We’ve been a longtime fan of community bank dividend stocks, and we just found 3 which reported record earnings in their most recent quarterly reports. Two of them are northeastern banks, First Bancorp (NYSE:FBP), is based in Maine; Washington Trust Bancorp (NASDAQ:WASH), based in Rhode Island; and the 3rd one, West Bancorporation (NASDAQ:WTBA is a midwestern bank, based in Iowa.

Profiles:

FNLC: The First Bancorp, Inc. operates as the holding company for First National Bank that provides a range of banking products and services to individual and corporate customers in coastal and eastern Maine. It operates through 16 full-service banking offices in Lincoln, Knox, Hancock, Washington, and Penobscot counties. The company was formerly known as First National Lincoln Corporation and changed its name to The First Bancorp, Inc. in April 2008. The First Bancorp, Inc. was founded in 1864 and is headquartered in Damariscotta, Maine.

WASH: Washington Trust Bancorp, Inc. operates as the bank holding company for The Washington Trust Company that offers various banking and financial products and services to individuals and businesses. The company operates in two segments, Commercial Banking and Wealth Management Services. As of December 31, 2016, it had 10 branch offices located in southern Rhode Island; 10 branch offices located in the greater Providence area in Rhode Island; and 1 branch office located in southeastern Connecticut. The company was founded in 1800 and is headquartered in Westerly, Rhode Island.

WTBA: West Bancorporation, Inc. operates as the holding company for West Bank that provides community banking and trust services to individuals and small to medium-sized businesses in the United States. The company has eight offices in the Des Moines metropolitan area; one office in Iowa City; one office in Coralville; and one office in Rochester, Minnesota. West Bancorporation, Inc. was founded in 1893 and is based in West Des Moines, Iowa.

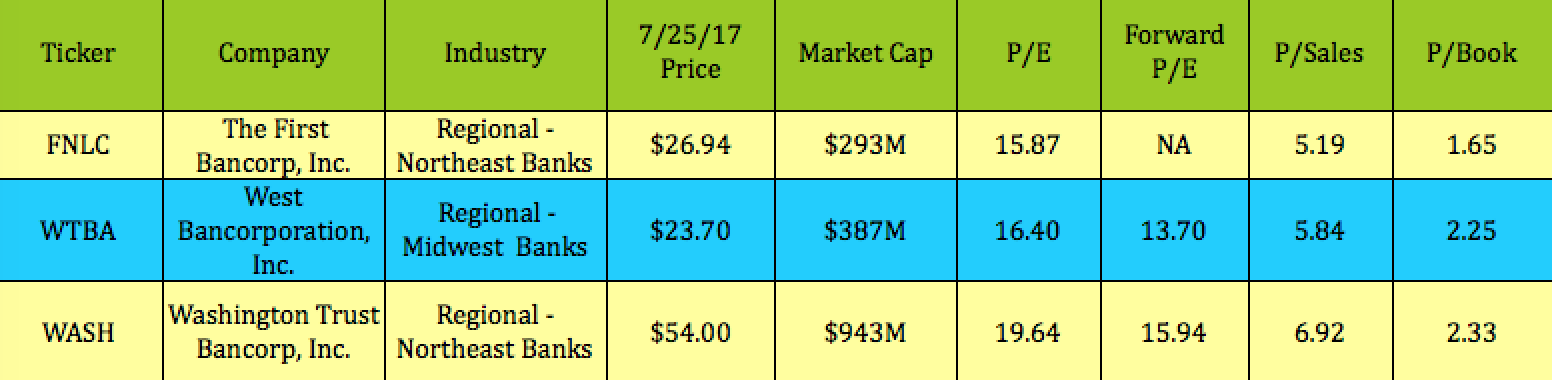

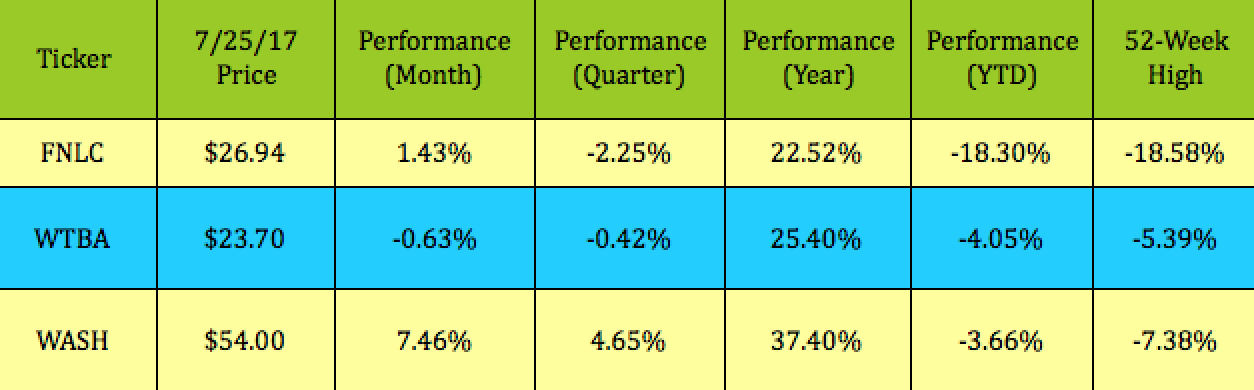

Valuations: These are small cap stocks, with not a whole lot of analyst coverage. WASH, the biggest company of the group, has 4 analysts covering it, who’ve given it an average price target of $58.00. WTBA has 1 analyst covering it, with a $25.00 price target. We couldn’t find any price targets for FNLC.

Both WTBA have a more attractive forward P/E valuation, and are priced at a premium to FNLC’s Price/Book and Price/Sales.

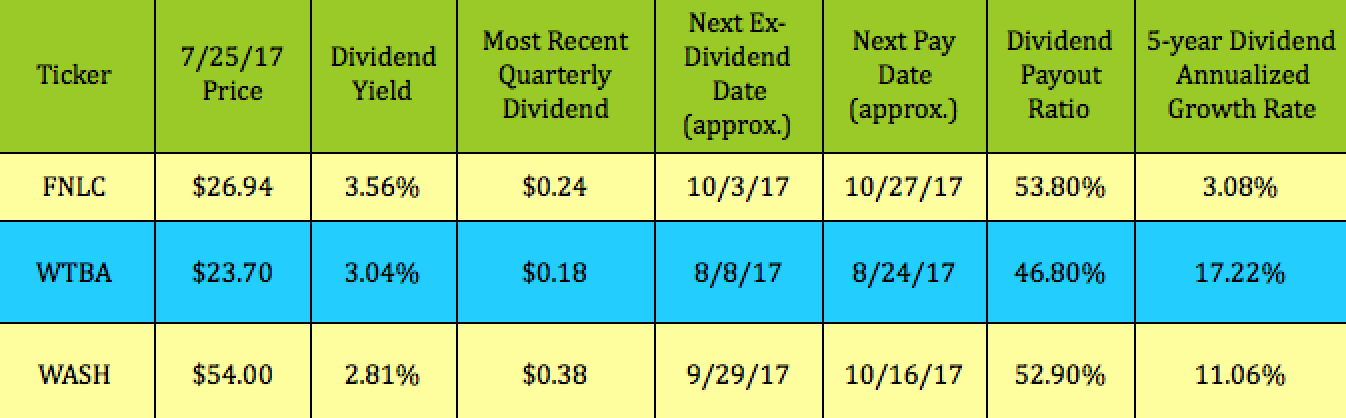

Dividends: Although their dividend yields are on the lower side, all 3 stocks have higher than market average yields, and reasonable dividend payout ratios.

FNLC has the highest dividend yield, but WTBA and WASH have the best 5-year dividend growth rates, at 17.22% and 11.06%. FNLC raised its Q2 dividend to $0.23/common share, from $.23 in Q1. It also paid a one-time special cash dividend of $.12/share in Q1, based upon record 2016 earnings.

WTBA raised its Q2 dividend to $0.18 per common share, the highest quarterly dividend they’ve ever paid.

WASH raised its Q1 ’17 dividend to $0.38/common share, from $.37 in Q4 ’16.

Options: Surprisingly, all 3 of these stocks have options, but they’re thinly traded, often with no bids at the money.

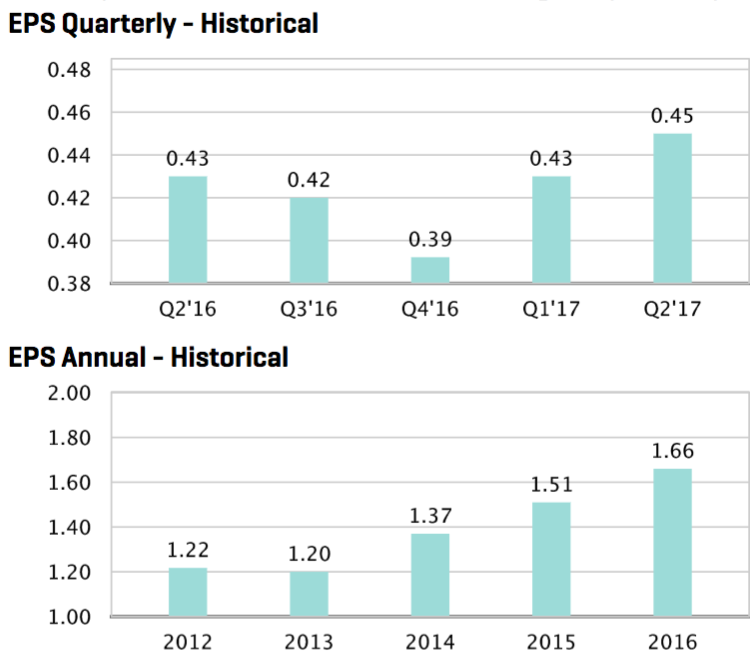

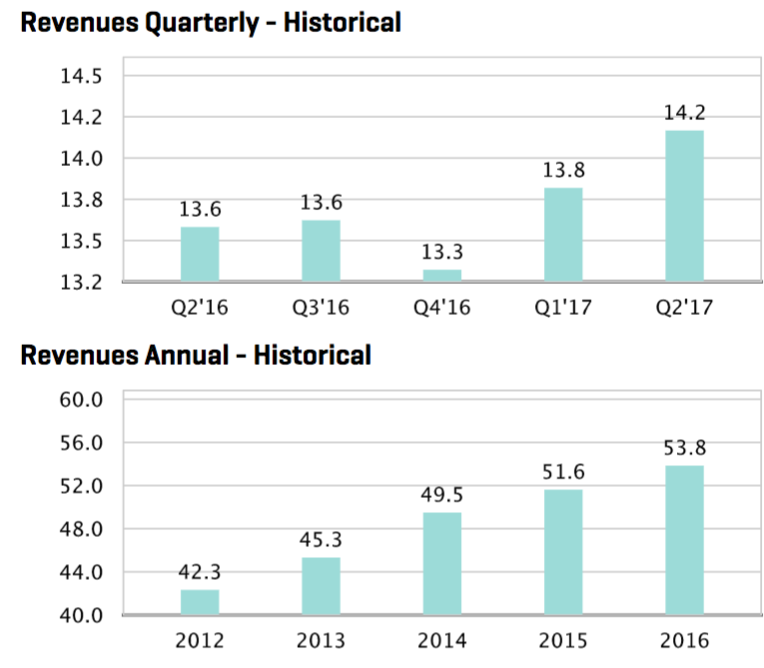

Earnings: Both FNLC and WASH reported record Q2 2017 earnings, while WTBA had record Q1 earnings, and will report its Q2 earnings on Thursday, 7/27/17.

Here is FNLC’s recent quarterly & annual EPS and Revenue history. They had record earnings in 2016 also.

WASH’s Q2 ’17 Returns on average equity and average assets were strong at 13.06%, (up 10% sequentially), and 1.21%, (up 12% sequentially), respectively. Comparable amounts for the first quarter of 2017 were 11.87% and 1.08%. Wealth management assets under administration at the end of the quarter totaled $6.4B and Q2 2017 revenues amounted to $9.9M. These were record highs for Washington Trust. Their Mortgage banking revenues totaled $2.9 million for the second quarter of 2017, up by 25% on a linked quarter basis.

WTBA reported record Q1 earnings – Q1 2017 net income was $6.1M, or $0.37/diluted common share, which was the highest net income ever recorded by the Company for the first quarter of any year. This compares to Q1 2016 net income of $5.7 million, or $0.35 per diluted common share. WTBA will report Q2 ’17 earnings on 7/27/17, before the market opens.

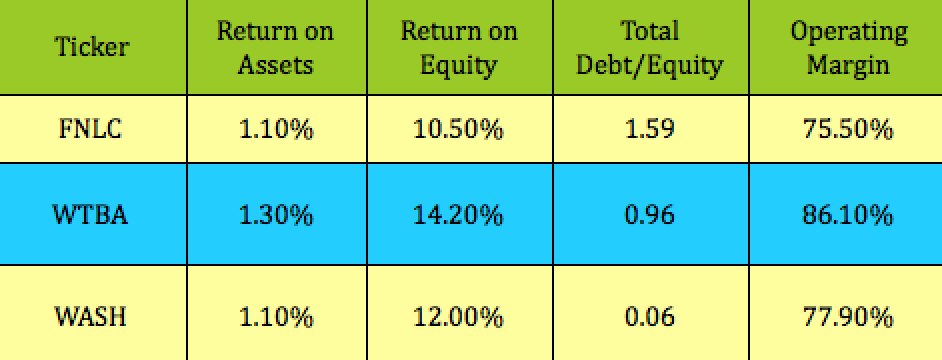

Financials: All 3 stocks have a healthy ROA above 1.00%, but WTBA wins the prize for ROA, ROE, and Operating Margin. WASH has by far the lowest Debt/Equity ratio, while FNLC has the highest, at 1.59, (based upon borrowed funds).

Performance: All 3 stocks are up considerably over the past year, but they’ve lagged the market year-to-date in 2017 so far, (especially FNLC). However, WASH jumped 7% today, (7/25/17), when it reported its record Q2 earnings.

All tables furnished by DoubleDividendStocks.com, unless otherwise noted.

Disclosure: Author owned no shares of any of the stocks mentioned in this article at the time of publication.

Disclaimer: This article was written for informational purposes only and is not intended as personal investment advice. Please practice due diligence before investing in any investment vehicle mentioned in this article.