Support seen close to the 1.3000 level.

EUR/USD is unwinding mildly from oversold conditions, driven by short-covering as the market adjusts to the break beneath 1.3146.

Our cycle analysis successfully signalled increased volatility within the first two weeks of December across “risk” proxies, including the equity and commodity markets.

Watch for a sustained close beneath 1.3000 (psychological level) to resume EUR/USD’s multi-month downtrend into 1.2870 (2011 major low).

Near-term resistance can be found at 1.3215 and potentially even 1.3550 (02 Dec high). Any rebound into these levels is likely to be short-lived.

Inversely, the USD Index has extended its recovery higher to new 11-month highs, (a move worth over 10% from the summer 2010 lows).

Speculative (net long) liquidity flows are strengthening once again and will continue to help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

Short-term a re-test of 1.5770/80 possible.

GBP/USD exhibits a short-term structure from 1.5409 that suggests a return back to 1.5770/80. However, a pullback would be expected should a return to these levels be achieved, as the rise from 1.5423 is seen as being corrective in nature. A sustained push over 1.5770/80 will negate this corrective scenario.

Italian ten year yields have eased back from the 7.000% level but this is seen as being a temporary respite, with an expectation that this yield will return to the 7.000% region and then on to re-test the high at 7.483%. This could lead to GBP/USD experiencing a degree of support given the negative structure that we are also seeing in EUR/GBP.

Failure to remain above 1.5423 will see an immediate target at 1.5272 and then potentially trend-line support near 1.5100.

Weakening beneath 78.24 (DeMark™ Level).

USD/JPY is still weak beneath 78.24 (DeMark™ Level), as price continues to hold within a multi-day trading range (see hourly chart below).

Confirmation beneath 77.25 (pivot level) would help trigger a third price retracement back to pre-intervention levels and potentially even a new post world war record low beneath 75.35.

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom, within the end of this multi-year contracting pattern.

This may first inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger over the next few weeks, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Tight range bound trade persists.

USD/CHF continues to trade largely sideways in the hourly timeframe. Focus remains on movements in EUR/CHF over coming days and particularly into next year. As EUR/CHF nears the 1.2000 level again the probability of intervention by the SNB will be heightened. Thus the near-term fate of USD/CHF may be determined by EUR/CHF.

As detailed in other parts of this report, there has been a return to the 7.000% region and higher in Italian 10 year yields, although today we are seeing a minor pullback, ahead of debt auctions today/tomorrow. Fresh highs are still anticipated in this maturity, with scope then for a minor pullback in yields, maintaining downside pressure on USD/CHF. Next year is also likely to see a return to focusing on rollover funding issues for the Italian economy.

10 year yields in Spain and Italy are currently trading at 5.084% and 6.767% versus 6.478% and 7.355%, before the US Dollar based swap agreement. These yields were trading at 5.384% and 7.103% respectively on 27 December.

Unwinding from intraday resistance at 1.0425.

USD/CAD is unwinding sharply from intraday resistance at 1.0425, which coincided with a short-term DeMark™ exhaustion signal.

We prefer to wait for a strong directional confirmation higher before initiating a buy trade setup.

A sustained break under 1.0220 now suggests further downside into 1.0000.

Meanwhile, the bulls need to push back above 1.0425 and 1.0524 (25 Nov swing high), in order to trigger a larger breakout from the rate’s multi-month triangle pattern.

In terms of the big picture, a directional confirmation above 1.0680 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott wave cycle.

EUR/CAD has breached the base of an important multi-month distribution pattern. A sustained break beneath 1.3393-79 (19th Sept low/61.8% Fib), now signals an important breakdown into 1.3140 and provides substantial correlation pressure onto EUR/USD.

Strong unwinding from oversold conditions.

AUD/USD is unwinding strongly from oversold conditions, which also coincided with an intraday DeMark™ buy signal.

Although this recovery is sharp, it is likely to be short-lived as signaled by the DeMark™ signal. The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie has weakened against the New Zealand dollar. Near-term price activity has mean reverted back over the 200-day MA and we watch for further setbacks over the multi-day/week horizon.

The Aussie dollar is also pairing back its mild recovery against the Japanese yen, while holding above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of global risk appetite.

Daily bear flag in focus for now.

GBP/JPY is potentially in the process of forming a bear flag in the daily timeframe. As anticipated a degree of resistance has been seen close to 123.00. A break under the 121.00 region will likely accelerate the downside momentum.

Although short-term weakness may be witnessed there is an expectation that GBP/JPY will see strong support on the approach to 116.84, should this region be revisited.

Longer-term it is anticipated that a much larger recovery will develop with scope for a return to 163.09 and then potentially on to 192.65. However, signs of basing are still not evident, with the bias still to the downside in the near-term.

Short-term range trading persists.

EUR/JPY has entered into a tight range bound trading zone in the hourly timeframe, after finding interim support close to the 105.00 level recently.

We remain wary of the fact that the 1.3146 level has now been breached in EUR/USD warning of a larger swing lower in EUR/USD. This makes the possibility of a return to 100.76 more likely in EUR/JPY.

However, the structure present since 100.76 is suggestive of a further swing to re-test 111.60 over the medium-term. Thus, while trade is maintained above 101.05, a further leg higher is favoured.

A breakout of the tight hourly trading range is now sought, with a push higher favoured in line with the medium-term structural arguement given above.

This clash between structure and event risk in the Euro-Zone keeps us on the side lines for now.

Sustained under 100.76 will warn of a much larger continuation to the downside.

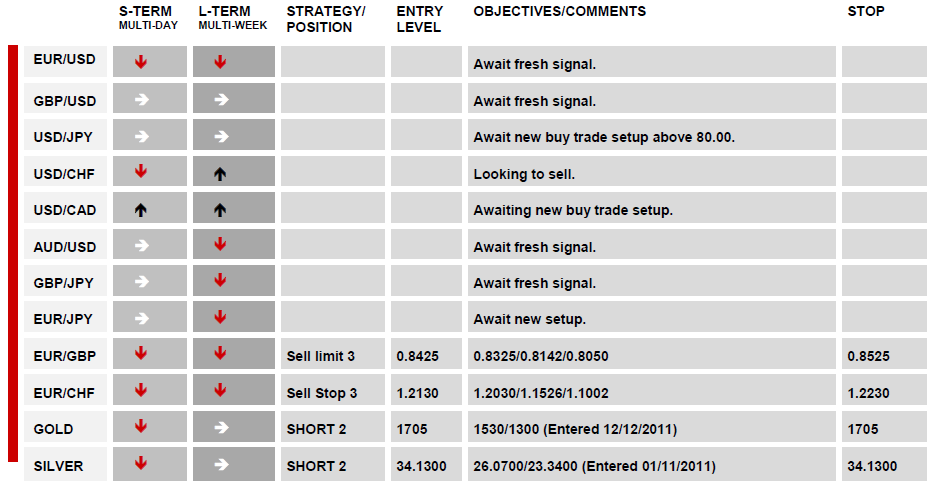

Lower high sought near 0.8425.

EUR/GBP is maintaining the initial support already seen near 0.8300. Scope is seen for a minor continuation of the short-term recovery higher. However, hourly structure remains bearish with a lower high sought versus 0.8613 for a fresh swing to re-test 0.8303.

If a sustained break under 0.8303 can be realised then an extension back to the 0.8068 – 0.8142 region would become viable. This view is assisted by the recent push under 1.3146 in EUR/USD, which may act to make EUR cross shorts easier to maintain.

Rising yields in the core Euro-Zone sovereign bond markets is a continued concern and one that may destabilise the FX markets going forward. Within this environment Sterling may well be judged as a short-term safe haven, further adding to the potential for downside pressure ahead.

Short-term structure conducive to an extension lower.

EUR/CHF is developing a structure in the hourly timeframe which is currently suggestive of a sizeable extension lower. It is anticipated that if a break under the recent low at 1.2170 can be achieved then momentum follow through may lead to the targeting of clustered stops under both 1.2123/30 and 1.2000.

The Italian 10 year sovereign yield remains elevated, trading close to 7.000%.

The new year will see further rollover funding, coupled with a likely bout of negative growth in Italy, an unhealthy combination. Thus, there is plenty of scope for the Swiss Franc to be sought once again as a safe haven. The low yield available on Swiss Franc deposits is unlikely to act as an impediment to it being demanded by investors.

Gold weakens after testing its 200-day average as resisance.

Gold has re-tested its 200-day average, which was recently broken for the first time in 3 years. The move was triggered by a multi-month triangle pattern breakout (see both daily and intraday charts).

Downside pressure remains heavy from inter-market weakness across related risk proxies such as EUR/USD and equity markets. Moreover, there is still heightened risk for a much larger decline if we confirm a weekly close beneath $1600 and $1530 (swing low).

A number of “bargain hunting” trend-followers will be watching this benchmark “line in the sand” for repeat support or a potential big squeeze lower into $1300 and perhaps even $1040-1000 (12-year channel–floor/see top chart insert).

Speculative (net long) flows also support this view having recently breached a key downside level which may threaten over 2 years of sizeable long gold positions. This will trigger a temporary, but dramatic setback that would ultimately offer a unique buying opportunity into summer 2012.

Weak bounce retested $30.0000.

Silver’s weak recovery from oversold conditions has tested key support turned resistance at $30.0000. A sustained close below here now triggers a test of the previous swing low at $26.0700.

Macro price structure continues to focus on the downside risks, following the major sell-off in September. Such a dramatic move traditionally produces volatile trading ranges. This allows the market to have enough time to recover and accumulate renewed buying interest.

Expect a large trading range to hold between $37.0000-26.0700 over the multi-week/month horizon, with downside macro risk into $21.5165 (61.8% Fib-1999 bull market) and $20.0000. This would still maintain silver’s long-term uptrend and help offer a potential buying opportunity for the eventual resumption higher.

Continue to watch the gold-silver “mint” ratio (see top chart insert) which has now accelerated higher by 70%, suggesting further risk aversion over the next few weeks. This also helps explain recent divergences between gold and silver.