Jobless claims have been rising. Earnings growth has been decelerating. Revenue growth has been stalling. And mortgage applications dipped to the lowest level in two decades. Is it possible that we have been placing a little too much faith in the ability of central banks to support asset prices?

Granted, there is no reason for gloom or doom in the intermediate-term. Corporate balance sheets are strong. Trailing 12-month P/Es are fairly valued or perhaps slightly overvalued. Most notably, the majority of developed world stock ETFs offer convincing technical uptrends.

Nevertheless, one should at least question the reasons behind the super-sized confidence in certain assets. In some instances, the boldness may very well be warranted. In other cases, it appears that momentum itself has superseded common sense.

You decide. Here are 3 ETFs and my “take” on the sensibility of the price movement.

1. iShares MSCI Italy (EWI). Nearly every eurozone economy has grown since the year 2000, including Spain. The one exception? Italy. Employment data show that labor force participation for Italy is at a dismal 55.6%, well below the eurozone average of 63.8%. Granted, I have been willing to invest in regional growth via iShares MSCI Small Cap EAFE (SCZ). This is a nod to the high probability of additional European Central Bank (ECB) stimulus as well as modest regional economic growth. However, peripheral countries like Spain and Italy could be the hardest hit should the ECB balk at cutting rates on March 6.

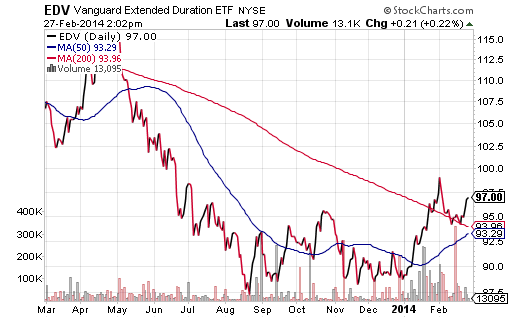

2. Vanguard Extended Duration Treasury (EDV). In 2013, few asset classes suffered as greatly as long-dated Treasury bonds. Since the Federal Reserve began tapering in December, though, funds like EDV and Pimco 25 Year+ Zero Coupon (ZROZ) have been extremely successful in the exchange-traded universe. I explained in December and early January that the deceleration of interest rate manipulation by the central bank of the U.S. would actually increase financial market uncertainty, likely sending many investors back toward traditional safe havens. Additionally, the technical picture supported the notion that prices were bottoming out. Today, EDV is receiving remarkable support at its 200-day long-term trendline; meanwhile, a “golden cross” by the 50-day moving average appears inevitable. Are there other reasons that investors seem to be bucking the conventional wisdom that rates had to go higher?

3. iShares NASDAQ Biotechnology (IBB). For years, I have been advocating non-cyclical sectors that are less tied to interest rates. It has led to client ownership of funds like SPDR Select Healthcare (XLV), PowerShares Pharmaceuticals (PJP) and iShares Aerospace and Defense (ITA). Yet, in spite of clear-cut relative strength in the ETF world, I have not chosen to board the biotech bandwagon in its purest form. Funds like SPDR Biotech (XBI) and IBB have literally defied gravity better than Sandra Bullock in a space suit. Does it make sense to buy a sub-sector that has become so speculative, that it now trades at a 60% premium to a fully valued market? Is it it sensible to embrace a sub-sector investment with a price-to-book (P/B) north of 11 and a trailing price-to-earnings (P/E) of 42? Or is the biotech boom showing characteristics like the dot-com mania in 1999?

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI