Short-covering around the key 1.3000 level.

EUR/USD is unwinding mildly from oversold conditions, driven by shortcovering

as the market adjusts to a new bearish paradigm, following the break beneath that all-important psychological level at 1.3000.

Our cycle analysis successfully signalled increased volatility within the first two weeks of December across “risk” proxies, including the equity and commodity markets. Expect some respite ahead of the holiday period.

Watch for a sustained close beneath 1.3000 (psychological level) to resume EUR/USD’s multi-month downtrend into 1.2870 (2011 major low). Near-term resistance can be found at 1.3215 and potentially even 1.3550 (02 Dec high). Any rebound into these levels is likely to be short-lived.

Inversely, the USD Index has extended its recovery higher to new 11- month highs, (a move worth over 10% from the summer 2010 lows).

Speculative (net long) liquidity flows are strengthening once again and will continue to help resume the USD’s major bull-run from its historic oversold extremes (momentum, sentiment and liquidity).

Short-term, long positioning favoured.

GBP/USD continues to move back towards the 1.5780/70 double top in the hourly timeframe after breaking over the resistance of the hourly falling channel that had been containing price since the beginning of the month.

The movement of Sterling is likely to be affected by the movement in selected core Euro-Zone sovereign markets. In particular we note that Italian 10 year yields are still trading close to 7.00%. Daily structure is also suggestive of a return to test 7.00% and higher. A continuation of higher yields may see Sterling being adopted as a safe haven again. This reasoning would likely help to keep cable within its year long range.

Failure to remain above 1.5423 will see an immediate target at 1.5272 and then potentially trend-line support at 1.5110.

Weakening beneath 78.24 (DeMark™ Level).

USD/JPY is still weak beneath 78.24 (DeMark™ Level), as price continues to hold within a multi-day trading range (see hourly chart below).

Confirmation beneath 77.25 (pivot level) would help trigger a third price retracement back to pre-intervention levels (PIR III) and potentially even a new post world war record low beneath 75.35 (PINL).

Sentiment in the option markets continues to suggest that USD/JPY buying pressure remains overcrowded as everyone continues to try and be the first to call the market bottom, within the end of this multi-year contracting pattern (see top chart insert).

This may first inspire a temporary, but dramatic, price spike through psychological levels at 75.00 and perhaps even sub-74.00. Such a move would help flush out a number of downside barriers and stop-loss orders, which would create healthy price vacuum for a potential major reversal.

The medium/long-term view remains bullish, as USD/JPY verges toward a major long-term 40-year cycle upside reversal. Expect key cycle inflection points to trigger over the next few weeks, offering a sustained move above our upside trigger level at 80.00/60, then 82.00 and 83.30.

Breaks under hourly channel support.

USD/CHF has weakened ever since meeting resistance close to 0.9550. This initial bout of weakness may now mark the end of the rising phase from 0.8568. A return back towards the 200 day moving average is possible from current levels.

We also note that in the hourly timeframe, a break under channel support has taken place, which if sustained may warn of further deterioration.

The yield on Italian 10 year sovereign debt tested 7.000% again this week. A return to this level is anticipated ahead of a push to 7.500% before completion of the recent rising phase off 5.758%. This is likely to cause the Swiss Franc to be deemed as a safe haven once again, despite the low yield available on Franc deposits.

10 year yields in Spain and Italy are currently trading at 5.041% and 6.560% versus 6.478% and 7.355%, before the US Dollar swap based agreement. Thus Spanish debt is experiencing a stronger positive effect, in contrast to the Italian market, which remains elevated. The funding needs of the Italian government will return in the early part of next year as large tranches of debt will need to be rolled over. These yields were trading at 5.107% and 6.641% yesterday.

Unwinding from intraday resistance at 1.0425.

USD/CAD is unwinding sharply from intraday resistance at 1.0425, which coincided with a short-term DeMark™ exhaustion signal.

The move is accelerating lower within an intraday consolidation pattern (see lower chart) and we prefer to wait for a strong directional confirmation higher before initiating a buy trade setup.

Until then, keep a watchful eye on support 1.0220. A break here would trigger further downside into 1.0000.

Meanwhile, the bulls need to push back above 1.0425 and 1.0524 (25 Nov swing high), in order to trigger a larger breakout from the rate’s multimonth triangle pattern.

In terms of the big picture, a directional confirmation above 1.0680 is still needed to unlock the recovery into 1.0850 plus. This would extend the upside breakout from the rate’s ending triangle pattern, which was part of a major Elliott wave cycle (see top chart insert).

EUR/CAD is retesting the base of an important multi-month distribution pattern. A break beneath 1.3393-79 (19th Sept low/61.8% Fib), signals an

important breakdown into 1.3140 and would provide substantial correlation pressure onto EUR/USD.

Strong unwinding from oversold conditions.

AUD/USD is unwinding strongly from oversold conditions, which also coincided with an intraday DeMark™ buy signal (see lower chart).

Although this recovery sharp, it is likely to be short-lived as signaled by the DeMark™ signal. The bears must sustain below 1.0000 to further compound downside pressure on the rate’s multi-year uptrend and push back towards 0.9611.

Elsewhere, the Aussie continues to weaken sharply, against the New Zealand dollar. Near-term price activity is mean reverting back into the 200-day MA and we watch for further setbacks over the multi-day/week horizon.

The Aussie dollar is also pairing back its mild recovery against the Japanese yen, while holding above the neck-line of its two-year distribution pattern. Watch for further downside scope into support at 72.00 which would signal further unwinding of global risk appetite.

Sustained over 122.23 suggests a fresh recovery leg higher.

GBP/JPY has broken over the resistance of a falling hourly channel. Coupled with this we have seen a push over the 122.23 lower high. If this rise can be sustained then a fresh leg higher will be favoured to form for a swing all the way back to 127.32.

A break back over 122.98 will add to a more medium-term bullish stance. A failure to do so will suggest that the recovery seen from the 116.84 low is corrective in nature. This suggests scope for a return to 119.38 and then potentially 116.84.

We do however note that for the majority of December a 120.33 - 122.64 range has been traded. A break out of this range is sought ahead of strategy formulation.

Breaks higher from extreme range bound conditions.

EUR/JPY has met short-term support close to the key long-term low at 100.76, reaching 101.05 so far, on a mid-market basis.

Although a short-term recovery has followed, a larger swing higher is required to ensure that we are not in the midst of a corrective phase higher.

The medium-term recovery that we have already witnessed from 100.76 to 111.60 is viewed as the initial leg higher in a larger recovery structure and thus, while trade is maintained above 101.05, a further leg higher is favoured.

We await a sustained resolution of the range trading conditions before formulating fresh strategy.

Sustained under 100.76 will warn of a much larger continuation to the downside.

Approaches daily channel support.

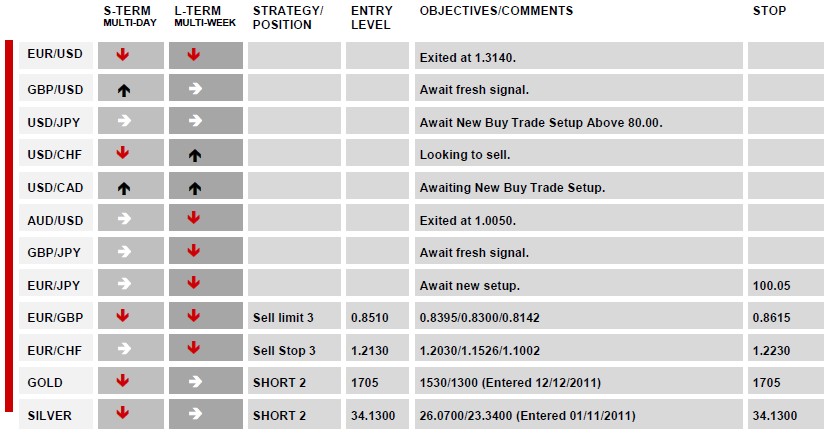

EUR/GBP remains weak in both the short and long-term timeframes. We note that price is now approaching the support of the daily channel that has contained the pair for the last 5/6 months. This potential support level lies near 0.8320 and constitutes a near-term target. However, we await a re-test of the old trend-line support as resistance ahead of possible short positioning.

Short positioning in EUR/GBP may not experience as many false breaks going forward, due to the clear break under 1.3146 that has been witnessed in EUR/USD in recent trade.

As detailed in other parts of this report, rising yields in the core Euro- Zone sovereign bond markets is a continued concern and one that may destabilise the FX markets going forward. Within this environment Sterling may well be judged the best of a bad bunch and to a degree be seen as a short-term safe haven.

Downside bias remains, while within a larger range.

EUR/CHF has broken under our filter level at 1.2226 leading to us changing our sell strategy to a sell stop, as detailed below. We also note that the 50 week moving average has managed to contain the market on the upside, warning that the larger down-trend may not be over.

The Italian 10 year sovereign yield continues to meet resistance close to the 7.000% level. A break over this level will place funding stresses on the Italian economy and may lead to the Swiss Franc being sought once again as a safe haven. As mentioned in prior reports, the low yield available on Swiss Franc deposits is unlikely to act as an impediment to it being sought as a safe haven.

The 1.2000 level is the only level that the SNB has suggested they will defend. There is thus likely to be a large cluster of stops under this level, which if triggered, could herald a return towards the 1.0075 level.

Gold re-testing its 200-day average

Gold is temporarily re-testing its 200-day average, which was recently broken for the first time in 3 years. The move was triggered by a multi-month triangle pattern breakout (see both daily and intraday charts).

Downside pressure remains heavy from inter-market weakness across related risk proxies such as EUR/USD and equity markets. Moreover, there is still heightened risk for a much larger decline if we confirm a weekly close beneath $1600 and $1530 (swing low).

A number of “bargain hunting” trend-followers will be watching this benchmark “line in the sand” for repeat support or a potential big squeeze lower into $1300 and perhaps even $1040-1000 (12-year channel–floor/see top chart insert).

Speculative (net long) flows also support this view having recently breached a key downside level which may threaten over 2 years of sizeable long gold positions. This will trigger a temporary, but dramatic setback that would ultimately offer a unique buying opportunity into summer 2012.

Weak bounce retesting $30.0000.

Silver’s weak recovery from oversold conditions is retesting key support at $30.0000. Only a sustained close below here would trigger a test of the previous swing low at $26.0700.

Macro price structure continues to focus on the downside risks, following the major sell-off in September. Such a dramatic move traditionally produces volatile trading ranges. This allows the market to have enough time to recover and accumulate renewed buying interest.

Expect a large trading range to hold between $37.0000-26.0700 over the multi-week/month horizon, with downside macro risk into $21.5165 (61.8% Fib-1999 bull market) and $20.0000. This would still maintain silver’s long-term uptrend and help offer a potential buying opportunity for the eventual resumption higher.

Continue to watch the gold-silver “mint” ratio (see top chart insert) which has now accelerated higher by 70%, suggesting further risk aversion over the next few weeks. This also helps explain recent divergences between gold and silver.