- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

21st Century Fox Accepts Disney's Offer, New Fox In Making

After long marketing buzz, Twenty-First Century Fox, Inc. (NASDAQ:FOXA) has agreed to sell some of its properties to The Walt Disney Company (NYSE:DIS) for about $52.4 billion in stock. This will include 21st Century Fox’s Twentieth Century Fox Film and Television studios, as well as cable and international TV businesses. For the rest, 21st Century Fox made clear that it will spin-off into a newly listed company — “Fox” including its highly-rated news, sports and broadcast businesses, just before the acquisition.

The merger has been approved by the board of directors of both companies, while shareholder approval of these companies still remains pending. Further, it is conditioned up on receiving approval under the Hart-Scott-Rodino Antitrust Improvements Act, numerous other non-United States merger and other regulatory reviews, as well as customer closing conditions.

The New “Fox”

The spinoff will include Fox Broadcasting Company, Fox Sports, Fox Television Stations Group, Fox News Channel, Fox Business Network, and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network (BTN). Additionally, the company’s studio lot in Los Angeles and equity investment in Roku will also form a part of the new Fox.

This new company will focus on live news and sports brands, which will be secured by Fox Network’s strength. Apart from owning the nation’s #1 cable news channel, the new Fox will gain from the business news channel with highest viewership and a stations group housed in nine of 10 major metro areas in the United States. It will also own the long-term sports rights to the NFL, MLB, World Cup soccer and NASCAR.

Further, the new company will have a sound financial position, backed by unmatched growth and strong free cash flow generation. The company will continue to benefit from higher affiliate rate, rise in retransmission and robust advertising demand for its live content and entertainment product.

The spinoff transaction is taxable only to 21st Century Fox and not to its shareholders. The new Fox is likely to distribute an $8.5 billion cash dividend to 21st Century Fox before the completion of the spin-off, which represents an estimate of such tax liability.

On completion of the spin-off, every 21st Century Fox shareholder will receive a share of the new Fox in the same class as previously held. The company will maintain two classes of common stock: Class A Common and Class B Common voting rights.

The Merger Transaction

Per the deal, the shareholders of 21st Century Fox will be entitled to take delivery of 0.2745 shares of Disney, against each share of 21st Century Fox. Further, Disney will take on 21st Century Fox’s $13.7 billion of net debt, consequently bringing the total transaction value for the deal to $66.1 billion. The previously mentioned $52.4 billion only makes for the equity component of the deal. The total enterprise value of the combined entity is estimated to be about $69 billion.

As part of the stock transaction, Disney is expected to issue 515 million new shares, which will be distributed to shareholders of 21st Century Fox. This represents nearly 25% stake in Disney on a pro-forma basis. The exchange ratio of 0.2745 Disney shares for every share of 21st Century Fox has been set on a 30-day volume weighted average price of Disney stock.

However, there are some adjustments to tax liabilities arising from the aforementioned spinoff and other transactions under the deal, which may alter this initial ratio.

How will Disney Benefit from the Acquisition?

The merger between the two media biggies will bring 21st Century Fox’s popular film production businesses, including Twentieth Century Fox, Fox Searchlight Pictures and Fox 2000, as well as its storied television creative units, Twentieth Century Fox Television, FX Productions and Fox21 under Disney’s ambit. Additionally, Disney’s entertainment business will be enhanced by the inclusion of FX Networks, National Geographic Partners, Fox Sports Regional Networks, Fox Networks Group International, Star India and Fox’s interests in Hulu, Sky plc, Tata Sky and Endemol Shine Group.

Notably, 21st Century Fox remain committed to closing acquisition deal to buy 61% stake of Sky, which it does not currently. The transaction is anticipated to conclude by Jun 30, 2018.

Disney sees this acquisition as an opportunity to enhance portfolio of everyone’s favorite franchises and branded content to strengthen its direct-to-consumer offerings. Further, this transaction will expand Disney’s international revenue mix and exposure.

In the international market, the company will gain from the addition of Sky serving about 23 million families in UK, Ireland, Germany, Austria and Italy. Further, Fox Networks International broadcasting, which operates more than 350 channels in 170 countries is going to be valuable addition. Moreover, the company will significantly boost its viewership with the inclusion of Star India, which runs 69 channels with 720 million viewers per month across India and more than 100 other countries.

Moreover, management at 21st Century Fox believes this combination will considerably enhance shareholder value as Disney continues to grow in a dynamic industry. Further, 21st Century Fox expects the able leadership of Bob Iger through the transition is likely to benefit the new company. For this, Iger has accepted to remain as Chairman and CEO of Disney through 2021.

How Did the Shares React?

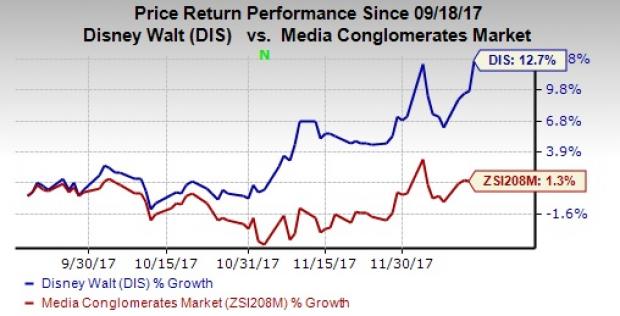

Shares of both 21st Century Fox and Disney reacted positively to the news, rising 6.5% and 2.8%, respectively. Overall, 21st Century Fox has surged 31.6% in three months, outperforming the industry’s growth of 21%. Meanwhile, Disney has jumped 12.7%, also surpassing the industry’s growth of 1.3%.

Our Take

We believe the deal could be turning point for Disney, which for quite some time now has been struggling in the fast changing media landscape, where rise in streaming and cord cutting have become two faces of the coin. The acquisition will not only enhance Disney’s bargaining power with Cable TV providers, but also increase affiliate fees, provide a fresh lease of life to ESPN and create cost synergies.

Though regulatory approvals for the deal should not be a hindrance, we would prefer to wait till the end before jumping to conclusions, any untoward situation as in the case of AT&T's (NYSE:T) deal to buy Time Warner (NYSE:TWX) would be disheartening.

Both 21st Century Fox and Disney currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Time Warner Inc. (TWX): Free Stock Analysis Report

Walt Disney Company (The) (DIS): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.