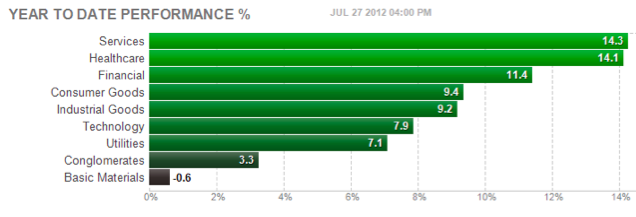

Basic Materials have been getting pummeled in 2012 for a number of reasons, chiefly the slowdown in the world economy, particularly China, and a strong dollar. This sector is the worst performing sector so far, down 0.6% in 2012:

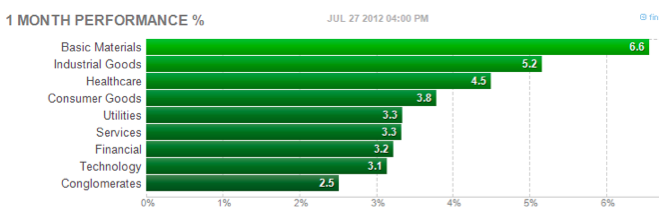

However, over the past month, this sector has outperformed all others, thanks to a falling dollar, and renewed stimulus from the Chinese government:

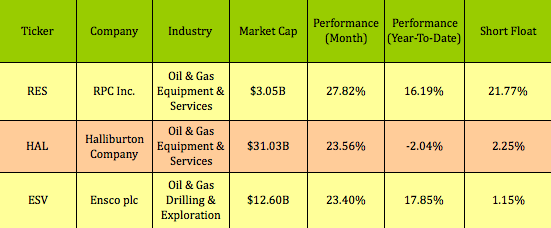

Here are the top 3 dividend paying stocks in this group over the past month:

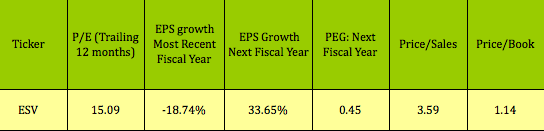

They all look pretty good, except when you look at that last metric – Short Float. With a high short float of 21.77%, it seems that many traders are betting against RPC. One big reason is most likely the EPS negative estimates of -15.83% for its next fiscal year. That leaves Halliburton, which we wrote about earlier this month, and Ensco, (ESV), an Oil and Gas Drilling/Exploration stock which struggled in 2011, has some good EPS growth prospects for 2012, and is currently undervalued on a PEG basis:

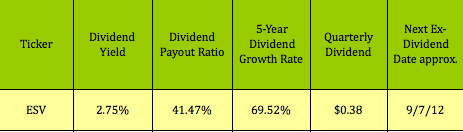

Dividends: Although it’s not part of the high dividend stocks world, Ensco has a respectable dividend yield, and did raise its quarterly dividend to $.38/share from $.35 in the 1st quarter of 2012, plus, it has a conservative dividend payout ratio. It also made a huge jump in its quarterly dividend payouts in 2010, going from $0.025, up to $0.35, which accounts for its very high 5-year dividend growth rate:

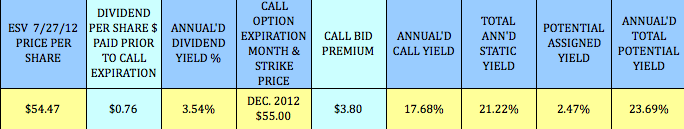

Covered Calls: Even with ESV’s high dividend growth rate, it’s easy to substantially embellish your income on this stock, via selling covered calls. ESV’s December $55.00 call options are now paying 5 times what its next 2 quarterly dividends pay.

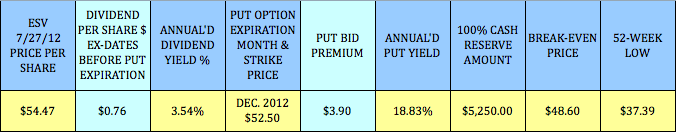

Cash Secured Puts: Want to sneak up on this stock, and get a lower entry cost? ESV’s December $52.50 put options offer you a $48.60 break-even price, which is nearly 11% below ESV’s current share price:

Disclosure: Author had no positions in any of the stocks mentioned at the time of this writing.

Disclaimer: This article is written for informational purposes only and isn’t intended as investment advice.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

3 Basic Materials Dividend Stocks Trouncing The Market

Published 07/30/2012, 12:44 AM

Updated 07/09/2023, 06:31 AM

3 Basic Materials Dividend Stocks Trouncing The Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.