Unable to find a compromise on a lasting solution to the deficit and debt problem, US politicians are resorting to short-term extensions of measures to push back the threat of a potential economic slump. The sequester, due to start at the start of the year, has been delayed to March. Ditto for the debt-ceiling which has been “suspended” until May. Amazingly, markets have cheered each extension as if those were real solutions. Growth expectations (and “risk on” bets) could be pared back if, as we expect, Congress is unable to delay the full sequester come March. The associated safe haven flows could help lift the US dollar.

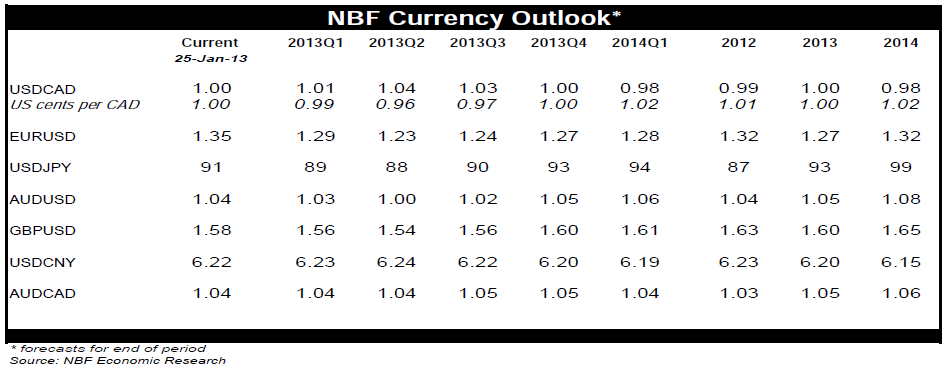

In light of recent market exuberance which has allowed the euro to defy gravity, we’ve pushed our US$1.23 target for the common currency to the second quarter, expecting investors to rediscover the zone’s weak economic fundamentals.

With the Bank of Canada finally acknowledging the economic stagnation at home and clarifying that rate hikes are “less imminent”, the loonie returned to the weaker side of parity for the first time in weeks as investors pared back bets of rate hikes. We’re now well on our way towards our USDCAD target of 1.04 which we’ve pushed by one quarter to Q2. The loonie’s volatility, which has been declining in recent years, could increase this year helped in part by Canada’s growing external imbalance.

US dollar has potential

The year may have changed but one thing remains steady — the uncertainty generated by the US Congress. US politicians remain as divided and conflicted as ever, unable to find a compromise on a lasting solution to the deficit and debt problem. Instead, they are resorting to short-term extensions of measures to push back the threat of a potential economic slump. The sequester (automatic spending cuts due to start at the start of the year) has been delayed to March. Ditto for the debt-ceiling which has been “suspended” until May. So, America will be able to borrow from markets and meet its obligations e.g. finance government operations and not default on bond holders over the next three months. Amazingly, markets have cheered each extension as if those were real solutions. US equities are near record highs, and the corresponding “risk on” bets, coupled with the Fed’s money printing exercise have hammered the US dollar. But given the short-term nature of those Congressional stop-gap measures, the current market exuberance could be cut short.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2013: The Return Of Currency Volatility?

Published 01/30/2013, 03:10 AM

Updated 05/14/2017, 06:45 AM

2013: The Return Of Currency Volatility?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.