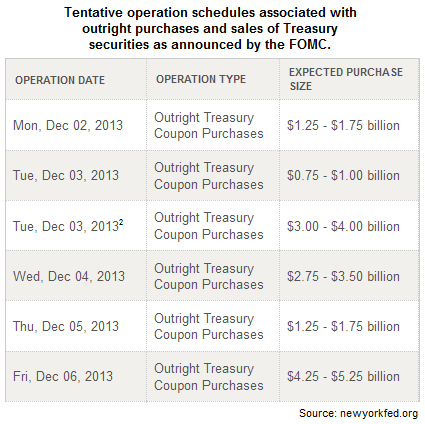

The table below puts some context around the impact of the Fed’s bond buying program. It tells us several billion dollars of freshly printed money will be pumped into the global financial system this week. The Fed’s actions greatly reduce the odds of an imminent plunge in stock prices.

Dual Mandate Speaks To Employment

The Fed has said for some time it wants to see substantial improvement in the labor market before ending this round of quantitative easing, meaning an aggressive tapering schedule is not likely to be announced in the coming weeks.

From Bloomberg: “The weakness in jobs is continuing fodder for the Fed to fulfill its most recent and steadfast comments about the support of the economy,” Holland, who oversees more than $4 billion in New York, said in a Nov. 26 phone interview. “Until the labor market gets better, the two parts of dual mandate have to be served,” he said. “I’m still pretty set in my position and prepared to see the market go higher.”

Manufacturing Picks Up

If the Fed hopes to taper their bond purchases without disrupting the bull market in stocks, the economy must show signs of improvement. Monday investors were greeted with some encouraging news.

From Bloomberg: Manufacturing unexpectedly accelerated in November at the fastest pace in more than two years, pointing to a pickup in business spending that will help propel the U.S. economy in early 2014. The Institute for Supply Management’s index increased to 57.3, the highest since April 2011, from 56.4 a month earlier, the Tempe, Arizona-based group’s report showed today. Readings above 50 indicate growth. The median forecast in a Bloomberg survey of economists was 55.1. Orders, production and employment strengthened.

Bears Have Work To Do

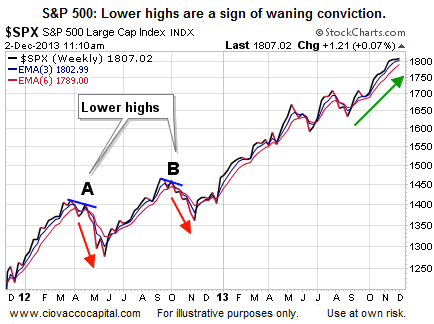

Rapid declines in stock prices occur when bearish economic conviction greatly exceeds bullish economic conviction. When doubt starts to creep into the equation, it shows up on a chart in the form of a lower high. Lower highs often foreshadow corrective activity in equities (see A and B in the chart below). In recent weeks, stocks have been making a series of higher highs, which tells us investors remain confident about future economic and market outcomes.

Technology vs. Brick & Mortar

Traditional Black Friday sales were down from last year, but retailers are still filling orders on Cyber Monday.

From Reuters:

ComScore Inc, an analytics firm, said U.S. online sales rose 17.3 percent on Thanksgiving and Black Friday, outpacing sales growth at brick-and-mortar stores. ComScore has forecast a 16 percent jump in online sales for the season, helped by greater use of mobile devices. The most visited e-commerce sites in order were those of Amazon.com Inc, eBay Inc, Walmart, Best Buy Co Inc and Target Corp, comScore said. Retailers are also being aggressive online as they look to benefit from Cyber Monday, which falls on December 2 this year. Cyber Monday is the biggest sales day of the year for e-commerce.

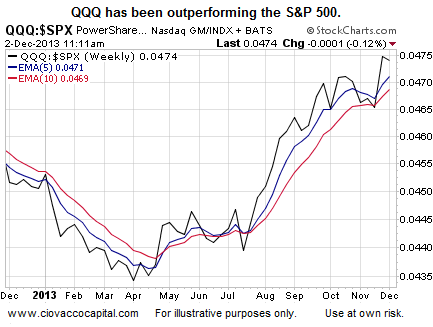

Tablets and smart phones make it even easier to shop online. Investors see the ever-growing role technology plays in our lives, which can be seen in the NASDAQ 100 ETF’s (QQQ) recent leadership. All things being equal, strength in technology stocks aligns with a “risk-on” market profile.

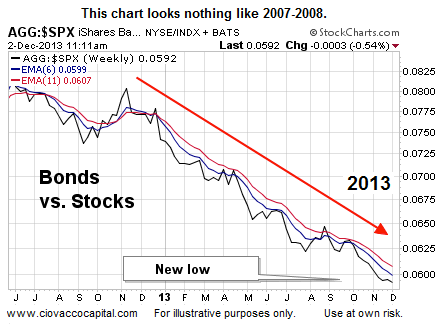

Defensive Bonds Not Waving 2008-Like Flags

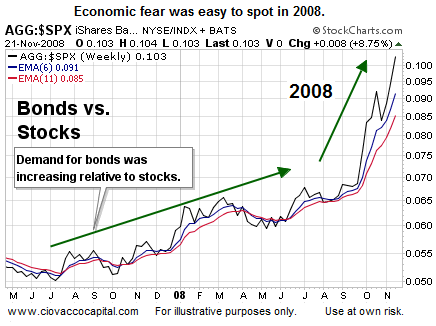

When investors are nervous about the economy, earnings, and Fed policy, they prefer to be in defensive-oriented bonds rather than growth-oriented stocks. In a November 27 article we compared the demand for Treasuries (TLT) to demand for stocks. A fair counter argument is “the demand for Treasuries has been skewed by the Fed”. We can address that issue by looking at the entire bond market, rather than Treasuries in isolation. The chart below shows the demand for bonds (AGG) relative to stocks (SPY). When the ratio rises, bonds are attracting more interest than stocks. Notice how the ratio bottomed in early July 2007, or three months before stocks peaked.

The same stock/bond ratio is shown below as of December 2, 2013. The sharp contrast between 2008 and 2013 tells us a 2008-like plunge in equities does not appear to be a high probability outcome.

Investment Implications – Staying Long Until Something Changes

Our market model began redeploying cash as stocks firmed on October 9 and 10. Since the October 9 intraday low, the S&P 500 has gained 163 points. Our game plan remains unchanged; as long as the market’s pricing mechanism continues to send bullish signals, we will continue to hold a broad stake in U.S. stocks (SPY), financials (XLF), energy (XLE), small caps (IWM) and global stocks (VT). We will remain highly flexible, looking for observable evidence of a shift toward risk aversion.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

2008-Like Plunge In Stocks Not Likely

Published 12/02/2013, 01:53 PM

Updated 07/09/2023, 06:31 AM

2008-Like Plunge In Stocks Not Likely

Labor Market Keeps Presses Rolling

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.