Here is something that investors can take to their “to-big-too-fail” banks: Authorities in China will never allow a full-blown credit crisis to decimate the world’s 2nd largest economy. Disappointing manufacturing data, a falling yuan and the country’s first junk bond default have all contributed to perceived investing risks. However, Chinese government officials have learned from the sub-prime disaster in the U.S. (2008) as well as the sovereign debt catastrophe in Europe (2011). They will provide stimulus as necessary.

I have been wrong about China turning a corner before. In early January commentary describing country ETFs that would benefit from capital shifting abroad, I gave the highest accolades to iShares MSCI New Zealand (ENZL), iShares MSCI Netherlands Index (EWN) and SPDR S&P 500 (ARCA:SPY) SPDR S&P China (GXC). Both ENZL and EWN performed admirably, while any exposure to China proved detrimental in the first quarter.

Keep in mind, corporate earnings in the U.S. are decelerating; spending cuts and share buybacks cannot prop up profits indefinitely. Meanwhile, China’s ability to stimulate its economy should provide the requisite stability for investors to consider countries that will benefit from the bottoming out of extreme China pessimism. In other words, you will probably need to broaden your horizons even if you choose not to invest in China directly.

Here are 3 Asian ETFs that should benefit from attractive fundamentals and increasingly improving technicals:

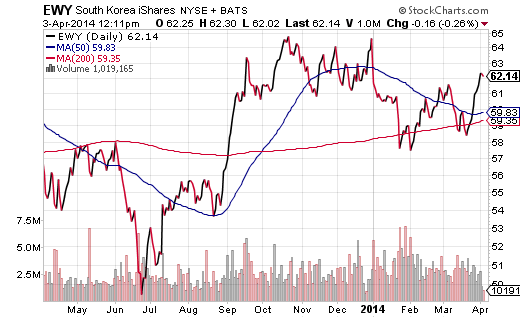

1. iShares South Korea Index (ARCA:EWY). After three years of extraordinary volatility and complete futility, what makes South Korea worthy of consideration today? For starters, EWY trades at roughly 9x present year earnings. Not only is that a 20% discount to Asia at large, it is a bonafide steal when compared with U.S. markets. Skirmishes with North Korea notwithstanding, EWY’s 33% information technology weighting is desirable for those that wish to overweight the sector. (Am I the only one that believes Samsung is one of the most innovative companies on the planet right now?)

Equally impressive, South Korean exports in March to the United States and Europe picked up considerably. And while exports to China grew at a below-forecast pace (4.5%), a more stable and soon-to-be-stimulated China should benefit investors in EWY. Additionally, the current price of EWY is above its shorter-term (50-day) and longer-term (200-day) moving averages.

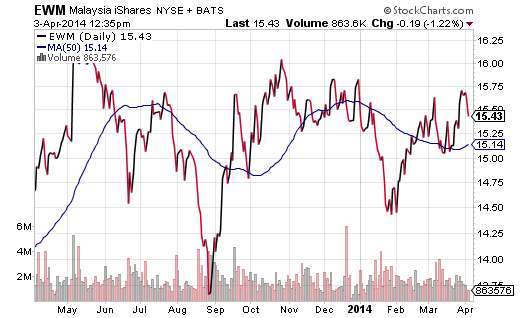

2. iShares MSCI Malaysia (EWM). Long-time readers know that EWM had been one of my largest holdings for nearly two years — from the summer of 2009 until the U.S. sovereign debt downgrade and subsequent eurozone financial calamity in the summer of 2011. I haven’t seriously considered an allocation since. That said, the capital of Malaysia, Kuala Lumpur, is one of the world’s premier financial centers for both Asian and Islamic transactions. And for those who place a high premium on economic freedom as a precursor for corporate profitability, take note of Malaysia’s overall ranking of #6 among 180 economies; it is #1 in access to credit.

It is true that U.S. monetary policy tapering has caused capital to shift away from a number of emerging markets back toward developed markets. On the other hand, recent year-over-year data showed exports to China rocketing 37%. In essence, for those who believe that China bearishness is overdone and/or bottoming out, EWM may be a “neighborly” way to profit from the trend. This exchange-trade tracker’s recent bounce higher off key technical levels is also encouraging.

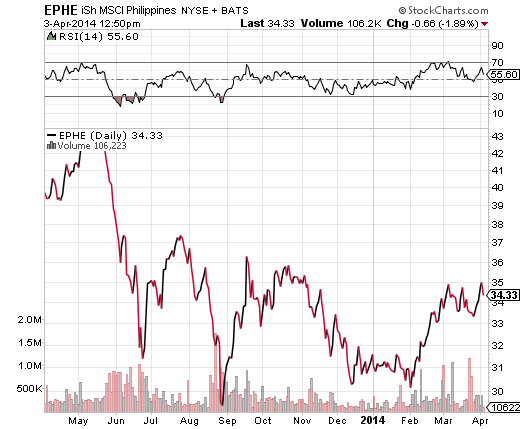

3. iShares MSCI Philippines Invest. (EPHE.K). On March 31, I talked about the ways in which I might purchase an emerging market asset. Specifically, I discussed having just missed a late November (2013) opportunity to purchase EPHE; its Relative Strength Index Reading (RSI) just missed dipping below my target of 30.

Regardless, the big picture for a country that I have traveled to on multiple occasions — both for work and for pleasure — is genuinely impressive. Few countries boast demographics as favorable as the Philippines with its median age at 23. Recent stability in the political arena has also bolstered domestic consumption, while the government has been looking toward a number of infrastructure enhancements. An area of ironic concern? The economy is flourishing without central bank stimulus such that many expect the country to begin a cycle of tighter monetary policy.