Creating a portfolio that reflects the strategies of renowned investors like David Swenson, Ray Dalio, and Warren Buffett is now more achievable than ever, thanks to the versatility of ETFs.

While specific ETFs dedicated to tracking the moves of these famous figures are not widely available, this doesn't limit our ability to replicate the essence of their investment philosophies through a careful selection of existing ETFs.

Our goal here is not to replicate their portfolios down to the last detail but rather to embody the overarching principles that define their investment styles. By strategically combining various ETFs, we can approximate the approaches that have underscored the success of these investment titans.

David Swensen Yale Endowment Portfolio

David Swensen, known for his role in managing the Yale Endowment, revolutionized institutional investing with his distinctive approach. The Yale Endowment represents the funds contributed to Yale University, utilized to support its academic mission.

Swensen's strategy for this endowment is notable for its departure from typical retail investment portfolios, particularly in its minimal emphasis on U.S. equities.

Instead, Swensen's approach heavily favors alternatives, including real estate, hedge funds, venture capital, and private equity. This strategy stems from a desire to tap into uncorrelated sources of risk and return, distinct from the traditional bond and stock markets.

For those looking to emulate Swensen's approach through ETFs, the following allocation can serve as a guide:

- Vanguard Total Stock Market ETF (VTI) - 2.25%: Offers broad exposure to the U.S. stock market.

- SPDR S&P Global Natural Resources ETF (GNR) - 4.50%: Focuses on global natural resources, aligning with the alternative assets category.

- iShares US Treasury Bond ETF (GOVT) - 7.50%: Provides a stable foundation with U.S. Treasury bonds.

- Real Estate Select Sector SPDR (XLRE) - 9.50%: Targets the real estate sector, reflecting the endowment's real estate investments.

- Vanguard Total International Stock ETF (VXUS) - 11.75%: Diversifies internationally in both developed and emerging equity markets.

- Invesco Global Listed Private Equity ETF (PSP) - 17.50%: Offers exposure to globally diversified, listed private equity companies.

- VanEck BDC Income ETF (BIZD) - 23.50%: Focuses on Business Development Companies (BDCs) as a proxy for venture capital, providing high-income potential.

- iMGP DBi Managed Futures Strategy ETF (DBMF) - 23.50%: Aims to deliver returns uncorrelated to traditional asset classes, similar to hedge funds and managed futures strategies.

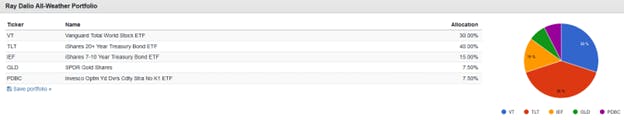

Ray Dalio All-Weather Portfolio

Ray Dalio, the founder of Bridgewater Associates, is renowned for developing the "All-Weather" investment strategy. This strategy is designed to perform well across various economic conditions or "seasons," making it a popular choice for investors seeking a balanced, risk-managed approach.

The All-Weather strategy is underpinned by Dalio's belief that different asset classes respond predictably to changes in the economic environment, such as inflation, deflation, growth, and recession.

Dalio's portfolio reflects a lower allocation to equities, with a stronger emphasis on fixed income and commodities. This is in line with his view that a well-diversified portfolio should include assets that perform well in different economic seasons, thereby reducing overall volatility and risk.

Here's a breakdown of ETFs that can be used to construct a portfolio mirroring the All-Weather strategy:

- Vanguard Total World Stock ETF (VT) - 30.00%: This ETF provides diversified exposure to global equities, encompassing both developed and emerging markets.

- iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) - 40.00%: Focused on long-term U.S. Treasury bonds, this ETF plays a significant role in the portfolio, offering stability and counterbalancing equity risk.

- iShares 7-10 Year Treasury Bond ETF (NYSE:IEF) - 15.00%: This ETF adds medium-term U.S. Treasury bonds, further diversifying the fixed income component.

- SPDR Gold Shares (NYSE:GLD) - 7.50%: Gold is often seen as a hedge against inflation and currency devaluation, making it a key element in the All-Weather strategy.

- Invesco Optimum Yield Diversified Commodity Strategy No K1 ETF (PDBC) - 7.50%: This ETF provides exposure to a range of commodities, which can perform well during periods of inflation or global growth.

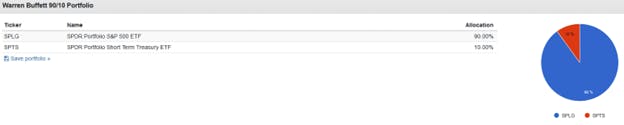

Warren Buffett 90/10 Portfolio

Warren Buffett, the legendary value investor and CEO of Berkshire Hathaway (NYSE:BRKa), is known for his long-term value investing strategy. However, his instructions for his own estate reveal a different, surprisingly simple strategy: 90% invested in a low-cost S&P 500 index fund and 10% in short-term U.S. Treasury securities.

Buffett's rationale for this allocation is rooted in his belief that most active managers fail to outperform the S&P 500 over the long term. He famously won a bet against hedge funds, demonstrating that a simple S&P 500 index fund could outperform a selection of hedge funds over a decade. Moreover, Buffett has expressed a preference for the liquidity and safety offered by short-term Treasury bonds over long-term bonds.

Today, investing in S&P 500 ETFs is more cost-effective than ever, with expense ratios as low as 0.02%. Similarly, short-term Treasury ETFs offer yields to maturity that are compelling, making this strategy a blend of low fees and simplicity. Here's how you can emulate Buffett's 90/10 strategy using ETFs:

- SPDR Portfolio S&P 500 ETF (SPLG) - 90.00%: This ETF tracks the S&P 500, providing broad exposure to large-cap U.S. equities. Its low 0.02% expense ratio aligns with Buffett's preference for low-cost investments.

- SPDR Portfolio Short Term Treasury ETF (SPTS) - 10.00%: This ETF focuses on short-term U.S. Treasury securities, offering the safety and liquidity that Buffett values in the fixed income portion of his portfolio.

This content was originally published by our partners at ETF Central.