Twenty-First Century Fox, Inc. (NASDAQ:FOXA) just released its second-quarter fiscal 2018 financial results, posting adjusted earnings of $0.42 per share and revenues of $8.04 billion. Currently, FOXA is a Zacks Rank #3 (Hold), and is up 1.22% to $36.50 per share in after-hours trading shortly after its earnings report was released.

FOXA:

Beat earnings estimates. The company posted adjusted earnings of $0.42 per share, beating the Zacks Consensus Estimate of $0.36 per share.

Beat revenue estimates. The company saw revenue figures of $8.04 billion, topping our consensus estimate of $7.97 billion.

Twenty-First Century Fox reported fiscal second-quarter GAAP net income of $1.83 billion, or $0.99 per share, marking a 114% gain from the year-ago period. This includes a one-time $1.34 billion gain related to the new tax reform bill.

Fox posted quarterly revenues that climbed 5% year-over-year, based in large part on higher affiliate, syndication, and advertising revenues from its Cable Network Programming segment. However, the company’s Television and Filmed Entertainment segments experienced quarterly declines.

The entertainment power also declared a dividend of $0.18 per for both Class A and Class B shares, payable on April 18. On top of that, Fox noted that it hopes to move forward to complete its deal with Disney (NYSE:DIS) .

“Looking ahead, we are focused on continuing to deliver value to our shareholders through achieving our near-term growth plans, completing our proposed acquisition of the balance of Sky, obtaining the required approvals for the successful completion of our transaction with Disney and planning for the exciting launch of the new ‘Fox’,” Executive Chairmen Rupert and Lachlan Murdoch said in a joint statement.

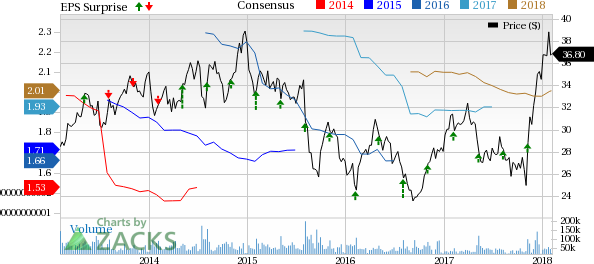

Here’s a graph that looks at FOXA’s Price, Consensus and EPS Surprise history:

Twenty-First Century Fox, Inc. is involved in creating and distributing media services. Its business portfolio consists of cable, broadcast, film, pay TV and satellite assets. Twenty-First Century Fox, Inc., formerly known as News Corporation, is based in New York, United States.

Check back later for our full analysis on FOXA’s earnings report!

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research