer.

These 3 stocks have all held up better than the market in pullbacks, and have also participated in rallies. Not surprisingly, these defensive dividend stocks hail from the Healthcare and Utilities sectors: NextEra Energy, (NEE), Xcel Energy, (XEL), and Eli Lilly Co., (LLY):

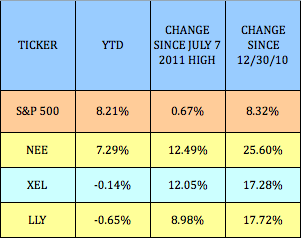

In addition to their defensive characteristics, these stocks have been some of the best stocks to buy for price gains since Dec. 2010, and all 3 have beaten the market since the beginning of last summer’s market meltdown, which began right after July 7th, 2011. Even with its strong showing since last fall, the S&P is still flat since its highs last July:

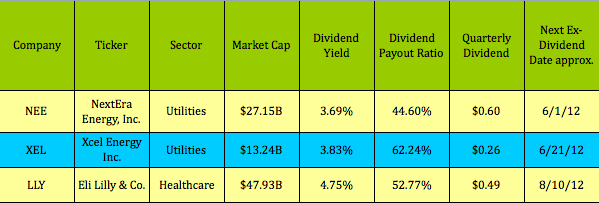

Dividends: NEE raised its quarterly dividends to $.60/share, from $.55 in 2012, and XEL raised its dividend to $.26, from $.25 in 2011. LLY hasn’t raised its dividend since 2008, when they raised to $.49, from $.47, right in the midst of the market turmoil.

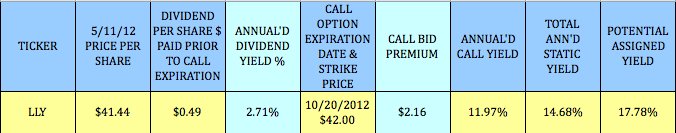

Covered Calls: If you want to improve upon its dividend yield, LLY’s near-the-money covered call options currently pay over 4 times its quarterly dividend in the October trade listed below.

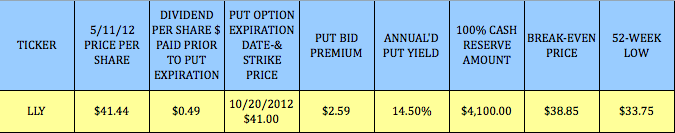

Cash Secured Puts: Another lucrative options trading strategy is to sell cash secured put options below a stock’s price, so that you can achieve a lower potential entry cost. The other benefit of this strategy is that, as with selling call options, you’ll get paid your put premium $ within 3 days of making the trade, often even the same day.

The differences between the 2 strategies are: Put sellers don’t collect dividends, and they also don’t buy the underlying stock in order to place the trade. Instead, they may have the stock sold/assigned to them at expiration, if the stock’s price is below their strike price around that time. Similar to the covered call trade, this put option pays over 5 times what the dividends pay for this 5-month term.

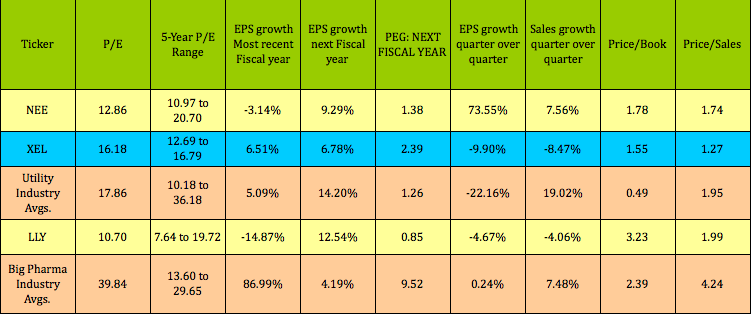

Earnings Growth & Valuations: Although Utilities aren’t known for growth, NextEra did put up good numbers in its most recent quarter, and is projected to grow over 9% in its next fiscal year. NEE is trading much closer to the low range of its 5 year P/E range. Lilly, along with many of is peers, had a mediocre quarter, thanks to ongoing drug patent expirations, but it’s projected to bounce back next year, and actually has an undervalued PEG of .85:

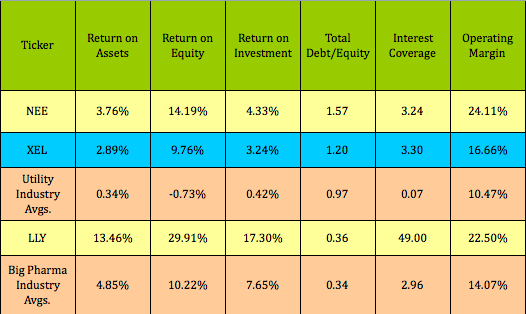

Financials: All 3 of these defensive dividend stocks have financial metrics that are superior to their peers:

Disclosure: Author had no positions in any of the above stocks at the time of this writing.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 High Dividend Stocks Bucking The Spring Pullback

Published 05/13/2012, 01:02 AM

Updated 07/09/2023, 06:31 AM

3 High Dividend Stocks Bucking The Spring Pullback

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.