The sun is setting on the oil production industry. OPEC has driven the US fracking industry to the point of pain and continues to pump more. Oil prices that were over $100 a barrel 18 months ago are now falling again and threatening $40 a barrel.

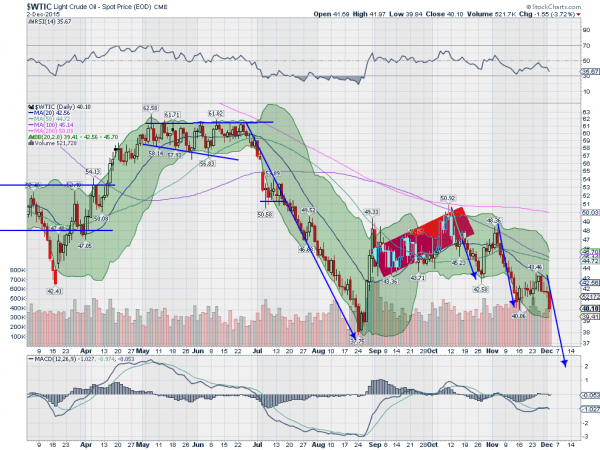

There have been a lot of head fake moves in the price of oil but the short term seems to have settled on the downside. After a test at 37.75 in August and a bounce that followed, the price is now in the middle of 2 technical patterns to the downside. The first is a 3 Drives pattern.

The move from near 51 to 42.60 is the first Drive or thrust. The second is from 48.36 to 40.06. Now the third has begin and would target a move to near 35. The second pattern is much more dire. The long move lower from 62 to the 37.75 bottom in August, was followed by a bounce and a bear flag. The break of that flag targets a move to 26.75 when it broke to the downside in early October.

Two targets lower. 3 Drives and a Bear Flag.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.