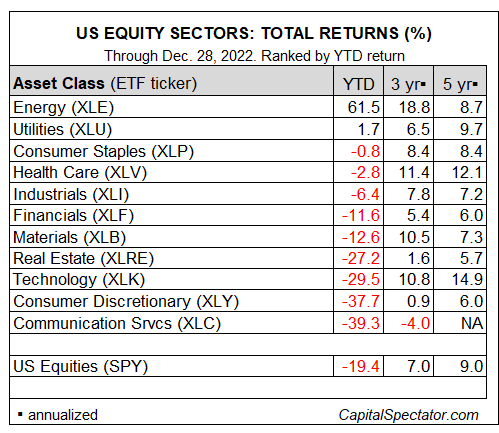

Annual returns for equity sectors are always a study in contrasts. Still, the blowout performance of energy stocks in 2022 is unusually divergent vs. the rest of the field, based on a set of proxy ETFs.

With just two trading days left in the year, the energy sector (NYSE:XLE)) is set to post a 60%-plus total return for 2022. The performance is all the more impressive, considering that XLE’s surge follows a similar gain in 2021 when the ETF rose more than 50%.

Note, too, that XLE’s surge this year is far above the other sector results, which are mostly negative year to date. Only utilities (NYSE:XLU) are above water via a modest 1.7% rise in 2022 through yesterday’s close (Dec. 28). US shares overall (SPY) are in the hole this year by more than 19%.

The Main Takeaway

Active strategies that have delivered strong results this year probably owe the good fortune to some degree (perhaps a large degree) to holding energy shares. Picking and avoiding sector betas isn’t easy, but when it works, it can be a huge driver of positive alpha.

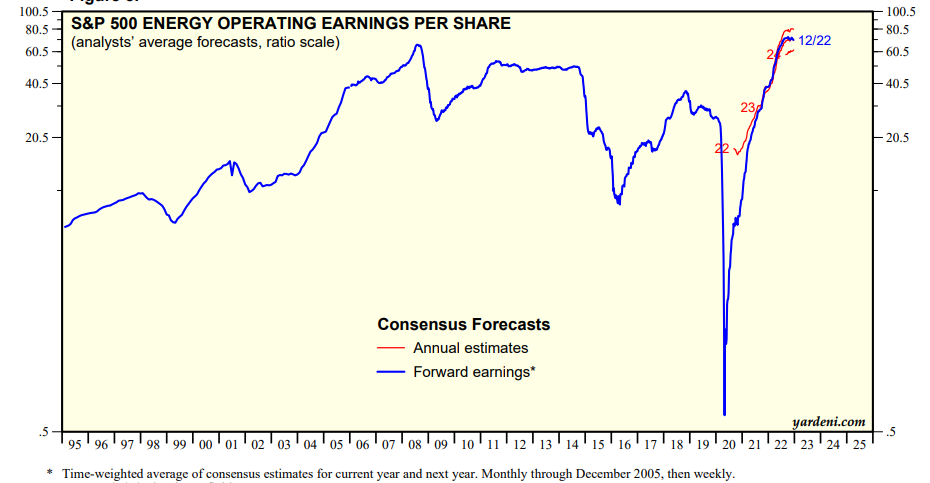

The key question for the new year: After two years of sizzling results, is it time to cash in some of the energy chips? Probably, but the war in Ukraine and other supply-related issues could keep energy prices elevated and earnings buoyant for companies in the sector.

Nonetheless, it takes a deeply committed energy bull to stay aggressively optimistic at this point in the cycle. As data from Yardeni.com shows, operating earnings per share for the energy sector are flying high, which begs the question: How much better can it get?