The insurance industry fears high claims due to occurrence of Hurricane Harvey last Friday. Per Aon Benfield, the global reinsurance intermediary and capital advisor of Aon plc (NYSE:AON) , the industry already digested $53 billion in catastrophe losses in the first half of 2017, which registered the highest figure since 2011.

Harvey hit Houston and the Texas Gulf Coast last week and is assigned to be Category 4 Hurricane. Per insurance analysts at J.P. Morgan, losses from Hurricane Harvey could range between $10 billion to $20 billion preliminary. However, this could exceed the primary estimate, given the intensity of damage caused.

This catastrophe loss will upset the insurers’ underwriting results, especially for carriers with a significant exposure to Houston and Texas Gulf Coast. However, insurers can gear up for raising higher premiums due to massive catastrophe losses.

Amid bad news, the silver lining for the insurance industry is the improving interest rate environment, reflecting an improving U.S. economy in turn. With the Federal Reserve already hiking rates twice this year (intended for one more), the insurers stand to benefit from the progressing rate environment.

Assured Value Picks to Play the Present Situation

We have zeroed in on three undervalued stocks which investors might add to their portfolio. Value investing is for those looking to buy stocks with the value lower than the intrinsic one. Hence, these investors target stocks with a low price-to-book (P/B) ratio or with high dividend yields. P/B ratio is the best multiple for valuing insurers owing to their unpredictable financial results.

We thus refine our search using the Value Score of A or B and a bullish Zacks Rank. A Buy rated stock with a Value Score of A or B are best investment bets.

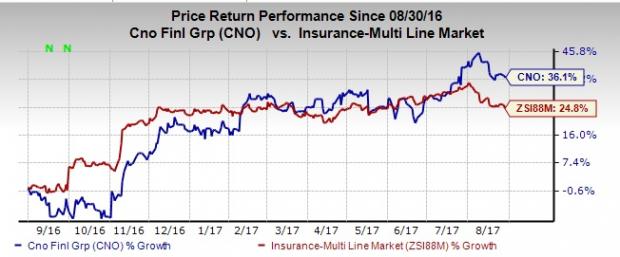

Carmel, IN-based CNO Financial Group Inc. (NYSE:CNO) develops, administers and markets supplemental health insurance, annuity, individual life insurance and other insurance products. The company has a Value Score of A and a Zacks Rank #2 (Buy). It is currently trading at a P/B ratio of 0.79, lower than the industry average of 1.35. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of the company have surged 36.1% in a year, thus outperforming the industry’s growth of 24.8%.

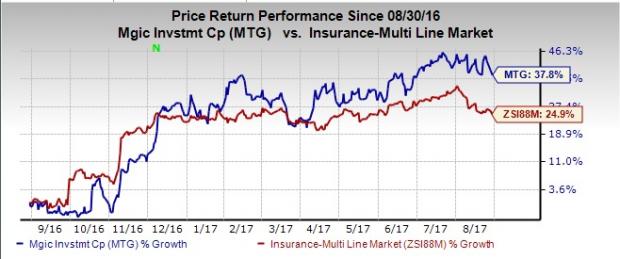

Milwaukee, WI-based MGIC Investment Corp. (NYSE:MTG) primarily covers single-family, first-time mortgage loans by providing primary insurance to cushion lenders against non-payment of individual loans. The company has a Value Score of B and a Zacks Rank #2. It is currently trading at a P/B ratio of 1.39.

Shares of the company have soared 37.8% in a year, outperforming the industry’s rise of 24.9%.

Reno, Nevada-based Employers Holdings, Inc. (NYSE:EIG) operates in the commercial property and casualty insurance industry, primarily in the United States. The company has a Value Score of B and a Zacks Rank #2. It is currently trading at a P/B ratio of 1.51.

Shares of the company have rallied 39.5% in a year, outperforming the industry’s 14.8% increase.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without.

More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off. See Stocks Now>>

Employers Holdings Inc (EIG): Free Stock Analysis Report

Aon PLC (AON): Free Stock Analysis Report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

CNO Financial Group, Inc. (CNO): Free Stock Analysis Report

Original post

Zacks Investment Research