- Coca-Cola's track record shows its ability to survive in the toughest of economic times

- Cisco has raised its payout during the past 12 years, making it attractive for those seeking growing income

- Lockheed Martin's dividend backed by strong cash flows and a recession-proof business nature

The persistent sell-off in equity markets this year is a powerful sign that the U.S. economy is heading for a hard landing amid the central bank’s fight to beat inflation. In such an uncertain economic environment when a recession is looming, which stocks are the best to buy if you’re building your retirement portfolio?

The answer to this question very much depends on your risk appetite and your retirement goals. But if you are like many retirees with a goal to preserve capital and generate stable returns to fund a comfortable lifestyle during your golden years, I generally recommend to buy low-risk stocks that provide steadily growing dividends.

In this screening criteria, you will generally find blue-chip companies with healthy balance-sheets, strong cash flows and a long history of paying dividends. Below, I have shortlisted three such dividend stocks for your consideration:

1. Coca-Cola

The Atlanta-based food and beverage giant Coca-Cola (NYSE:KO) is a recession-proof and cash-rich company that has issued dividend checks for more than a century. This impressive track record shows the strength of its brands and its ability to survive in the toughest of economic times.

The latest evidence of this strength came when Coca-Cola released its second-quarter earnings report. Coca-Cola’s sales exceeded expectations and the company raised its full-year guidance, helped by consumers’ willingness to pay more for its beverages.

For the full year, the Atlanta-based company now sees organic revenue growth of 12% to 13%, up from its previous estimate of 7% to 8%. That’s despite an expected negative currency impact of 9%.

Source: InvestingPro

The maker of Sprite, Fanta and Simply is acquiring startup beverage companies to resonate better with health-conscious clients and find new growth areas. Its recent investments include Honest Tea, Fairlife Dairy and Suja Life.

Trading at $61.92, Coke's stock is yielding 2.85% annually. That return might not look too exciting, but the company has a long track record of hiking its payout—for 58 consecutive years now.

With a 6% annual dividend growth rate over the past 10 years, KO currently pays a quarterly $0.44 a share.

2. Cisco Systems

Cisco Systems (NASDAQ:CSCO) is another stable dividend-paying stock that suits well for long-term investors whose aim is to build a solid income stream during their golden years. Cisco is a cash-rich company that is well positioned to pay uninterrupted dividends. The San Jose-based networking giant is the world's largest producer of routers, switches and other gear that companies use to connect computers.

Cisco has meaningfully improved its future growth prospects after an aggressive diversification drive away from hardware to a software-driven model within new, high-growth areas of the market, like cybersecurity, applications and services.

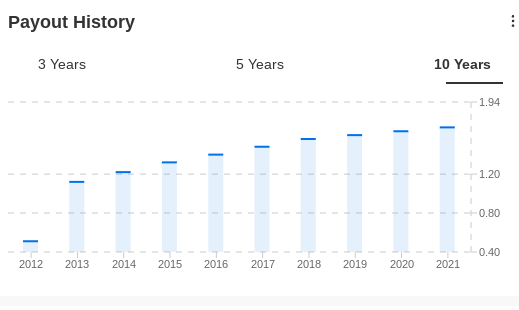

Source: InvestingPro

These growth initiatives, coupled with the company’s dominant position in the Americas, where it generates the majority of its sales, have positioned the company to outperform when the macroeconomic risks decrease.

Cisco’s latest earnings report shows that the company is succeeding in overcoming supply-side challenges that hampered its growth last year. The company in the second quarter saw orders remain steady and there’s no indication that customers are tightening their budgets.

The company has traditionally generated the bulk of its revenue from the expensive switches and routers that form the backbone of computer networks, but that’s changing. Revenue from subscriptions will reach 50% of Cisco’s total by fiscal 2025, the company predicted in September 2021.

In addition to growth, Cisco is also a reliable dividend payer. Cisco has raised its payout every year during the past 12 years, making it an attractive option for those seeking growing income. The company currently pays $0.38 per quarter for an annual payout of $1.52 per share.

3. Lockheed Martin

Lockheed Martin Corp. (NYSE:LMT) isn’t the kind of stock that generates daily headlines. But it is certainly one of those names that fit nicely in a long-term retirement portfolio. It pays $2.8 a share quarterly dividend that translates into 2.67% annual dividend yield, backed by the company's strong cash flows and its recession-proof business nature.

In a report titled “Into the new Cold War,” RBC Capital Markets analyst Ken Herbert this week initiated coverage of defense companies, saying “the elevated defense spending (with less volatility) will justify a positive re-rating on the sector.” While Russia’s war on Ukraine is bolstering demand, “the persistent China risk will support long-term sentiment and funding upside.”

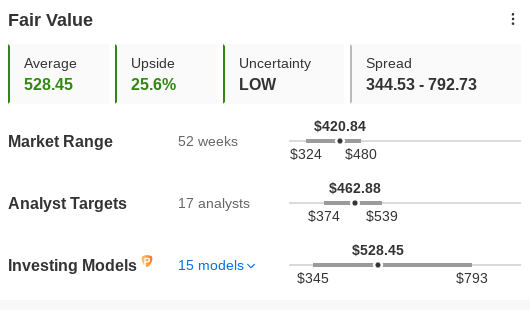

Due to this increased military spending and its defensive nature, LMT stock has handily beat the market this year, rising more than 18%. According to several financial models, like those that value companies based on P/E or P/S multiples or terminal values, the average fair value for LMT on InvestingPro stands at $528.45, implying more than 25% upside potential.

Source: InvestingPro

Russia’s invasion of Ukraine has triggered pledges by European governments to boost military spending, while the U.S. Congress is on track to increase the domestic defense budget above the request from the White House. Jay Malave, Lockheed’s chief financial officer, said in July that the overall pipeline of potential new defense deals is stronger than a year ago.

Disclaimer: Haris Anwar owns shares of Cisco and Coca-Cola.