One major theme of 2022 is the Federal Reserve raising interest rates to squash inflation. Case in point, the Fed raised rates another 75 basis points on Wednesday.

Will this be enough? What’s to come of interest rates?

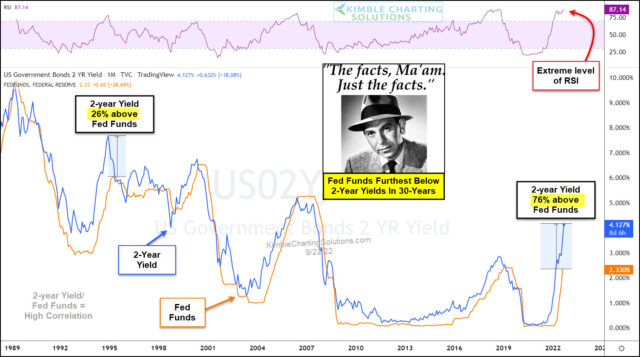

That question brings us to today’s chart, where we compare Fed Funds to the 2-year treasury bond yield (a good short-term gauge of interest rates).

As you can see, the 2-year yield and Fed Funds have been pretty correlated over the past 30 years. Typically the 2-year yield leads Fed Funds on the way up and down. But what happens when it reaches extremes? Because this is what we have today.

The 2-year yield is trading at an extremely overbought level of RSI. It is currently 76% above Fed Funds! The next closest example over the past three decades was back in the 1990s when it traded 26% above Fed Funds (before stalling out and heading lower).

If the 2-year yield stays high and Fed Funds match yields currently (over 4%), the odds are good that stocks and bonds will struggle.