It’s been a strange week in the currency markets. At last week’s close the market was frothing at the lips over the possibility of a French downgrade. It duly happened, but what was the resulting effect on the euro? Well it’s 2.5% stronger against the US dollar and GBPEUR has touched a 3 week low overnight so all is not as it seems.

Bond auctions have progressed well in the past week with yesterday’s sales from Spain and France proving no exception. Madrid managed to sell EUR6.6bn, a good amount above the initial target of around EUR3.75bn, and at lower yields than the previous instance. France’s auction went similarly as investors seemed to forget about the downgrade, or maybe they never gave a stuff, and bought EUR8bn worth of debt. As we have been saying since December however, these auction results are completely reliant on the ECB’s liquidity operations.

As we know, the ECB opened the taps in December by extending the time that banks could take advantage of the LTRO up to 3 years. Banks can borrow as much money as they want, at a rate of 1% for up to 3 years, as long as they put down collateral. In this case the collateral is normally sovereign debt and herein lies the rub. It is very likely that the banks’ demand for the debt is merely as a “carry trade”; borrow money cheaply (from the ECB at 1%) and invest it in European debt for a return of 3-5% making the difference in-between. Liquidity can lead to solvency, which is the sovereign problem, but these bond auctions are curing a symptom of the problem and not the underlying disease.

The Greek problem is still the main issue for Europe at the moment. We have been hearing a lot of soothing talk from European leaders of late that negotiations are going well. The problem is that they have been going on for a fair while now, so something must be up. Greek yields are higher this morning and we, alongside others, think that the market may get restless if an announcement is not forthcoming by close of business today.

Overnight earnings across the pond have been dominated by the news that Google took one in the teeth last night with earnings and revenue both missing target by a fair margin. Overall however, earnings were strong last night and this has led to further moves higher in Asian equities. This broad support for risk is allowing euro to remain bid but, as we have said, significant risks remain from Greece’s debt negotiations.

In structured data the main headline will be UK retail sales for December, with those of us who are looking for a strong GDP figure hoping that shoppers helped through Christmas. The market is looking for a rise of 0.7% against a 0.4% fall in December. While this may be a tough hurdle to leap given warnings from individual retailers we can take some encouragement from the latest British Retail Consortium numbers that showed sales were 2.2% higher in December. If they miss expectations then expect the weekend papers to be full of stories and comment about the UK’s “imminent recession” or something like that. Barring a complete collapse in sales our Q4 GDP estimate remains at 0.1%.

We also have a UK bill auction at 11.10 which should be well bid alongside other issuances.

Have a great weekend.

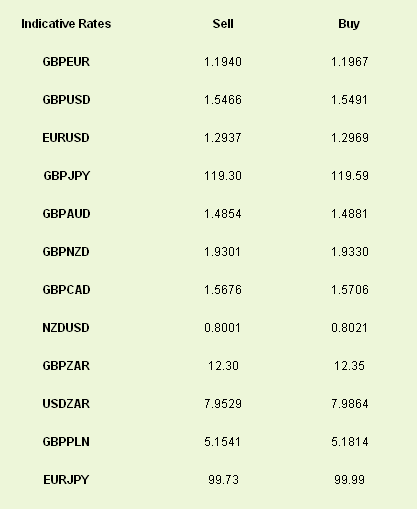

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

20th January 2012: Euro Fights Higher on Hopes for Greece

Published 01/20/2012, 08:04 AM

Updated 07/09/2023, 06:31 AM

20th January 2012: Euro Fights Higher on Hopes for Greece

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.