Why are investors still buying Treasuries and short-term investment grade bonds? Many have grown accustomed to the exceptional total returns.

As I look out across the 2013 landscape, however, I see less opportunity for investors to score big with a capital appreciation component on taxable U.S. debt or quality (e.g., AAA, AA, etc.) corporate debt. Depending on the bond duration, 1%-4% yields represent the total gain that one should expect here.

Of course, President Obama’s reelection has secured the current Federal Reserve’s mandate for a 0% interest rate target. High yield corporates, preferred shares and convertibles with their 5%-7% yields should work just fine in our muddle-through economy.

These popular asset types are unlikely to see additional capital appreciation, though. More impressive total returns may need to come from another source.

Here are 3 ETF areas with enhanced total return potential in 2013:

1. Foreign REIT ETFs. While yields on domestic real estate investment trusts are better than comparable 10-year treasuries, the 3.4% yield on Vanguard REIT (VNQ) is about the same as the yield for First Trust Morningstar Dividend Leader (FDL). Yet the latter offers much greater total return potential.

On the other hand, REIT distributions have never been part of the beneficial tax rates on dividends. This implies that REIT yields may soon be on a level playing field with dividend stocks. If so, SPDR DJ International Real Estate (RWX), currently offering 3.8%, may have the power to lure investors over for the payout. Meanwhile, new investors would bolster the price that contributes to a handsome total return.

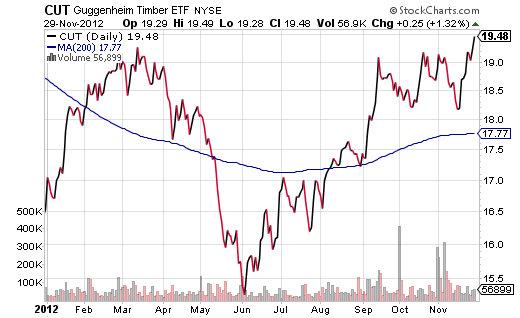

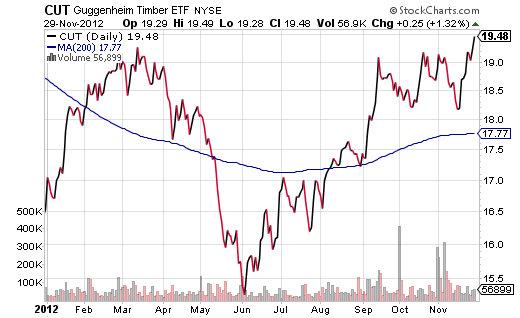

2. Timber ETFs. Homebuilder ETFs rocketed in 2012 based on the underlying belief that a housing recovery is sustainable. Yet, after a remarkable price run-up, Homebuilder ETFs may have a lot less to offer for total return hunters. High dividends? You won’t find them in this volatile sector.

Nevertheless, companies that own/lease forested property for sale of lumber and other wood-based products may be a means for total return seekers to capitalize on a real estate renaissance. REITs like Plum Creek Timber (PCL) and forest product manufacturer Weyerhaeuser (WY) can be found in the list of holdings for Guggenheim Global Timber (CUT) as well as iShares Global Timber and Forestry (WOOD).

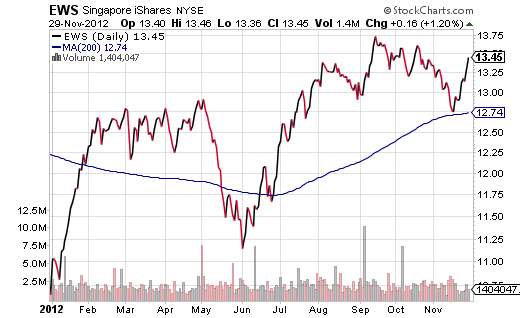

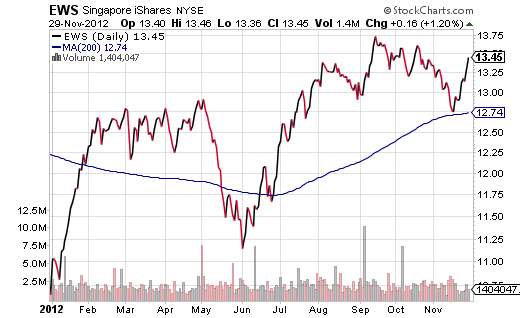

3.) Singapore ETFs. Singapore Telecom provides mobile services to nearly 1/2 billion people in the Asia Pacific region. The company has a 10% weighting in iShares MSCI Singapore (EWS), helping to bolster the dividend yield to 3.6%. What’s more, with Singapore rapidly become the center of the Asian financial universe, there are few places with as much “Street” credibility. Note: More adventurous souls might look to iShares Singapore Small Cap (EWSS).

Hesitant to revisit the Asia growth story? You shouldn’t be. Not only is China’s economy stabilizing, but Singapore boasts full employment (1.9% unemployed) as well as an enviable budget surplus that is 16.4% of GDP.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

As I look out across the 2013 landscape, however, I see less opportunity for investors to score big with a capital appreciation component on taxable U.S. debt or quality (e.g., AAA, AA, etc.) corporate debt. Depending on the bond duration, 1%-4% yields represent the total gain that one should expect here.

Of course, President Obama’s reelection has secured the current Federal Reserve’s mandate for a 0% interest rate target. High yield corporates, preferred shares and convertibles with their 5%-7% yields should work just fine in our muddle-through economy.

These popular asset types are unlikely to see additional capital appreciation, though. More impressive total returns may need to come from another source.

Here are 3 ETF areas with enhanced total return potential in 2013:

1. Foreign REIT ETFs. While yields on domestic real estate investment trusts are better than comparable 10-year treasuries, the 3.4% yield on Vanguard REIT (VNQ) is about the same as the yield for First Trust Morningstar Dividend Leader (FDL). Yet the latter offers much greater total return potential.

On the other hand, REIT distributions have never been part of the beneficial tax rates on dividends. This implies that REIT yields may soon be on a level playing field with dividend stocks. If so, SPDR DJ International Real Estate (RWX), currently offering 3.8%, may have the power to lure investors over for the payout. Meanwhile, new investors would bolster the price that contributes to a handsome total return.

2. Timber ETFs. Homebuilder ETFs rocketed in 2012 based on the underlying belief that a housing recovery is sustainable. Yet, after a remarkable price run-up, Homebuilder ETFs may have a lot less to offer for total return hunters. High dividends? You won’t find them in this volatile sector.

Nevertheless, companies that own/lease forested property for sale of lumber and other wood-based products may be a means for total return seekers to capitalize on a real estate renaissance. REITs like Plum Creek Timber (PCL) and forest product manufacturer Weyerhaeuser (WY) can be found in the list of holdings for Guggenheim Global Timber (CUT) as well as iShares Global Timber and Forestry (WOOD).

3.) Singapore ETFs. Singapore Telecom provides mobile services to nearly 1/2 billion people in the Asia Pacific region. The company has a 10% weighting in iShares MSCI Singapore (EWS), helping to bolster the dividend yield to 3.6%. What’s more, with Singapore rapidly become the center of the Asian financial universe, there are few places with as much “Street” credibility. Note: More adventurous souls might look to iShares Singapore Small Cap (EWSS).

Hesitant to revisit the Asia growth story? You shouldn’t be. Not only is China’s economy stabilizing, but Singapore boasts full employment (1.9% unemployed) as well as an enviable budget surplus that is 16.4% of GDP.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.