After the hectic start to the year seen last week, this week so far has been somewhat of a damp squib. This leaves short term overbought or sold signals a bit of time to come back from extremes, for USD/JPY in particular. But given TMM are long relatively short-dated USD/JPY puts, they would rather see this correction pick up a bit of panickyness, as opposed to what can so far be considered by bulls to merely be a "healthy consolidation" before a further move higher.

Another notable twist in market dynamics is how the complete lack of shouty news has left the market chasing flow. Moves being blamed on any old news headlines have rapidly morphed into low level debate over who has done or may do what. Yawn. Basically its suddenly gone pretty quiet. So we press on with our Non-Predictions.

2) The Polish Zloty will NOT underperform the Czeck Koruna even if the NBP cut rates aggressively.

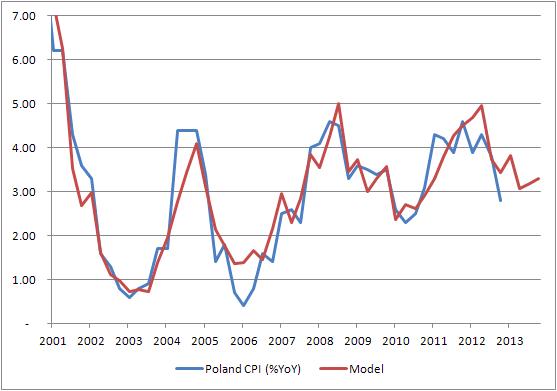

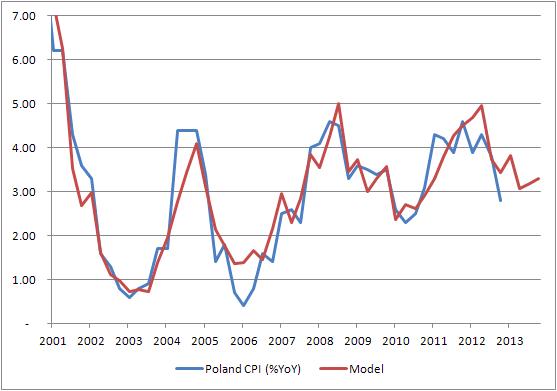

Let's start with Poland. Although CPI has surprised to the downside over the past few months, this will not last. The National Bank of Poland often stress that they want real interest rates to remain positive. The model suggests that CPI should remain above 3% for the coming year, which implies a floor for rates. And even if they do cut rates aggressively, TMM reckon that it will not be long before they are once again tightening.

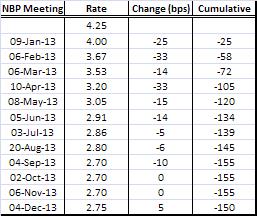

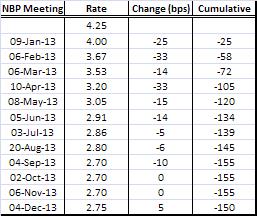

But with the recent NBP minutes suggesting more members dissenting in favour of a 50bp cut in December, the curve prices around 150bps in the coming year, and well below the real rate floor implied above. TMM don't disagree that the cutting cycle may continue over the next few months, we just don't think they will be as aggressive given the inflation outlook and also the coming improvement in the activity outlook (more below).

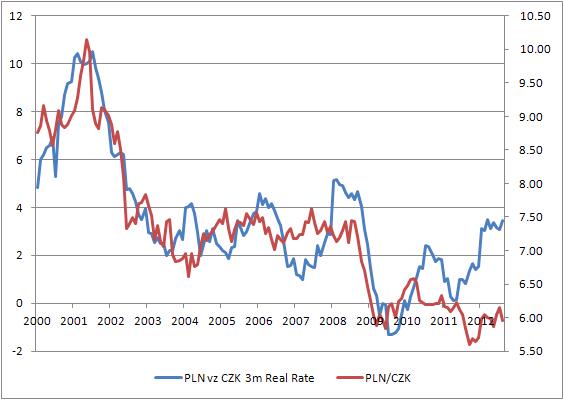

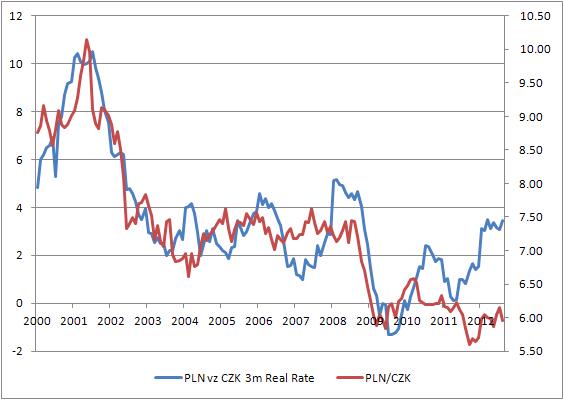

By contrast, the Czech Nationalbank are faced with the zero bound on rates and have become increasingly vocal on currency strength, the relative real rate spread vs. Poland has moved sharply higher in favour of the Zloty. Of course, the EMU crisis has hit Poland hard as it runs a reasonably large current account deficit (in contrast to the Czech Republic's surplus) and coupled with the risk aversion of the past two years has resulted in significant underperformance of the Zloty vs. the Koruna.

But TMM reckon there are reasons to believe that this is coming to an end now as there has been a dramatic improvement in the Current Account over the past year...

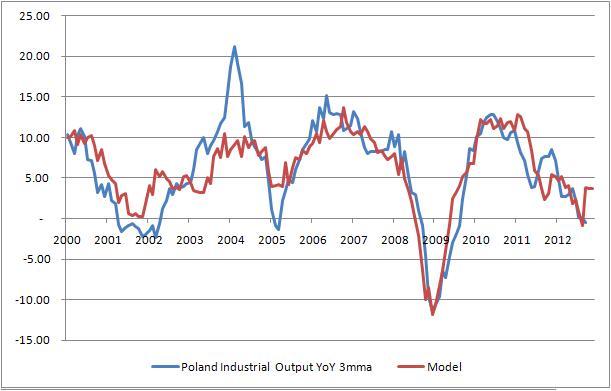

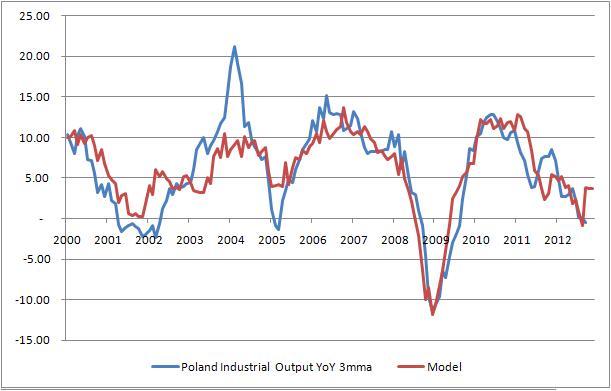

...and while both IP and retail sales have been weakening in Poland, they have not decelerated as much as in the Czech Republic, and look set to bounce in the coming months as the Eurozone begins to exit recession. Poland should be in a good place to be as the data in Europe improve.

The Czech Koruna, however, just looks like a crap Euro to TMM as at the end of the day, it is an EM currency (no matter how credible the central bank...) with zero yield with the possibility of currency intervention to weaken it on the horizon.

Putting those together, TMM like both being long PLN/CZK but also paying the 9x12 FRA in Poland.

Another notable twist in market dynamics is how the complete lack of shouty news has left the market chasing flow. Moves being blamed on any old news headlines have rapidly morphed into low level debate over who has done or may do what. Yawn. Basically its suddenly gone pretty quiet. So we press on with our Non-Predictions.

2) The Polish Zloty will NOT underperform the Czeck Koruna even if the NBP cut rates aggressively.

Let's start with Poland. Although CPI has surprised to the downside over the past few months, this will not last. The National Bank of Poland often stress that they want real interest rates to remain positive. The model suggests that CPI should remain above 3% for the coming year, which implies a floor for rates. And even if they do cut rates aggressively, TMM reckon that it will not be long before they are once again tightening.

But with the recent NBP minutes suggesting more members dissenting in favour of a 50bp cut in December, the curve prices around 150bps in the coming year, and well below the real rate floor implied above. TMM don't disagree that the cutting cycle may continue over the next few months, we just don't think they will be as aggressive given the inflation outlook and also the coming improvement in the activity outlook (more below).

By contrast, the Czech Nationalbank are faced with the zero bound on rates and have become increasingly vocal on currency strength, the relative real rate spread vs. Poland has moved sharply higher in favour of the Zloty. Of course, the EMU crisis has hit Poland hard as it runs a reasonably large current account deficit (in contrast to the Czech Republic's surplus) and coupled with the risk aversion of the past two years has resulted in significant underperformance of the Zloty vs. the Koruna.

But TMM reckon there are reasons to believe that this is coming to an end now as there has been a dramatic improvement in the Current Account over the past year...

...and while both IP and retail sales have been weakening in Poland, they have not decelerated as much as in the Czech Republic, and look set to bounce in the coming months as the Eurozone begins to exit recession. Poland should be in a good place to be as the data in Europe improve.

The Czech Koruna, however, just looks like a crap Euro to TMM as at the end of the day, it is an EM currency (no matter how credible the central bank...) with zero yield with the possibility of currency intervention to weaken it on the horizon.

Putting those together, TMM like both being long PLN/CZK but also paying the 9x12 FRA in Poland.