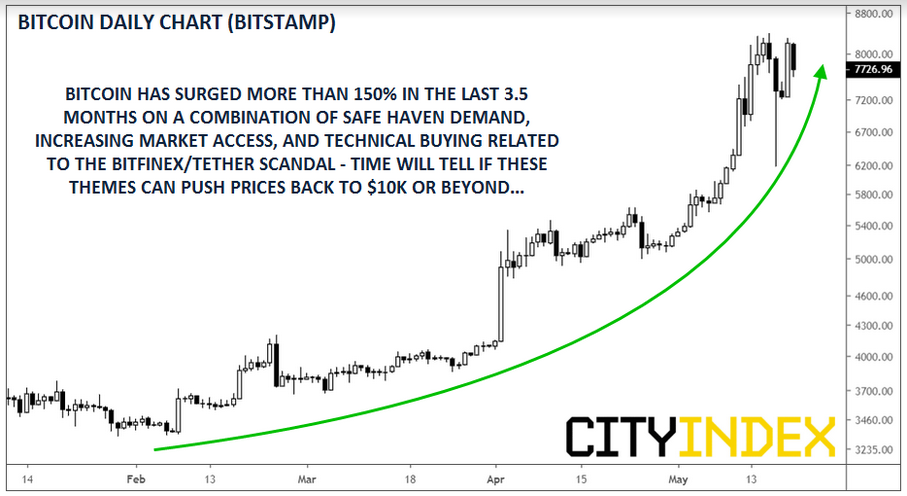

It hasn’t quite garnered the hype we saw in the halcyon days of Q4 2017, but bitcoin is once again surging. The world’s oldest cryptoasset has gained more than 150% since early February in a stunning technical move.

While we’ve discussed bitcoin’s technical drivers and outlook at length (see “Terrors In Tandem: BTC and CNH Plot Their Next Moves”), we haven’t discussed the major fundamental catalysts for the recent rally:

1) Safe-Haven Demand

Bitcoin bugs’ favorite explanation for the recent rally is that the cryptocurrency is operating exactly as intended. Bitcoin’s censorship resistance and mathematically fixed supply is increasingly valuable as nuclear-armed countries engage in protectionism, trade wars, high-stakes military exercises and rampant stimulative measures. Last week, President Trump himself tweeted that “China will be pumping money into their system and probably reducing interest rates…If the Federal Reserve ever did a ‘match,’ it would be game over, we win!”

With global geopolitical tensions and unprecedented economic experimentation becoming increasingly common, traders may be seeing Bitcoin as a compelling, potentially uncorrelated hedge to more traditional investments.

2) Increasing Market Access

As many traders will recall from 2017’s bullish run, one of the biggest chokepoints was access to the crypto markets. Most traditional brokerages didn’t offer cryptoassets and the unproven brokerages that did were inundated with new accounts to the point that they had to limit new account creation, resulting in a lively secondary market where desperate traders would pay thousands of dollars merely for an account to “get into the game.”

Now, the tide is starting to turn: Fidelity will begin buying and selling bitcoin for institutional customers in the coming weeks; E*Trade is preparing to enable cryptoassets in its trading platform; TD Ameritrade recently introduced bitcoin futures. The entrance of well-capitalized, traditional Wall Street brokerages lends an air of legitimacy to the asset class. Some traders are buying in anticipation of a flood of institutional and retail money into the space.

3) The Bitfinex/Tether Scandal

The final explanation for Bitcoin’s big run may be the most acute. The Attorney General of New York recently filed a lawsuit accusing Bitfinex, one of the largest cryptoasset exchanges, of fraud. Bitfinex is suspected of siphoning off $700MM of reserves for its stablecoin Tether to cover other missing funds. Paradoxically, this scandal may be boosting demand for bitcoin, as traders rush to sell their potentially unbacked Tethers to the relative safety and stability of bitcoin (there’s a sentence I never thought I’d write!).

Source: TradingView, City Index

Moving forward, the first two themes could continue to drive bitcoin’s value higher in the coming weeks and months, though buying related to the Tether scandal may be petering out. Despite these potentially bullish fundamental signs, last week’s 20%+ “flash crash” highlights the risks associated with this nascent market, underscoring the need for proper risk management and conservative position sizing.

Cheers