Investing.com’s stocks of the week

Joy Global (JOY) isn’t having a very good year, as its orders have plunged amidst a slow-down in capital spending in the mining industry due to tepid global growth. This is a very solid company that can be characterized as a ‘growth cyclical’, and the time to buy stocks like this, in my view, is when things don’t look so great. The earnings are likely to decline sharply in 2014 based on weak orders currently, but then pick up in 2015. If this proves correct, 2014 should be a better year for the stock as investors look forward to the upturn. I estimate that JOY could trade to 73 over the next year, which would represent a total return of 33%.

Background

Based in Milwaukee, Joy Global makes mining equipment that is used for coal and mineral extraction. The company competes closely with cross-town rival Bucyrus, which was acquired by Caterpillar (CAT) in 2011. The two companies were very similar, but JOY now differentiates itself for its direct selling, which puts it closer to the customer than CAT’s model of using a network of outside dealers, a strategy that should ultimately allow the company to gain market share. One key to understanding JOY is its early 2012 purchase of International Mining Machinery. While strategically sound, the buy of this Chinese company was very poorly timed.

JOY divides its business into two segments: Underground Mining Machinery and Surface Mining Equipment, both similar in size with respect to sales and operating income. Importantly, the company has a very large ‘aftermarkets’ business and doesn’t focus solely on new equipment sales.

CEO Mike Sutherlin (67) has led the company since 2006, but he will be retiring in December, with Ed Doheny (51), who has served as COO since March and as COO of the Underground Mining Equipment Division previously, succeeding him. Doheny joined JOY in 2006 and worked with Ingersoll-Rand for two decades previously.

Fundamentals

JOY reported its Q3 results on August 28, and it was not pretty, though, encouragingly, the numbers were better than had been feared and the outlook was in line with prior expectations. The key metric was that bookings fell 36%, suggesting weak sales in the quarters ahead. Sales declined 7%, triggering a small decline in earnings from 1.87 to 1.70 excluding one-time items. Within bookings, which totaled $695mm, aftermarket represented $599mm and fell 13% while original equipment plunged from $394mm to just $96mm. The weakness was more pronounced in Underground relative to Surface. The company reports backlog, and it fell from $2.2 billion to $1.6 billion from Q2 to Q3. The decline in bookings and backlog is a sure indicator of the rough year ahead for sales.

The balance sheet has improved as the company has been using free cash flow to pay down debt. As of July, the net debt totaled $843mm, down from a peak of $1.24 billion six quarters ago. Encouragingly, inventory has declined about 12% in the first three quarters of this year, mitigating risk of future pressure on prices. The company recently authorized a $1 billion share repurchase over the next three years.

Valuation

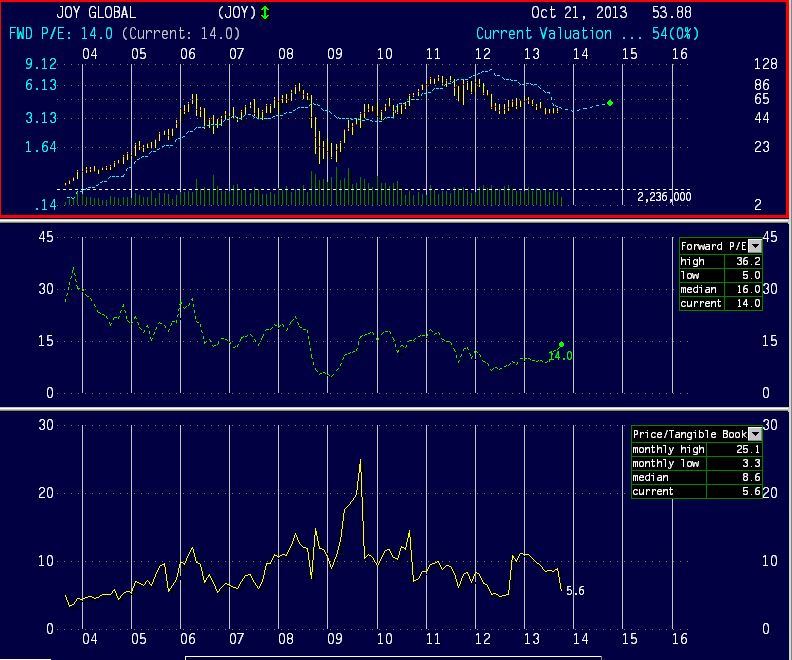

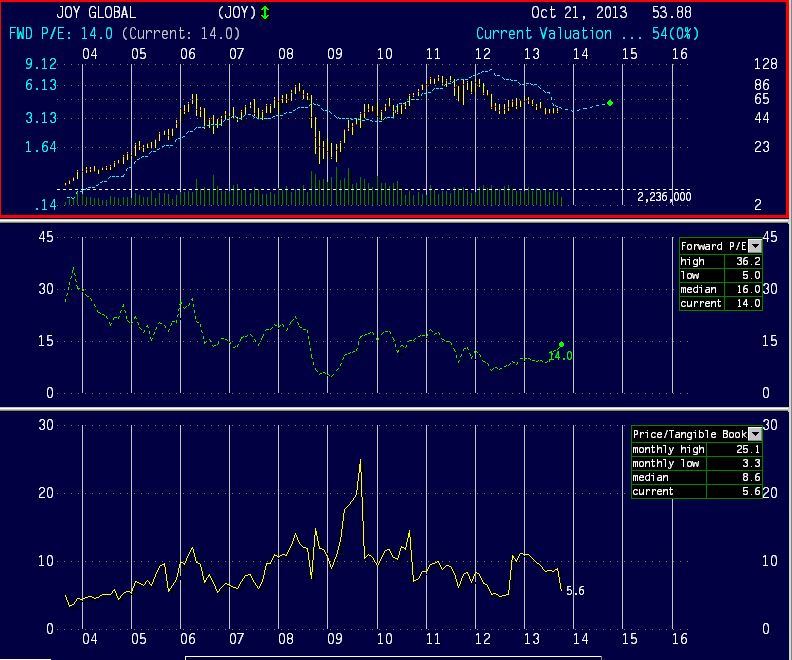

On a forward PE basis, at 14X, JOY is priced at a fairly low multiple considering the trough nature of its current earnings.

When earnings are rising, the stock typically commands a PE between 15 and 20. Like many stocks in the crash of 2008/09, forward PE’s fell to very low levels on JOY in early 2008, as investors feared extensive losses. Notably, JOY EPS never got even close to negative, and this may explain a higher valuation now than the giveaway levels then. I have also included an alternate valuation metric of price to tangible book, noting that by this measure, the stock has rarely traded this inexpensively.

My own forecast is that the PE can rise to 17.5 or so as soon as investors become confident that the low is in. FY14 EPS are projected to decline 37% to 3.68, which is down from 5.52 in July and 6.44 six months ago. The current outlook for FY15 is that EPS will then rebound to 4.15. The last peak was near $7 in FY12, and I would expect the next peak to be higher given the larger size of the company. At 17.5PE while it is trading closer to the trough (and perhaps 12X the next peak ultimately), JOY could reach 73 over the next year, perhaps 108 in the cycle, after having hit 103 in the last cycle.

Technicals

JOY recently bottomed near 48, creating a double-bottom near the summer of 2011 lows:

I am leery of stocks that have declined, as I expect this to be a very tough tax-loss selling year due to huge gains in the market and few stocks that offer large potential write-offs. With that said, while JOY is down about 15% in 2013, it’s down only slightly more for its 52-week high. So, I don’t expect a lot of pressure. I see a bottoming formation even outside the double-bottom. The 50dma has been below the longer-term 150dma since April, but we are about to cross. I think a beak of 56 suggests a potential move to 58.50-60. The stock seems to have support near 50. Note that rival CAT reduced guidance rather sharply on 10/23, which could push the stock back towards the lower end of the recent range.

Conclusion

JOY has been under pressure now since peaking in 2011 near 103 as its earnings have fallen sharply as sales have declined following reduced orders. I like JOY here as a contrarian investment leveraged to global economic recovery that should benefit especially on improved prospects for Chinese growth. The stock has been forming a base and looks to offer a good entry between 50-55, offering upside of almost 33% to my one-year price.

Disclosure: I have no position in JOY, though I have recommended a short-term trade at The Analytical Trader at Marketfy.

Background

Based in Milwaukee, Joy Global makes mining equipment that is used for coal and mineral extraction. The company competes closely with cross-town rival Bucyrus, which was acquired by Caterpillar (CAT) in 2011. The two companies were very similar, but JOY now differentiates itself for its direct selling, which puts it closer to the customer than CAT’s model of using a network of outside dealers, a strategy that should ultimately allow the company to gain market share. One key to understanding JOY is its early 2012 purchase of International Mining Machinery. While strategically sound, the buy of this Chinese company was very poorly timed.

JOY divides its business into two segments: Underground Mining Machinery and Surface Mining Equipment, both similar in size with respect to sales and operating income. Importantly, the company has a very large ‘aftermarkets’ business and doesn’t focus solely on new equipment sales.

CEO Mike Sutherlin (67) has led the company since 2006, but he will be retiring in December, with Ed Doheny (51), who has served as COO since March and as COO of the Underground Mining Equipment Division previously, succeeding him. Doheny joined JOY in 2006 and worked with Ingersoll-Rand for two decades previously.

Fundamentals

JOY reported its Q3 results on August 28, and it was not pretty, though, encouragingly, the numbers were better than had been feared and the outlook was in line with prior expectations. The key metric was that bookings fell 36%, suggesting weak sales in the quarters ahead. Sales declined 7%, triggering a small decline in earnings from 1.87 to 1.70 excluding one-time items. Within bookings, which totaled $695mm, aftermarket represented $599mm and fell 13% while original equipment plunged from $394mm to just $96mm. The weakness was more pronounced in Underground relative to Surface. The company reports backlog, and it fell from $2.2 billion to $1.6 billion from Q2 to Q3. The decline in bookings and backlog is a sure indicator of the rough year ahead for sales.

The balance sheet has improved as the company has been using free cash flow to pay down debt. As of July, the net debt totaled $843mm, down from a peak of $1.24 billion six quarters ago. Encouragingly, inventory has declined about 12% in the first three quarters of this year, mitigating risk of future pressure on prices. The company recently authorized a $1 billion share repurchase over the next three years.

Valuation

On a forward PE basis, at 14X, JOY is priced at a fairly low multiple considering the trough nature of its current earnings.

When earnings are rising, the stock typically commands a PE between 15 and 20. Like many stocks in the crash of 2008/09, forward PE’s fell to very low levels on JOY in early 2008, as investors feared extensive losses. Notably, JOY EPS never got even close to negative, and this may explain a higher valuation now than the giveaway levels then. I have also included an alternate valuation metric of price to tangible book, noting that by this measure, the stock has rarely traded this inexpensively.

My own forecast is that the PE can rise to 17.5 or so as soon as investors become confident that the low is in. FY14 EPS are projected to decline 37% to 3.68, which is down from 5.52 in July and 6.44 six months ago. The current outlook for FY15 is that EPS will then rebound to 4.15. The last peak was near $7 in FY12, and I would expect the next peak to be higher given the larger size of the company. At 17.5PE while it is trading closer to the trough (and perhaps 12X the next peak ultimately), JOY could reach 73 over the next year, perhaps 108 in the cycle, after having hit 103 in the last cycle.

Technicals

JOY recently bottomed near 48, creating a double-bottom near the summer of 2011 lows:

I am leery of stocks that have declined, as I expect this to be a very tough tax-loss selling year due to huge gains in the market and few stocks that offer large potential write-offs. With that said, while JOY is down about 15% in 2013, it’s down only slightly more for its 52-week high. So, I don’t expect a lot of pressure. I see a bottoming formation even outside the double-bottom. The 50dma has been below the longer-term 150dma since April, but we are about to cross. I think a beak of 56 suggests a potential move to 58.50-60. The stock seems to have support near 50. Note that rival CAT reduced guidance rather sharply on 10/23, which could push the stock back towards the lower end of the recent range.

Conclusion

JOY has been under pressure now since peaking in 2011 near 103 as its earnings have fallen sharply as sales have declined following reduced orders. I like JOY here as a contrarian investment leveraged to global economic recovery that should benefit especially on improved prospects for Chinese growth. The stock has been forming a base and looks to offer a good entry between 50-55, offering upside of almost 33% to my one-year price.

Disclosure: I have no position in JOY, though I have recommended a short-term trade at The Analytical Trader at Marketfy.