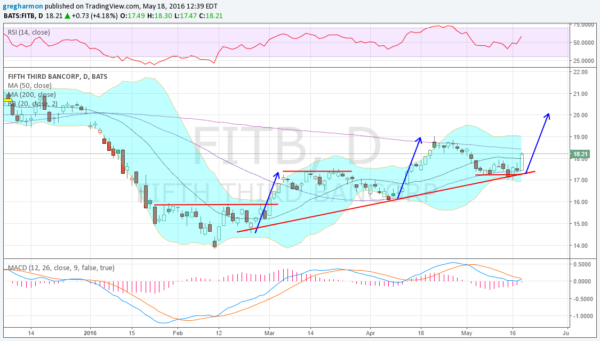

Fifth Third Bancorp (NASDAQ:FITB) looks good right now. After a pullback to its February 11 low, it settled for a couple of weeks before moving higher. FITB has made two steps to the upside -- each about $3 -- followed by retracements of about half of that move -- a series of higher highs and higher lows.

Wednesday saw the start of a third move higher. A Three-Drives pattern looks for a move similar to the first two, taking the stock price to just over 20. That would also close the gap down from the beginning of the year. Momentum indicators support that move. The RSI is pushing back higher in the bullish zone and the MACD is about to cross up. Are you going along for the ride?