There’s not much hitting the wires in terms of actionable economic news (beyond the slight negative, but still better-than-expected revision to Q3 US GDP data), so we wanted to revisit one of the forex market’s strongest correlations: the relationship between EUR/USD and USD/CHF.

One of the most common problems I see from newer FX traders is that many of them analyze the Swiss franc in isolation. Even though the Swiss National Bank officially ended the EUR/CHF floor back in January, trade in the franc is still driven predominantly by flows in the euro. That’s because the Swiss economy is still heavily dependent on its neighbors to the east (and west and north and south)… in other words, the Eurozone. It’s worth noting here that the Eurozone’s economy (~ $13T USD) is nearly 20 times larger than that of Switzerland ($685B USD), and traders tend to lump these two currencies together under the umbrella of “European currencies.”

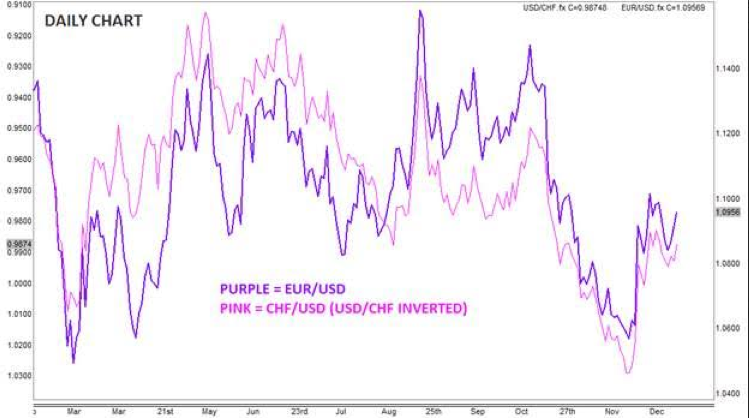

To add some meat to the discussion, the current 50-day correlation between EUR/USD and USD/CHF is -0.97, amazingly close to the 1.0 figure that would signal that the two instruments move in lockstep. For more visual traders, I’ve plotted chart of the EUR/USD vs. CHF/USD (inverted version of the USD/CHF):

Source: FOREX.com. Please note that this correlation can change and factors other than the value of the euro could influence USD/CHF.

Why does it matter?

Beyond the obvious implication that USD/CHF traders should be extremely plugged in to Eurozone economic news, we can also use the two pairs to confirm moves in one another. In other words, if EUR/USD sees a bullish breakout above a resistance level, traders could look to see if there’s a corresponding bearish breakout below a support level in USD/CHF to give them more confidence in the move (and visa-versa).

Though 2015 brought the officially brought the end of the central bank enforced relationship between USD/CHF and EUR/USD, traders have created a correlation that is nearly as strong. With the Swiss National Bank’s monetary policy moves now more in-line with the European Central Bank, EUR/USD traders could use moves in USD/CHF to gain an edge in 2016.