- Bitcoin’s rebound sets the stage for altcoins, with Ethereum, Dogecoin, and Ethena primed for key moves.

- As Ethereum nears $4,000 resistance, Dogecoin and Ethena face levels that could define their next moves.

- A weaker dollar boosts the crypto rally—altcoins like Ethereum and Dogecoin may capitalize on the momentum.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro!

The cryptocurrency market has made a strong start to the year, with the total market capitalization bouncing back by 10%, hitting the $3.5 trillion mark. Bitcoin has rebounded sharply, pushing past $100,000 after halting its downward trend near $92,000 in late December. But it's not just Bitcoin leading the charge—altcoins have outpaced the crypto's performance since the start of 2025, with average gains of about 13%.

This shift has largely been fueled by a decline in Bitcoin's dominance, which gave altcoins more breathing room. Recent rumors of potential regional tariffs under Trump's administration sparked a dip in the US dollar, funneling investments into riskier markets, including cryptocurrencies. While Trump dismissed the reports, the dollar’s weakness persists, leaving traders focused on upcoming US labor market data. A weaker-than-expected report could signal further short-term dollar declines, offering more fuel for crypto’s ongoing recovery.

Bitcoin’s surge to nearly $102,000 yesterday highlights the growing momentum. Meanwhile, although altcoins have slowed since the weekend, they’re maintaining a positive outlook with a 1.2% increase. Among the top altcoins, Ethereum continues to capture attention, but other altcoins like Dogecoin and Ethena are also vying for the spotlight. Here's a closer look at three altcoins that could see significant moves in 2024.

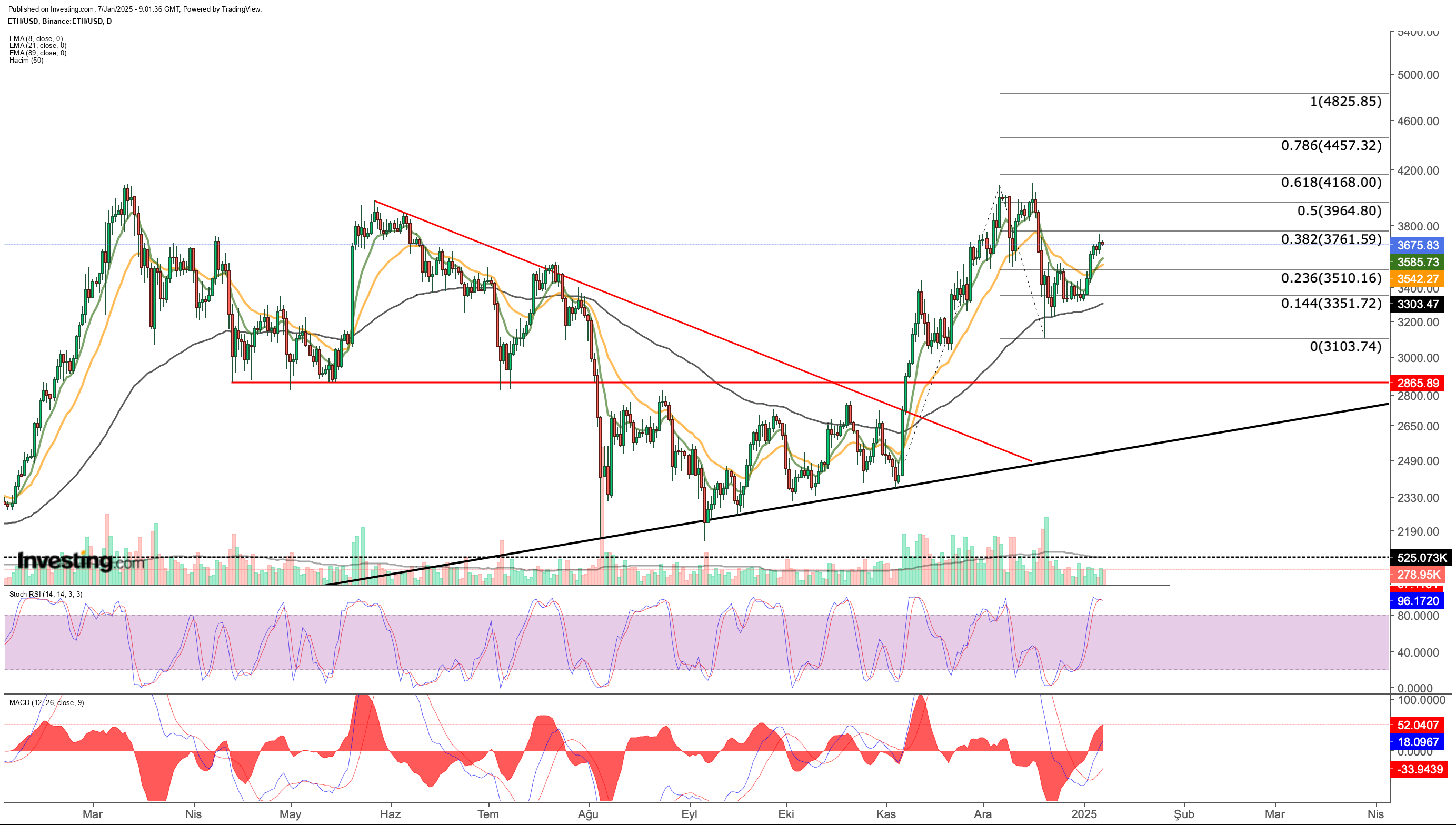

1. Ethereum Eyes Key Resistance Level for a Potential Breakout

After Ethereum found support at its long-term trendline post-US elections, it surged from $2,350 to over $4,000, marking a 70% gain in just a few months. However, resistance has been a challenge, with Ethereum recently struggling in the $4,000-$4,100 range, where it faced heavy sell-offs earlier in the year. While it dipped to around $3,300 in December, the selling pressure has since weakened, and the next major hurdle sits at the $3,760 level (Fib 0.382).

A daily close above this level would signal a clear recovery and could propel Ethereum toward $4,450 and potentially $4,800. If it fails to break through, the $3,500 level remains critical as the primary support. Ethereum's near-term direction will depend on whether it can maintain its momentum above key levels, with the $3,300 level providing the final line of defense against a deeper pullback.

2. Dogecoin Tests Key Resistance - Can It Maintain the Momentum?

Dogecoin (DOGE) found itself in a correction phase after breaking below the $0.39 support level last month, but it has since reversed course, rallying from its low of $0.30 to test resistance at $0.39 once again. If DOGE manages to clear this resistance and push past $0.40, the next targets are $0.432, $0.47, and $0.50.

A positive crossover in short-term EMAs supports the bullish outlook, but overbought conditions, as indicated by the Stochastic RSI, could cap further gains. If Dogecoin consolidates above $0.385, it may avoid overbought territory and pave the way for more upside. However, failure to maintain this level could lead to a retest of $0.355, potentially offering a buying opportunity—though a close below this support would suggest further downside risk.

3. Ethena at a Crossroads: Will It Break Through Critical Resistance?

Ethena (ENA), which gained significant attention on major exchanges last year, has been in recovery mode since September. After tumbling from $1.50 to $0.20 following its April launch, ENA has managed to consolidate and surge back into the $1.00 range, currently hovering between $0.90 and $1.25.

The key to its next move lies at the $1.20 resistance level. A breakout above this zone could set ENA on course for $1.50 and potentially higher, toward the Fibonacci expansion zone of $1.80 to $2.24. On the downside, support levels at $1.13, $1.06, and $0.98 could serve as key markers. If ENA fails to hold above $0.98, a correction back to around $0.80 is possible, though a rebound from this area could lead to another breakout.

As the altcoin market continues to evolve, all eyes will be on these three coins. Ethereum, Dogecoin, and Ethena each have the potential to make significant moves this year—will they break through their resistance levels and push the boundaries in 2024? Only time will tell.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure InvestingPro at a 50% discount.

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.