With S&P 500 stocks approaching all-time highs daily, it may be more instructive to look at potential hedges and “diversifiers.” Here are 3 ETFs that are less likely to receive accolades when investors are smitten with Google (GOOG) and Gilead (GILD).

1. iShares Silver Trust (SLV). Over the last year, SLV has served as a fine diversification vehicle due to its low correlation (0.38) with the S&P 500 SPDR Trust (SPY). And over the last 6 months, SLV has been an admirable hedge against a stock market decline (-0.50).

Yet there’s one statistical relationship that may make silver a solid longer-term investment… its 10-year .92 correlation with the national debt. In other words, as long as the national debt increases, so should the price of silver.

Many people believe that the U.S. will never be able to pay down the national debt… that we can only push back the day reckoning. They argue that electronic money printing and/or quantitative easing merely allows the U.S. government to borrow inexpensively until a catastrophic event (e.g., war, hyperinflation, European-style debt crisis, civil unrest, crash, default, etc.) restructures the entire economy.

It’s hard to argue that our national debt will go down over the next 10 years. It follows that — end of days or no end of days — correlation data demonstrate silver’s precious nature in a rising debt environment. Equally compelling, SLV has remarkable support at a price point of $25.

2. iShares Global Consumer Staples (KXI). One of the issues that face the “reluctant bull” is the reality that the tried-and-true U.S. consumer staples sector is hardly cheap. There may be safety and income for those who own Procter & Gamble, Pepsico and Colgate Palmolive via SPDR Select Consumer Staples (XLP), but unforeseen dollar weakness or a shift to foreign equities could cause underperformance.

One way to diversify some of that risk is to “go global.” Adding Nestle, Unilever and British American Tobacco to the mix involves hedging in non-dollars (roughly 50%) as well as benefiting from foreign mega-brands. Equally desirable, KXI’s worst drawdown over the 4 year bull market is approximately 15%… much less than the drawdown for a comparable benchmark like the iShares S&P 100 Global Iandex Fund (IOO).

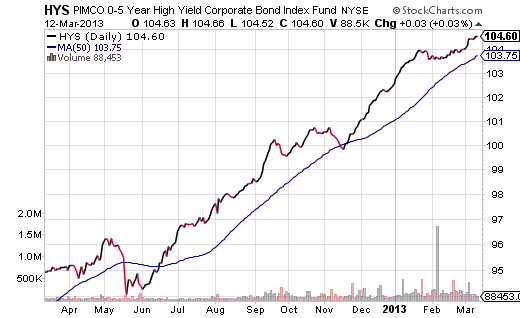

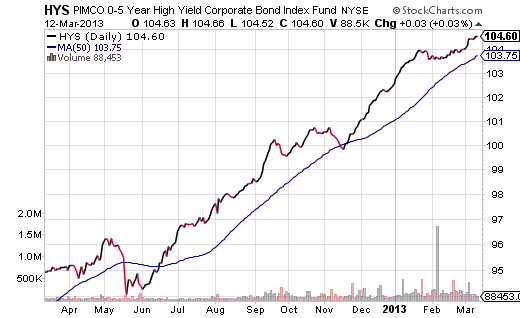

3. Pimco 0-5 Year High Yield Corporate Bond (HYS). What if interest rates rise… won’t that hurt high-yield bonds? Perhaps, but it is more likely to hurt the longer-end of the curve. What if the stock market crashes… don’t high yield bonds tend to correlate more with stocks than bonds? Yes, but this shorter-term high yield vehicle has 336 securities with an effective maturity of 2.9 years; its 5% distribution yield and monthly income stream is plenty of reward for the possibility of a modest price pullback.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

1. iShares Silver Trust (SLV). Over the last year, SLV has served as a fine diversification vehicle due to its low correlation (0.38) with the S&P 500 SPDR Trust (SPY). And over the last 6 months, SLV has been an admirable hedge against a stock market decline (-0.50).

Yet there’s one statistical relationship that may make silver a solid longer-term investment… its 10-year .92 correlation with the national debt. In other words, as long as the national debt increases, so should the price of silver.

Many people believe that the U.S. will never be able to pay down the national debt… that we can only push back the day reckoning. They argue that electronic money printing and/or quantitative easing merely allows the U.S. government to borrow inexpensively until a catastrophic event (e.g., war, hyperinflation, European-style debt crisis, civil unrest, crash, default, etc.) restructures the entire economy.

It’s hard to argue that our national debt will go down over the next 10 years. It follows that — end of days or no end of days — correlation data demonstrate silver’s precious nature in a rising debt environment. Equally compelling, SLV has remarkable support at a price point of $25.

2. iShares Global Consumer Staples (KXI). One of the issues that face the “reluctant bull” is the reality that the tried-and-true U.S. consumer staples sector is hardly cheap. There may be safety and income for those who own Procter & Gamble, Pepsico and Colgate Palmolive via SPDR Select Consumer Staples (XLP), but unforeseen dollar weakness or a shift to foreign equities could cause underperformance.

One way to diversify some of that risk is to “go global.” Adding Nestle, Unilever and British American Tobacco to the mix involves hedging in non-dollars (roughly 50%) as well as benefiting from foreign mega-brands. Equally desirable, KXI’s worst drawdown over the 4 year bull market is approximately 15%… much less than the drawdown for a comparable benchmark like the iShares S&P 100 Global Iandex Fund (IOO).

3. Pimco 0-5 Year High Yield Corporate Bond (HYS). What if interest rates rise… won’t that hurt high-yield bonds? Perhaps, but it is more likely to hurt the longer-end of the curve. What if the stock market crashes… don’t high yield bonds tend to correlate more with stocks than bonds? Yes, but this shorter-term high yield vehicle has 336 securities with an effective maturity of 2.9 years; its 5% distribution yield and monthly income stream is plenty of reward for the possibility of a modest price pullback.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.