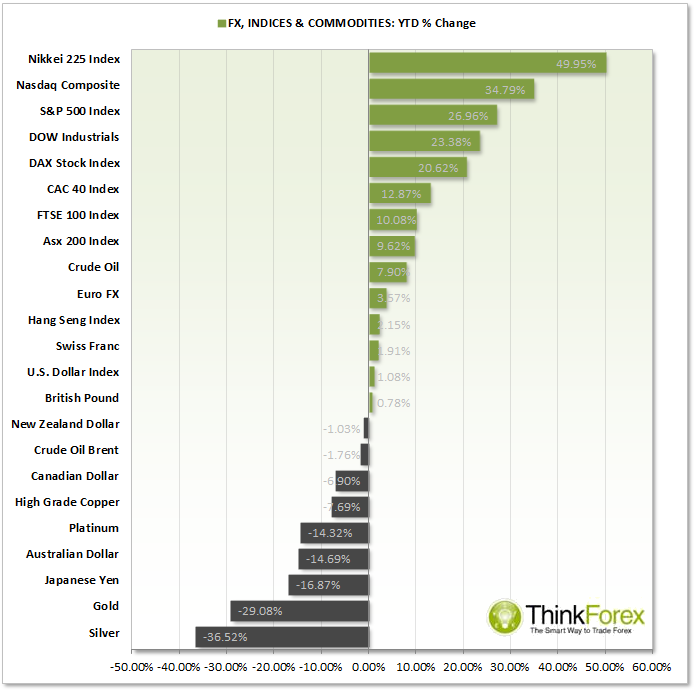

As 2013 rapidly draws to a close it's worth taking a look back to compare which markets one should have been trading:

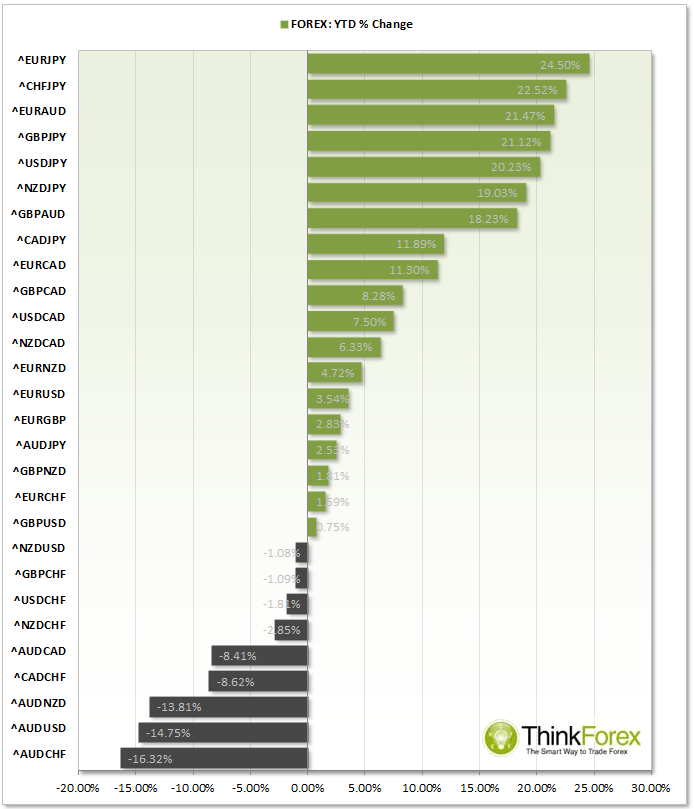

AUD: The Australian Dollar has not had a great year and unfortunately I don't see this getting much better going into 2014. It leads the top 3 places in the 'biggest loser competition' this year selling off aggressively against USD, NZD and CHF.

CAD: The Lonnie has done full circle this year by circle this year - after a promising start but quickly returning all gains we now finish -6% down for the year. We have recently broken beneath January's lows and this signals further downside as this was a key low. Technically the CAD remains Bearish on the Primary Trend and I see no reason to change this view for some time.

CHF: To the relief of SNB they manage to keep EURCHF above 1.20. However many are speculating a large decline in the event the SNB remove the Peg, which is definitely something to watch out for in 2014.

EUR: The Euro Finishes the year considerably more bullish than many expected back this time last year. However the Euro Bears are always quick to make their voice heard amongst the lingering fear of inflationary issues hovering over Europe. My view is Euro will have a bad year in 2014 so EURUSD shorts will be something to watch out for.

JPY: The Yen has provided some of the better opportunities for traders this year, putting EURJPY and CHFJPY at the top of the leader board this year. I believe JPY will continue to weaken throughout 2014 as we have witnessed a multi--decade (and all-time) low.

GBP: Whilst the British Pound has finished off the year with a bang I don't see 2014 continuing this trend. Carney recently announced that a strengthening GBP will undermine the

NZD: The Kiwi has been very choppy throughout the year with the Weekly Charts showing lots of confusion to the general direction. However across individual currency pairs has provided some excellent opportunities for traders throughout. My view is we will see a more bearish structure in 2014 as the yearly high is technically a lower high to 2012.

USD: Year to date the Dollar doesn't appear to have done anything when you see it has only appreciated by 1.08%. However any trader will tell you it has certainly seen its ups and downs and with vengeance. I see 2014 being a much brighter year and more directional, celebrated with a Bull party.

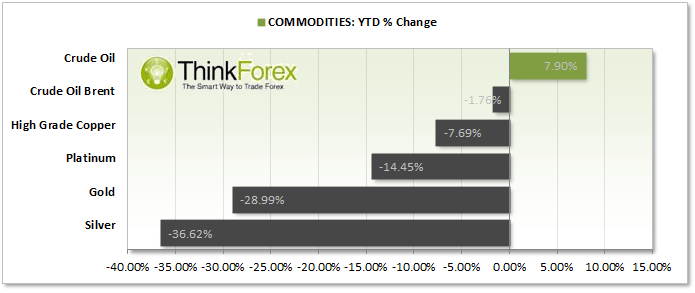

COMMODITIES:

METALS: Gold has been one of the bigger disappointments of the year as many have been calling for the low and for it to break to new highs. Repeatedly... Despite this, Silver depreciated by a greater percentage making it even more painful for Bullish Silver investors. Technically I am still bearish on these markets and believe there is still plenty of room for further disappointment.

OIL: WTI has seemingly created a multi-week low so Q1 of 2014 looks to be a bullish one. Brent is not so clear cut and has been technically correcting since 2011. However in the grand scheme of things the charts appear to be more bullish than bearish.

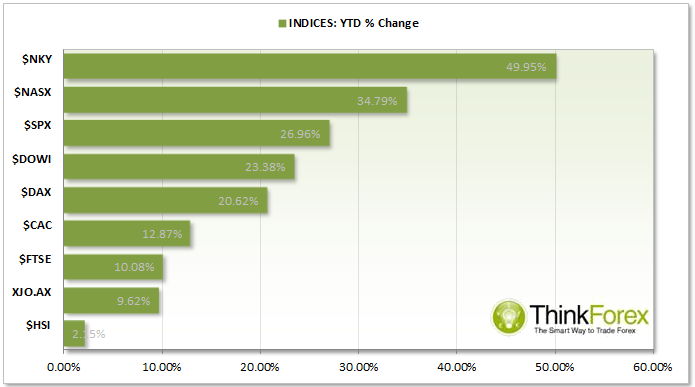

INDICIES:

With US Equities continuing to break to new highs the bulls have managed to silence the last of the bears form the GFC. Whilst the FED's QE has obviously leant a helping hand many speculate a decline in Indices as soon as this program is eventually wound down in 2014.

The Nikkei up around 50% is clearly the biggest mover of 2013 and going into 2014 I do not see any reason to be calling a top any time soon.

DISCLAIMER: Trading in the Foreign Exchange market involves a significant and substantial risk of loss and may not be suitable for everyone. You should carefully consider whether trading is suitable for you in light of your age, income, personal circumstances, trading knowledge, and financial resources. Only true discretionary income should be used for trading in the Foreign Exchange market. Any opinion, market analysis or other information of any kind contained in this email is subject to change at any time. Nothing in this email should be construed as a solicitation to trade in the Foreign Exchange market.

If you are considering trading in the Foreign Exchange market before you trade make sure you understand how the spot market operates, how Think Forex is compensated, understand the Think Forex trading contract, rules and be thoroughly familiar with the operation of and the limitations of the platform on which you are going to trade. A Financial Services Guide ( FSG) and Product Disclosure Statements (PDS) for these products is available from TF GLOBAL MARKETS (AUST) PTY LTD by emailing compliance@thinkforex.com.au .The FSG and PDS should be considered before deciding to enter into any Derivative transactions with TF GLOBAL MARKETS (AUST) PTY LTD. Please ensure that you fully understand the risks involved, and seek independent advice if necessary. Also, see the section titled “Significant Risks” in our Product Disclosure Statement, which also includes risks associated with the use of third parties and software plugins. The information on the site is not directed at residents in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. 2013 TF GLOBAL MARKETS (AUST) PTY LTD. All rights reserved. AFSL 424700. ABN 69 158 361 561. Please note: We do not service US entities or residents.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2013 Annual Wrap: Leaders And Laggards

Published 12/20/2013, 01:15 AM

Updated 08/22/2024, 06:01 PM

2013 Annual Wrap: Leaders And Laggards

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.