A number of key takeaways can be observed from investing in 2013. These include a boom in the U.S. stock markets, a drawn-out period of speculation regarding the QE Taper, a turnaround in Japan helped by ‘Abenomics’, the Eurozone’s return to growth, a horrid run in Gold-based products and a slump in emerging markets.

Following the footsteps of the stock market, the ETF industry has hauled in plenty of money so far in 2013 with a lot of smart launches across the asset classes. In such a scenario, we take a look at some top-and-bottom asset generators of the year.

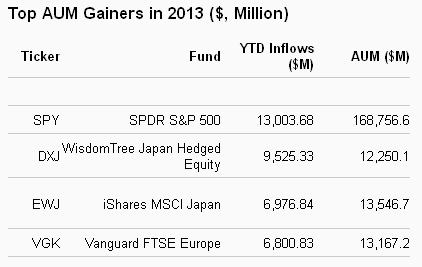

Top Winners

Japan-based funds along with the S&P 500 focused-products were the star performers in terms of asset gathering this year.

U.S. stock markets hit new highs repeatedly this year. The S&P 500 index gained 24% making the SPDR S&P 500 (SPY) a clear winner of 2013 hauling in about $13 billion in 2013 to amass an asset base of about $169 billion so far.

This is largely thanks to the Fed’s easy monetary policy which turned investors’ attention to riskier assets like equities, improving economic conditions, better job and inflation data and decent corporate earnings growth.

The runner-up was the WisdomTree Japan Hedged Equity ((DXJ)) tracking the Japan Hedged Equity Index, pulling in around $9.5 billion and amassing around $12.3 billion thus far. Since the beginning of the year, Japan turned out to be a top market for investments.

Along with 'Abenomics', a reform initiative introduced by the Japanese Prime Minister Shinzo Abe early this year, modest overseas recovery also played a vital role in the nation’s recent outperformance.

The economy ended a long string of deflation in June this year. Also, weakness in the Japanese currency relative to the greenback led to an export boom in Japan. All of these culminated in a share price rally which pushed up the benchmark Nikkei 225 Index to a six-month peak. The benchmark Nikkei gained an impressive 48% in 2013.

Another Japan-oriented fund, the iShares MSCI Japan Index Fund (EWJ), took the spot of third place as it accumulated about $7.0 billion in assets in 2013 to reach a total of $13.5 billion.

The Vanguard FTSE Europe (VGK) – the fourth most popular ETF – saw an inflow of around $6.8 billion. With many European countries emerging from the crisis that hit two years ago, investing in Europe again took front and centre this year.

All the major indexes including the leading blue chip index for the Euro zone – EURO STOXX 50 Index – are trading near five-year highs (read: Ride Europe Higher with This Top Ranked ETF).

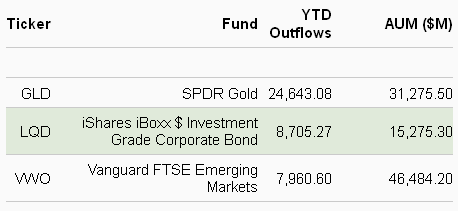

Top Losers

Discussed below are the products which investors tended to avoid during 2013. The table lists funds which lost assets considerably during the said period.

Biggest Losers 2013 ($, Million)

The SPDR Gold Shares ((GLD)), tracking Gold Bullion, saw around $24.6 billion in outflows and stood at $31.3 billion in total assets at the end of December 22, 2013. The product has been downbeat since the beginning of the year. Growing optimism surrounding the U.S. economy leading to the taper concerns dulled the appeal of the yellow metal (Read: Pain or Gain Ahead for Gold Mining ETFs?).

iShares iBoxx $ Investment Grade Corporate Bond ((LQD)) shared the same fate. It witnessed $8.7 billion in redemptions. The taper threat raised yields on the U.S. Treasury 10-year note (2.89% as of December 20, 2013, compared with 1.66% early in May) (Read: Long-Term Treasury Bond ETF Investing 101).

After that comes iShares MSCI Emerging Markets (EEM) fund, tracking the MSCI Emerging Markets Index. It saw asset drainage of about $8.0 billion to $46 billion in the YTD frame. Concerns of slower growth in some emerging markets and the expected cessation of the cheap dollar on account of ‘Taper’ concerns might have resulted in assets gushing out of the fund.

Original post