A few tech stocks posted beat and raise quarters last night after the close. Let’s take a look at their results and what impact the report will have on the current Zacks Rank.

Big Mover

Nutanix (NTNX) beat the Wall Street estimate by 3 cents and then guided the next quarter higher by a penny on the bottom line and on the top line as well. This might have been a surprise to many, but it really wasn’t to me. I tweeted my watchlist for the week on Monday that included several big movers. Nutanix was the last one to report.

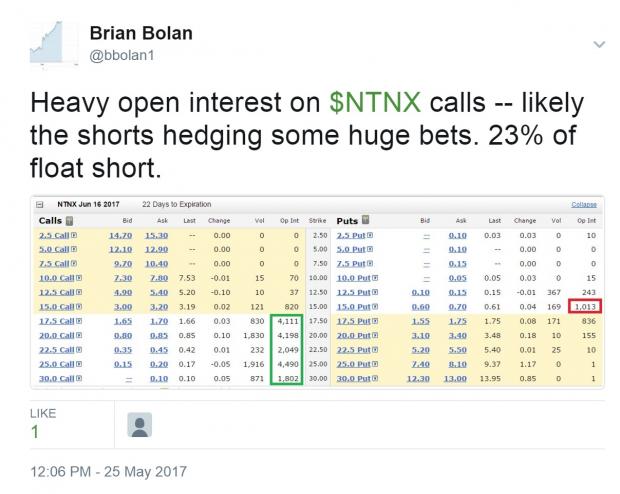

As well as reviewing the recent research coverage on the stock I posted a picture of the options table for the next expiring contracts. The June 16 expiration had 22 days as of yesterday and around midday you could see two things going on. First was the big open interest in the calls compared to the open interst in puts. The other was the big volume on the call side. I noted that some of the call buying was likely hedging by shorts --- which happened to be 23% of the float.

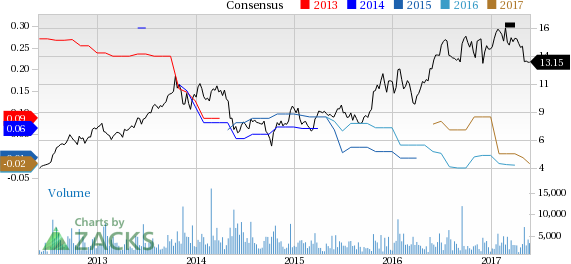

NTNX is a Zacks Rank #3 (Hold) but the beat and guide higher will likely send analysts back to their models to raise estimates. Earnings estimate revisions are the foundation of the Zacks Rank and I expect the models to come in over the next few days with higher estimates for this year and next. I would not be surprised to see NTNX move to a Zacks Rank #2 (Buy) next week.

Follow Brian Bolan on Twitter: @BBolan1

The Answer Is 64

On the smaller side of things there was the quarter reported by 8x8 Inc (EGHT). This stock is also a Zacks Rank #3 (Hold) but could be moving higher next week as models show the impact of a strong beat and raise quarter. The company posted EPS of $0.05 when Wall Street was looking for $0.03. The topline also came in ahead of expecations and showed growth of 16% on a year over year basis.

The guidance was for the 2018 fiscal year, and the company is expecting revenues of between $296M - $300M with the Wall Street consensus coming in at $294M. This is good news for investors as growth looks to continue.

The company is on tap to present at the 37th Annual Growth Stock Conference hosted by William Blair on June 14. Before that, they will be speaking at four other tech / small cap conferences hosted by other broker dealers.

Vive Life!

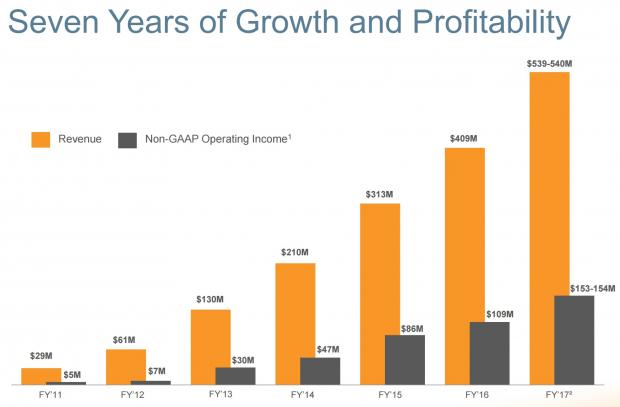

Finally we have a CRM / Software play that focuses on life sciences customers. Veeva Systems (VEEV) is a Zacks Rank #3 (Hold) that has shown seven years of growth and profitability.

VEEV reported earnings of $0.24 when Wall Street was looking for $0.18 for a $0.06 beat. Revenues of $158M were well ahead of the $151M estimate and reflected 32% growth from the prior year. Guidance came in one penny ahead of the consensus for next quarter on the bottom line and was higher on top too. The company also increased the guidance range for Fiscal 2018, from $0.78-$0.80 to $0.82-$0.84.

To me, VEEV looks like the type of stock that could trade to $75 before the end of the month.

Of these three stocks I like VEEV the best going forward.

Veeva Systems Inc. (VEEV): Free Stock Analysis Report

Nutanix Inc. (NTNX): Free Stock Analysis Report

8x8 Inc (EGHT): Free Stock Analysis Report

Original post

Zacks Investment Research