Let’s consider the widening spreads between the spot market price for LIBOR and FRA pricing. We think those widening spreads spell rising risk.

Two acknowledgments are necessary before we wade into the LIBOR weeds. Zoltan Pozsar (Credit Suisse (SIX:CSGN), Global Fixed Income Research Strategy) has done and continues to do stellar work dissecting the changes in the money market end of the yield curve and discerning the interconnection of policies. We first met in Paris years ago at a Global Interdependence Center conference at the Banque de France, when he and Paul McCulley presented a joint paper. I’ve admired Zoltan’s work and followed it closely ever since. His analyses inform today’s discussion.

My colleagues in Cumberland’s fixed income area helped me organize data for this commentary and researched some history for me. Dan Himelberger and Amy Raymond cover for each other and prepare the morning daily summary on certain important data series. LIBOR is one of those series. For a detailed discussion of FRA, see Dan’s summary at the end of this commentary. It includes the Bloomberg instructions needed to see the data.

Let’s get into the LIBOR weeds.

The London Interbank Offered Rate (of interest on loans among banks) has a long history, and some of it is checkered with misdeeds. For a succinct yet complete summary of those misdeeds, including names of perpetrators and those who paid billions in fines, see: cfr.org/united-kingdom/understanding-libor-scandal/p28729.

The new oversight of LIBOR seems to be working well. For the purpose of this writing we will assume that there are no misdeeds influencing the current LIBOR pricing references we will use.

Currently, there are 38 clearing members in LIBOR participating for five major currencies (USD, EUR, GBP, JPY, and CHF). See list here. Those firms post rates for seven different maturities. A total of 35 rates are posted every business day (the number of currencies [5] multiplied by the number of different maturities [7]). The largest usage is the 3-month US dollar rate. In the United States it is often referred to as the “LIBOR rate.”

Of the world’s $300 trillion in total debt and derivatives, about half is denominated in the US dollar. The other half is divided among the four other major LIBOR currencies and many additional smaller currency allocations. Nearly every OECD country has some form of interbank unsecured lending facility and associated interest rates. For this commentary we are going to focus on 3-month US dollar LIBOR because it is the single most important of the rates posted daily and because it is a reference for us as money managers of US dollar-denominated fixed-income portfolios. Readers may note that the US dollar LIBOR rates may anchor one side of a swap, with the other side being denominated in another currency and even another maturity. While those prices and terms are critical in money management, for today’s missive we will restrict our basic focus to US dollar LIBOR.

Let’s add a perspective on the huge size of a $300 trillion sector, of which about $150 trillion is US dollar-denominated. Every single basis-point shift (a basis point is 1/100th of 1%) in LIBOR amounts to an annual transfer of $15 billion from lenders to borrowers or vice versa. LIBOR isn’t about quantity; it’s about price. An American who borrows $1 million for a real estate project owes the million regardless of the interest rate changes that are tied to LIBOR. If the loan is floating-rate, it is likely tied to LIBOR. If the loan is fixed-rate, it may have been “swapped” with a floating rate by the originating lending bank. Trillions are involved in these notional swaps, which are not loans themselves. Swaps are ways that the pricing mechanism adjusts prices to reach a market-based equilibrium between lenders and borrowers.

LIBOR is quoted daily and can be found in two ways. The first is the spot pricing reported by the member banks (see the Wall Street Journal reference above). The spot price is supposed to be the interest rate the banks are charging for unsecured loans to each other. Commercial borrowers and institutional agents that transact with those banks usually structure their transactions at a spread above a LIBOR benchmark. The 3-month US dollar rate is the most commonly used. In the transaction world it is the spreads that are discussed and negotiated.

The second way to determine a LIBOR price is by means of a forward rate agreement (FRA) commitment. This type of agreement is more obscure than daily spot prices are. We use a Bloomberg database for FRA pricing references. In the case of FRA, the borrower pays a premium for a commitment at a future date to a specified LIBOR benchmark. FRA is used in various transactions among currencies and in the same currency among maturities. It is also used for fixed to floating notional swaps. That market is an active one among professionals. The difference between the spot market price and FRA pricing is a spread that we track daily. It is hard for me to imagine that any serious fixed-income manager isn’t looking at this spread every day.

Why do we track the spread daily? Because the way it changes is an indicator of rising or falling market-based risk perceptions. That risk may be to rising or falling interest rates. Or it may be influenced by currency fluctuations in the foreign exchange (FX) market. Or it may be due to a perception of credit risk if the banking system is becoming stressed. Note that LIBOR rates and spreads were the most sensitive of indicators during the sequential financial crises of 2007–2009. Then, the failure of financial institutions and especially banks demonstrated the dominance of credit risk as the main reason behind widening spreads.

The spread is the key element that gives an analyst a market-based price reference of a risk premium. We offer a special hat tip to Fred Feldkamp on this subject. His work on spreads is profound and thought-provoking.

With regard to spreads, why this measure of risk is rising may be unclear. At the early stages of spread widening, the cause is often opaque or at best murky. But one must not ignore it just because its cause is still not fully transparent. The pricing of a rising risk is apparent in the market action on a daily basis even if the observer doesn’t know why. We would use the metaphor of smelling a whiff of smoke but not seeing it or seeing the actual fire. You know something is wrong. You just don’t know where it originates or what the cause is or how dangerous it may be.

As practitioners, we know that market-based price changes of risk premia are the market’s way to measure risk perceptions among market agents. While those perceptions may not always be realized, they are based on real-time prices and are therefore the very best information we can obtain. The reason is simple: Market-based prices are the results of actual real-money bets by both sides of a live market transaction. In a world of media-based financial and economic pundits who talk a lot and think they know everything (just ask them), real prices of actual transactions are far superior to lots of freely offered opinions.

LIBOR prices and spreads are presently talking to those who are willing to observe and listen. We will now dive deeply into the weeds as we enter 2017.

At the end of 2016, the 3-month LIBOR spot price was quoted at about 1% (actually 0.99817%). We used that spot price as a starting point to compute a forward rate estimate. That forward rate calculation gave us a spot price estimate of 1.67% for the 3-month LIBOR, three months from now. (For a description of how to do this math, see here. In other words, the term structure of LIBOR derived from spot prices is steepening. Note that we can do this for diverse maturities. For today’s commentary we are limiting our focus to 3-month LIBOR.

On the same day, the FRA contract price of 3-month LIBOR, three months from now was 1.07%. Thus the difference between (a) the spot market-derived forward rate estimate and (b) the FRA price observation reported by Bloomberg was a spread of about 60 basis points (1.67% minus 1.07%). Readers may ask why these market-based prices are different. Why aren’t they arbitraged? The fact is, they are two different pricing references used for two difference purposes.

A useful metaphor is the spot price of oil versus its futures price. The spot prices for different delivery dates are available, just like the LIBOR spot prices. The futures curves have characteristics like backwardation or contango. Those are interpreted by market agents who use them for forecasting purposes and for measuring market-based pricing of risk in the oil markets.

The spread between spot-based LIBOR forward rates and FRA provides us with a market-based price reference to estimate market risk perceptions. What is important here is that the source for estimating risk is one basic reference: 3-month LIBOR.

It is this spread between two LIBOR pricing methods that helps us estimate the amount of risk priced into the global system by market-based pricing agents. We will now plunge really deep into the weeds.

As we’ve seen, the spread for 3-month LIBOR at the end of last year, versus FRA at the end of last year, was 60 basis points (actually 0.604218%). At the end of 2015 that spread was 32 basis points (actually 0.316%). At the end of the previous year (2014) the spread was 17 basis points (0.172%).

We therefore estimate that using 3-month LIBOR as a guide (and this comparative method of spot versus FRA), risk pricing in the global US dollar liquid market rose 28 basis points during the past year and 15 basis points the year before. Remember that every basis-point widening of this spread adds an annualized risk premium of $15 billion to the global cost of financing in US dollars. For the purpose of this commentary we are ignoring counterparty risks and limiting our conversation to the US dollar. We acknowledge that those risks are rising and suggest readers dig into them to further understand this early stage of the repricing of global risk.

Some observations and inferences follow.

1. Risk premia are rising and were rising long before Trump became president-elect.

2. The US dollar is strengthening and has been for a year and half – and not only because of trade flows. The widening spread allows an inference that the worldwide desire for dollars is raising their price (interest rate and spread), because the quantity is static while the demand is dynamic. Note that the source of dollar quantity is the Fed, and it has held its balance sheet constant in size for three years.

3. FRA versus spot pricing suggests a risk premium may include risks derived from foreign exchange swaps. FX tension and risk are revealed in FRA, and FRA versus spot LIBOR allows an estimate of the impact of global currency tensions on US dollar rates.

4. Nothing on the horizon seems to indicate this risk premium is peaking; everything points to its rising in 2017.

5. This type of analysis is not widely followed; therefore, it has not been subjected to a loss of efficacy (Goodhart’s law). When it becomes widely followed, it will be of little forecast value (as with the VIX).

6. You do not see any comments from Fed officials on this issue. In due time we believe you will be seeing them.

7. Money market regime changes in the US moved about $1 trillion from prime to govy funds. The widely expected post-October normalization of rates didn’t happen. Instead, risk premia widened.

Zoltan recently labeled what we are calling a rising risk premium (my focus is on risk premia; his is on FX exchange and notional swap rates) an “existential trilemma” for the Fed. We agree on the conclusion: Dollars are supposed to be completely fungible and identical to each other. They should trade at parity. But they don’t. FRA versus spot-derived forward rates reveals the growing disparity.

The non-parity trading of dollars is worsening (that is why the spread is widening), which means systemic risk is worsening. Zoltan wrote (November 18, 2016) that “Basel III and money fund reform are turning the exorbitant privilege [he means the dollar’s role as the world’s reserve currency] into an existential trilemma.” Zoltan posits that that’s “a problem for EM [emerging-market] central banks with pegs to the dollar, rather than the Fed at the center of the dollar-based financial order.”

We add that it becomes a problem for the Fed as the risk premium widens. Is the new Trump administration ready for a widening risk premium? We shall soon find out.

In sum, the Fed can control the policy interest rate (the fed funds rate and interest on reserves). It can alter the foreign exchange value of the dollar (or leave that decision to the US Treasury Department). The Fed can manage the size of its balance sheet. It can pursue regulatory reforms. It can use FX swap lines with foreign central banks. BUT it cannot do them all at once unless there is some miraculous alignment.

Spreads and risk premia take the measure of the limits the Fed confronts. Investors need to look for these measures and understand them. LIBOR and LIBOR-based spread analysis are critical for the investor’s estimate of the risks entailed as one or more of these limits is reaching its outer band(s).

For Cumberland, this analysis suggests a stronger dollar, wider spreads, and more volatility in the FX markets. Central banks and their governments that are under pressure (read China or Saudi Arabia) will use their dollars for defense. Their supply may be large, but it is not inexhaustible.

The changes are nonlinear and can become violent when they accelerate. While the outcomes may be attributed to our soon-to-be president Trump, the forces operating in setting current risk premia were in play way before the election. It will be Trump and his team who will either act prudently to dampen those forces beneficially, or fail to do so and exacerbate them. We expect more on their prognosis for success to be revealed soon.

In our US ETF accounts we started 2017 with a cash reserve. In our managed muni accounts we deployed monies in good credits: US dollar-denominated tax-free bonds at yields above 4% and at ratios of 130% of taxable US Treasury bonds. In our international ETF accounts we are very selective as to geography.

We are cautious about 2017 as it unfolds. Last year we called 2016 “the year of politics.” This year we think geopolitical risk and violent volatility in the foreign exchange markets will be sources of concern. They will also present opportunities. We will continue to track LIBOR-based spreads daily.

Here is Dan Himelberger’s discussion of FRA.

A Forward Rate Agreement, or FRA, is an agreement between two parties who want to protect themselves against future movements in interest rates. By entering into an FRA, the parties lock in a fixed interest rate for a stated period of time starting on a future settlement date. The FRA market is a large, highly liquid, over-the-counter market that is typically linked to LIBOR. FRAs and forward-forward contracts are very similar in the sense that they both have the economic impact of guaranteeing an interest rate. However, forward-forward contracts have the interest rate applied to the loan’s principal amount, while FRAs achieve the same economic impact by paying the difference between the desired rate and the market rate at the beginning of the contract period.

The buyer of an FRA enters into the contract to receive a fixed interest rate when there is the belief that interest rates may rise in the future and the buyer wants to fix a borrowing cost today. An FRA is essentially a forward contract on a short-term interest rate, in this case LIBOR, in which cash flow obligations at maturity are calculated on a notional amount and based on the difference between a predetermined forward rate and the market rate prevailing on that date. The parties involved are classified as the “buyer” and “seller”. The buyer, who wants the fixed interest rate, receives a payment if the reference rate is higher than the FRA rate. If the reference rate is lower, then the seller receives payment from the buyer. The buyer is also sometimes referred to as the “borrower” and the sell as the “lender,” even though the notional principal is never lent.

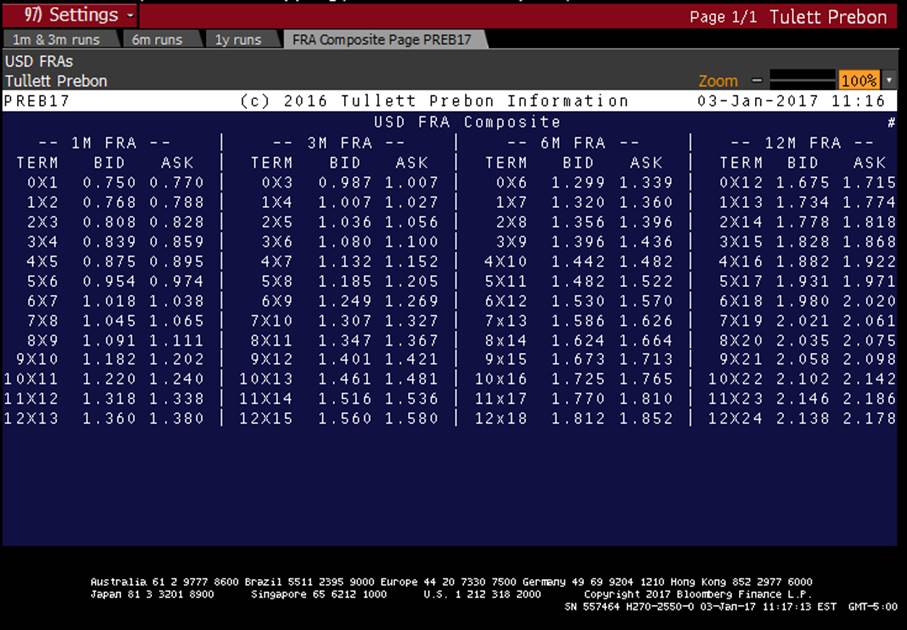

The following step-by-step directions can be used on a Bloomberg Terminal to take you to the Forward Rate Agreement (FRA) market. The data is provided by Tullett Prebon Information, which is a provider of independent real-time price information from the global OTC financial and commodity markets.

Step 1: PREB

Step 2: Select #10 (FRA)

Step 3: Select #17 (FRA Composite Page). Below is a snapshot of the screen used:

The above screen provides a list of several different forward LIBOR rates. For example, 3x6 = 3 months forward 3-month LIBOR, and 6x12 is 6 months forward 6-month LIBOR.

About Tullett Prebon Information

Tullett Prebon Information Limited is the leading provider of real-time price information from the wholesale inter-dealer brokered financial markets. Tullett Prebon Information is a wholly owned subsidiary of Tullett Prebon PLC, a fully diversified inter-dealer broker with a leading presence in global Fixed Income Securities, Money Markets, Capital Markets, Equities, and associated derivative products.

Tullett Prebon Information’s data is delivered via industry-leading information vendors and also via direct feeds to some of the world’s largest financial institutions. The information is relied upon by thousands of market professionals around the globe moving billions of dollars of assets daily for the purposes of trading, derivatives and FX pricing, risk management, and portfolio valuations.