It’s long weekend time with markets closed Monday and the trend higher nicely intact.

The metals are looking better and better and moving higher very well.

That said, mining stocks are a bit mixed but may well give us some strong moves early in 2017, as they did in the first half of 2016.

Time will tell but miners and stocks in just about every sector are doing fine and set to continue so stay with the trend.

Gold gained just 0.26% this week and is looking better and better.

The $1,220 area held well and now gold is breaking out of its little bull flag area.

That said, the 200 day average around $1,260 should pose some resistance.

We may need another couple or few weeks to setup for the move up to $1,300 resistance but gold looks good.

Silver did slightly better than gold, gaining 0.54% and already trying to move past the 200 day moving average area.

Silver looks great for this move to take it up to $19 over the next month or so.

Platinum slid 0.56% but is setting up to continue higher.

The 200 day average is a theme this week and always is a critical level when price is either above, or below.

A highly likely move above $1,020 should take platinum up to resistance at $1,080.

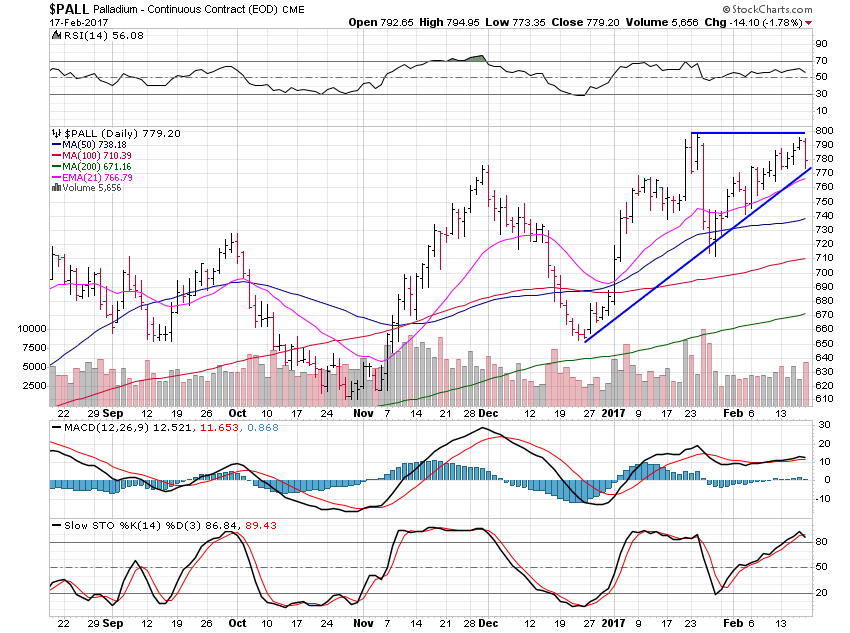

Palladium was also on the losing side this past week falling 0.50% but still looks good for a move out of this large triangle, higher.

I see the $850 level as resistance or a target above, along with all-time highs at $913.