The Federal Reserve yesterday confirmed what it’s been hinting at for months: it will start winding down its bond-buying program. It’s still a long leap to launching interest-rate hikes, Fed Chair Powell suggests. But the first baby step has been taken for laying the groundwork for a post-pandemic policy regime.

Lest the market read too much into the shift, Powell clarified that the Fed will continue to move slowly. “We don’t think it is time yet to raise interest rates. There is still ground to cover to reach maximum employment,” he reasoned.

The complicating factor: Inflation is running hotter for longer than expected, which suggests that the central bank may forced to start lifting rates earlier than Powell would prefer.

But for now, the market doesn’t look set to force the central bank’s hand. Fed funds futures continue to price in low odds for a rate hike through the first half of 2022. Only in June of next year does the probability of tightening rise above 50%.

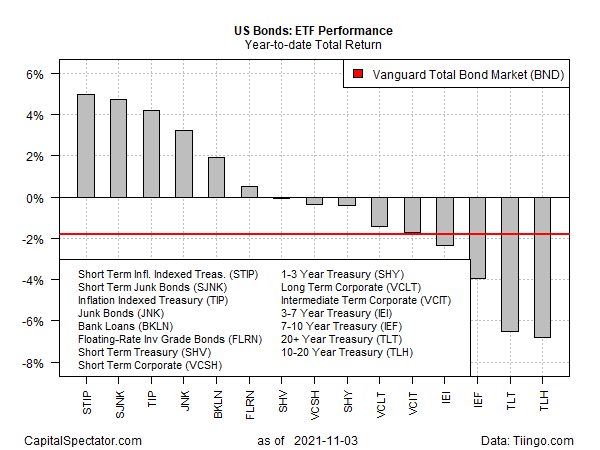

Nonetheless, the ground has shifted on the outlook for inflation and rates at the long end of the curve. Indeed, long bonds remain deep in the red this year, based on a set of ETFs through yesterday’s close (Nov. 3). By contrast, short-term inflation-indexed Treasuries and junk bonds are the leading performers year to date via our set of proxy funds for the US fixed-income market.

The iShares 0-5 Year TIPS Bond ETF (NYSE:STIP) is leading the field with a 5.0% year-to-date gain. Inflation has shot up this year, raising demand for inflation-indexed Treasuries, whose principle increases as inflation rises.

The Fed is still forecasting that the recent inflation surge is transitory, although the exact timetable for official defining that estimate is fuzzy. Nonetheless, some analysts are comfortable with a relatively time-sensitive forecast. “Inflation will remain stubbornly high and above target for much of 2022 before it moderates,” predicts Gemma Wright-Casparius, principal and senior fixed-income portfolio manager at Vanguard. “Combined with low interest rates, a dovish Federal Reserve, and the fact that investors have previously been underweight TIPS for the past 12 years, it’s a perfect environment for TIPS to outperform.”

The worst performer this year: long Treasuries via iShares 10-20 Year Treasury Bond ETF (NYSE:TLH). The fund is down 6.7% so far this year.

The US benchmark for fixed income is also nursing a loss for 2021: Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) is off 1.7% year to date.

The Fed presumably has some non-public timetable that it’s following and for now it’s sticking to its plan. Slow and gradual is the focus for removing the extraordinarily dovish policy stance. But even Powell admits that nothing’s written in stone and so the near-term future could (and probably will) bring surprises, for good or ill. “We have to be humble about what we know about this economy, which is still very COVID-affected,” he admitted.