Today I'm focusing on dividend growth stocks that have raised their payments over a period of more than five years but less than 10 years in a row. Such stocks are collectively referred to as Dividend Challengers.

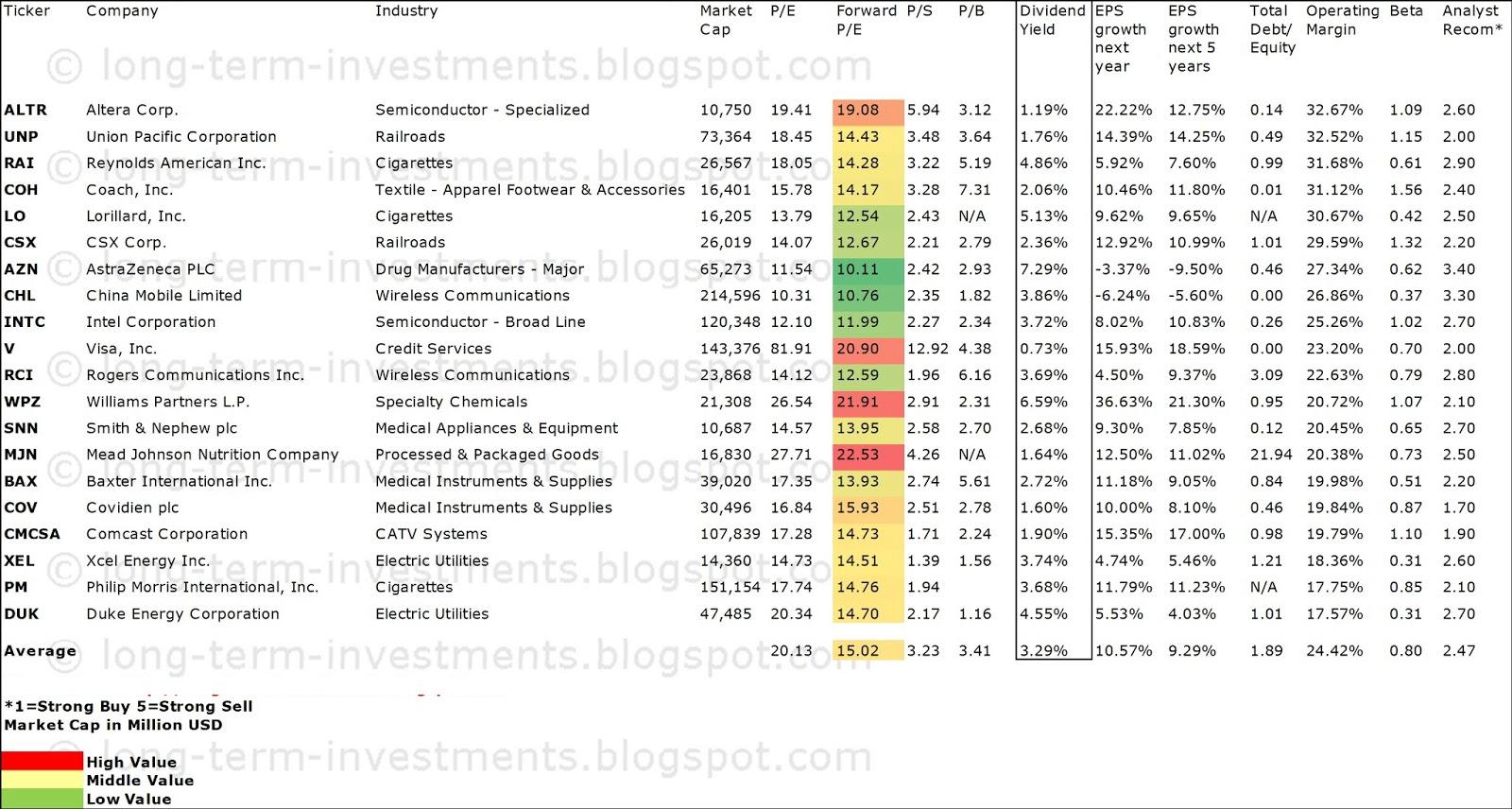

The results show the top 20 companies with margins between 17.57 percent and 32.67 percent. Eleven of the results have a current buy or better recommendation.

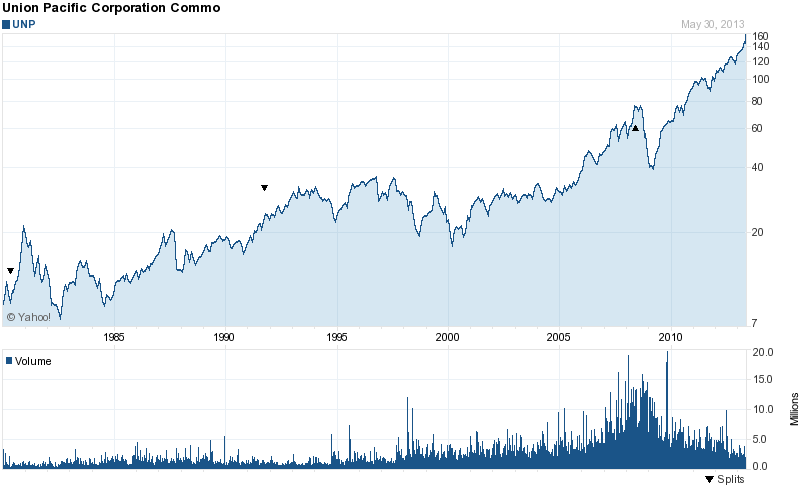

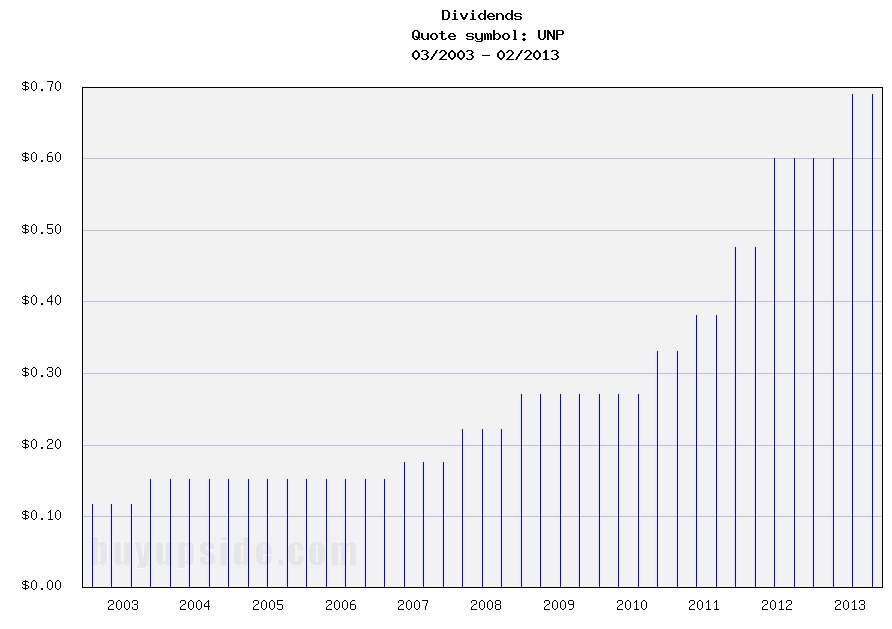

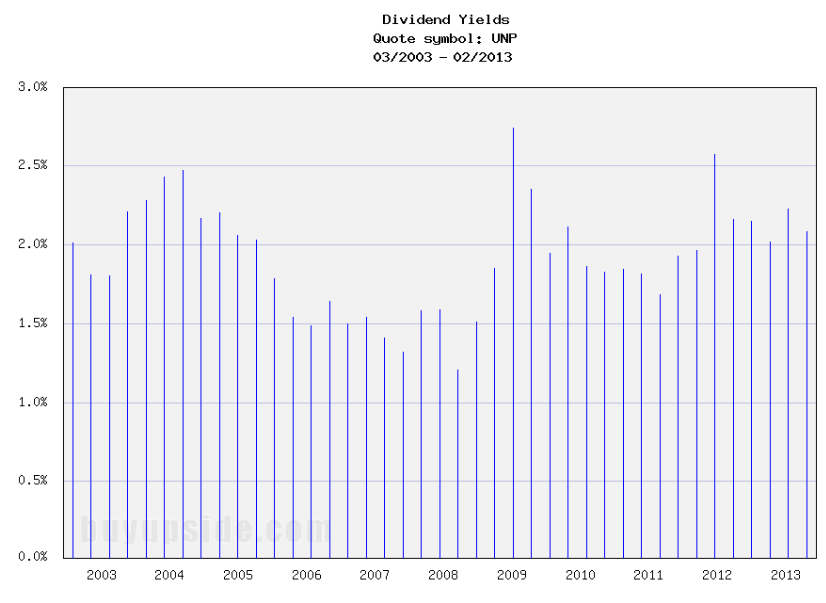

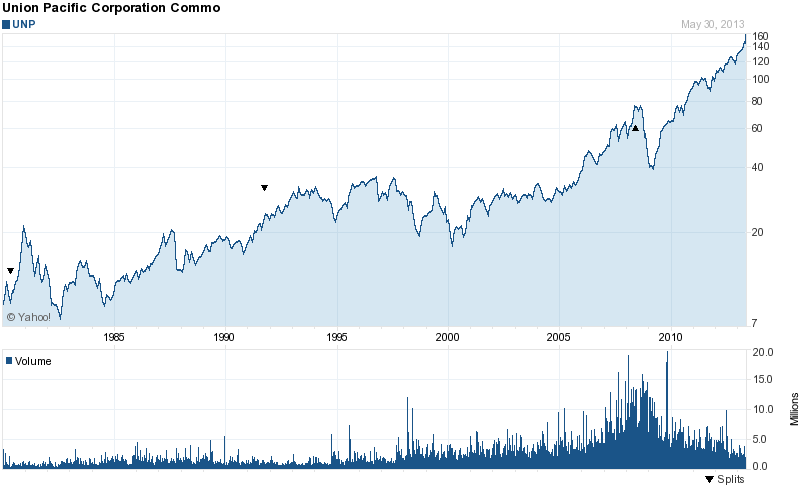

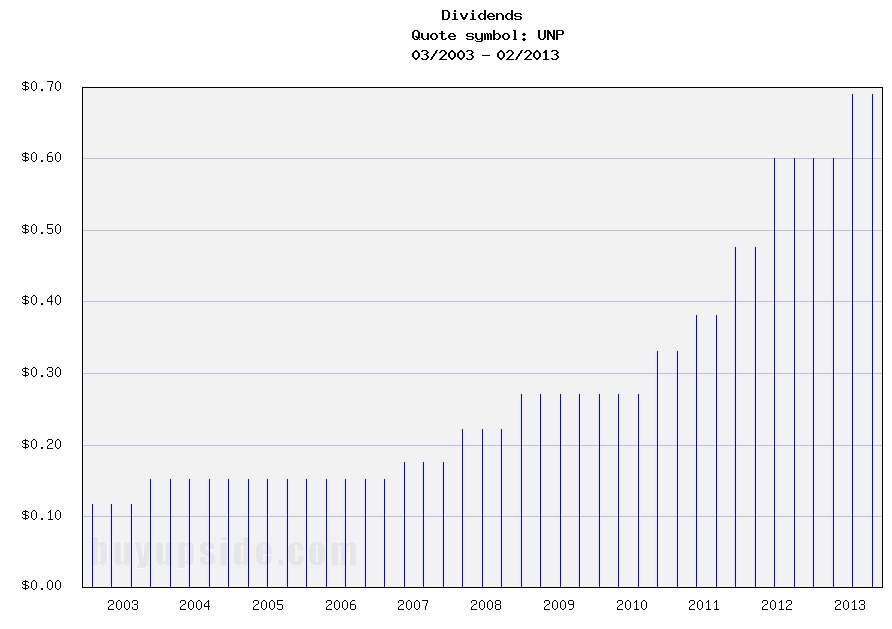

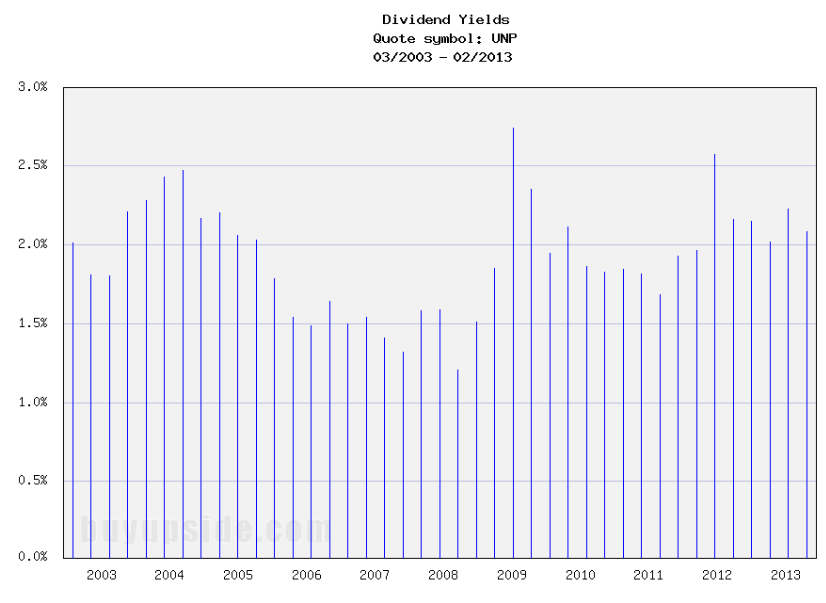

Union Pacific (UNP) has a market capitalization of $73.36 billion. The company employs 46,437 people, generates revenue of $20.926 billion and has a net income of $3.943 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $8.505 billion. The EBITDA margin is 40.64 percent (the operating margin is 32.20 percent and the net profit margin 18.84 percent).

Financial Analysis: The total debt represents 19.08 percent of the company’s assets and the total debt in relation to the equity amounts to 45.26 percent. Due to the financial situation, a return on equity of 20.51 percent was realized. Twelve trailing months earnings per share reached a value of $8.52. Last fiscal year, the company paid $2.49 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 18.45, the P/S ratio is 3.48 and the P/B ratio is finally 3.69. The dividend yield amounts to 1.77 percent and the beta ratio has a value of 1.15.

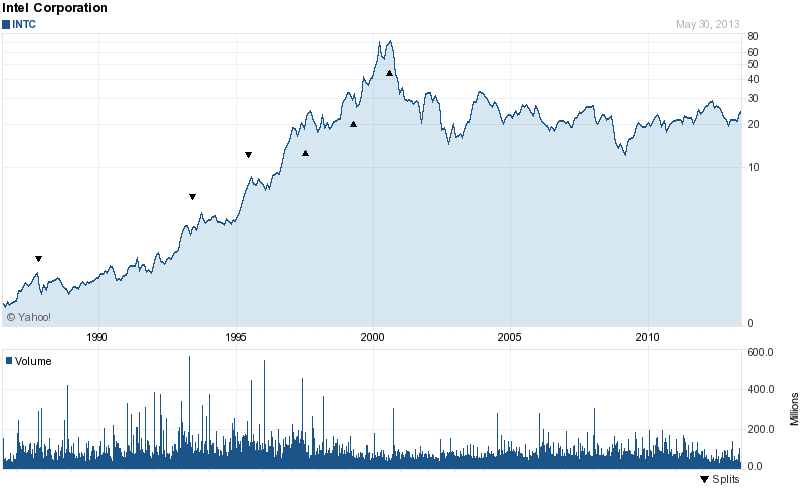

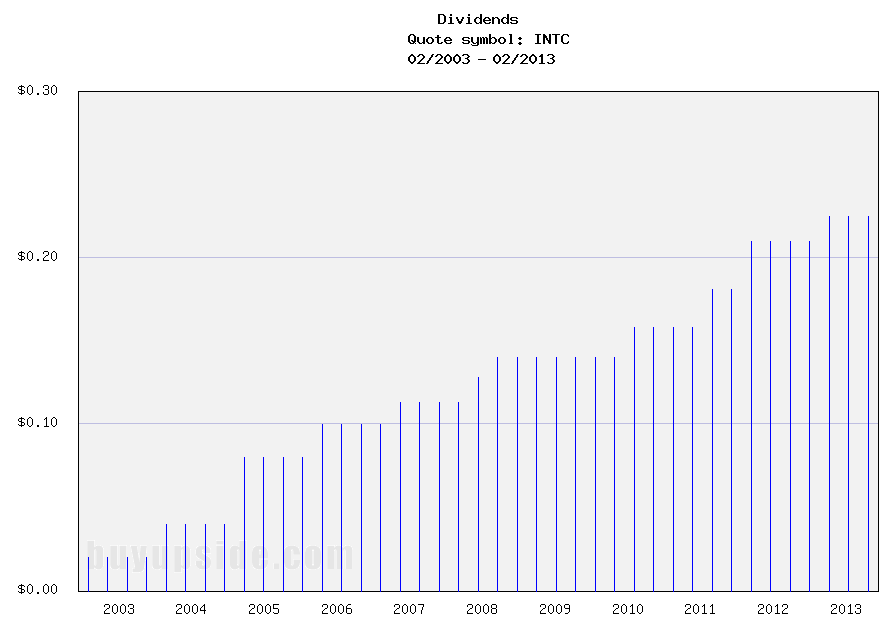

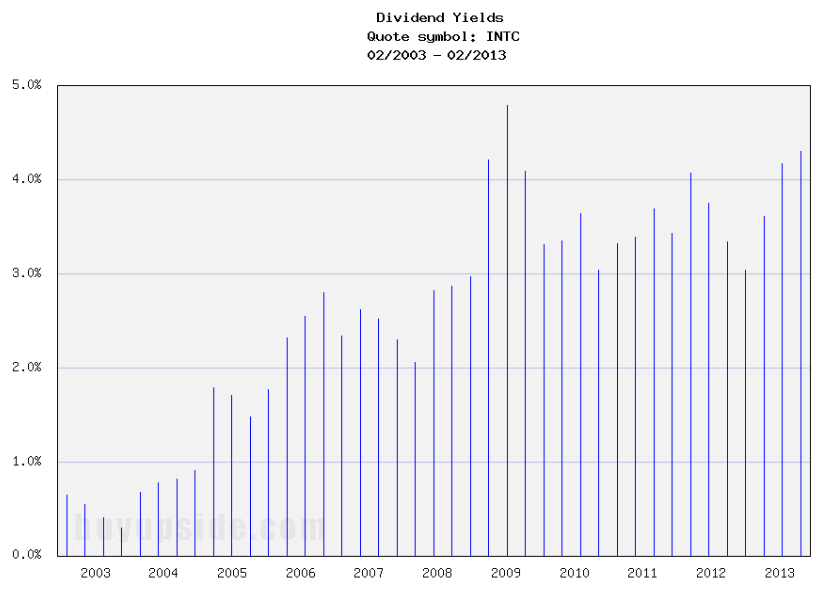

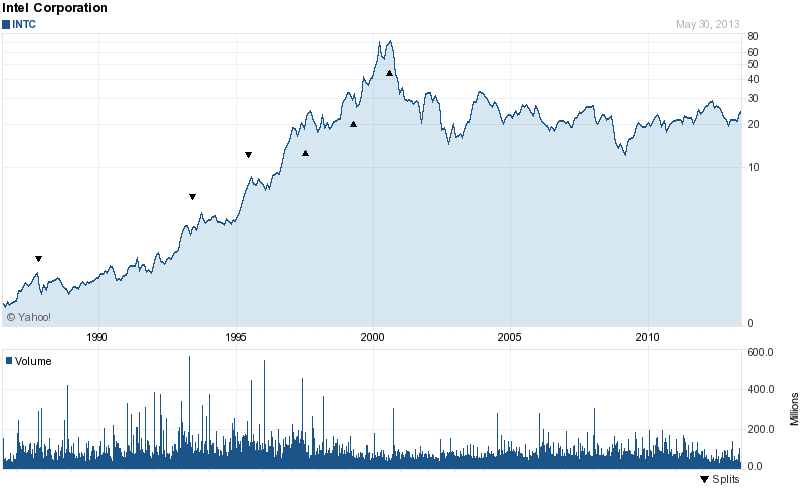

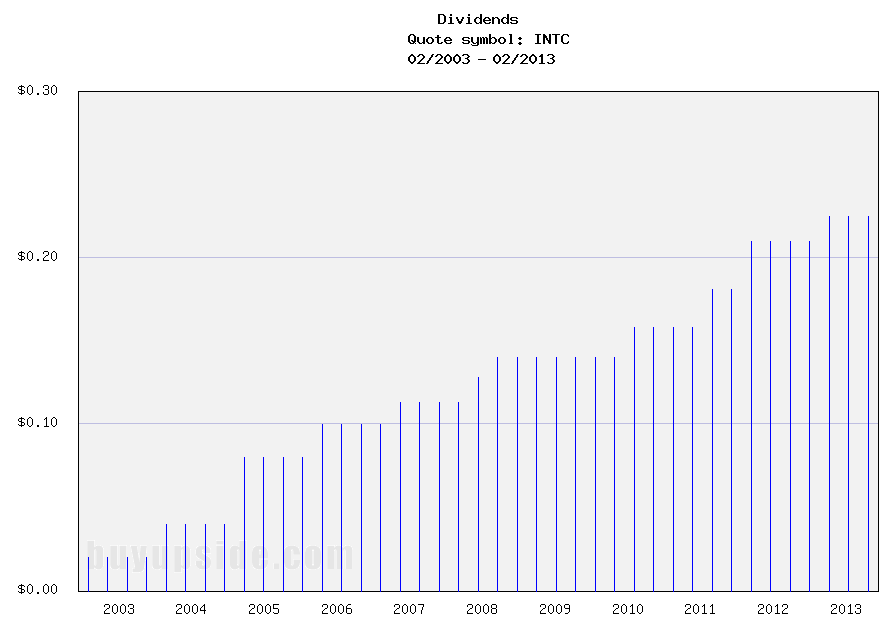

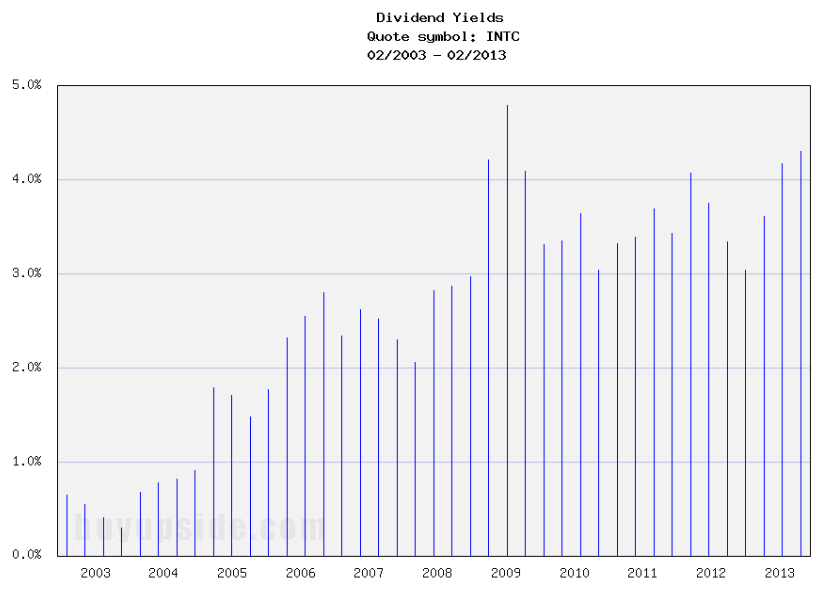

Intel Corporation (INTC) has a market capitalization of $120.35 billion. The company employs 105,400 people, generates revenue of $53.341 billion and has a net income of $11.005 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $22.160 billion. The EBITDA margin is 41.54 percent (the operating margin is 27.44 percent and the net profit margin 20.63 percent).

Financial Analysis: The total debt represents 15.94 percent of the company’s assets and the total debt in relation to the equity amounts to 26.26 percent. Due to the financial situation, a return on equity of 22.66 percent was realized. Twelve trailing months earnings per share reached a value of $2.00. Last fiscal year, the company paid $0.87 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 12.09, the P/S ratio is 2.26 and the P/B ratio is finally 2.34. The dividend yield amounts to 3.71 percent and the beta ratio has a value of 1.02.

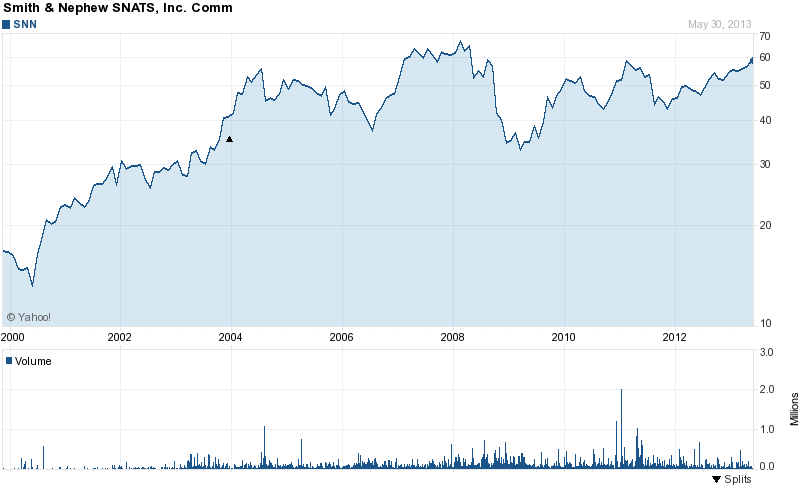

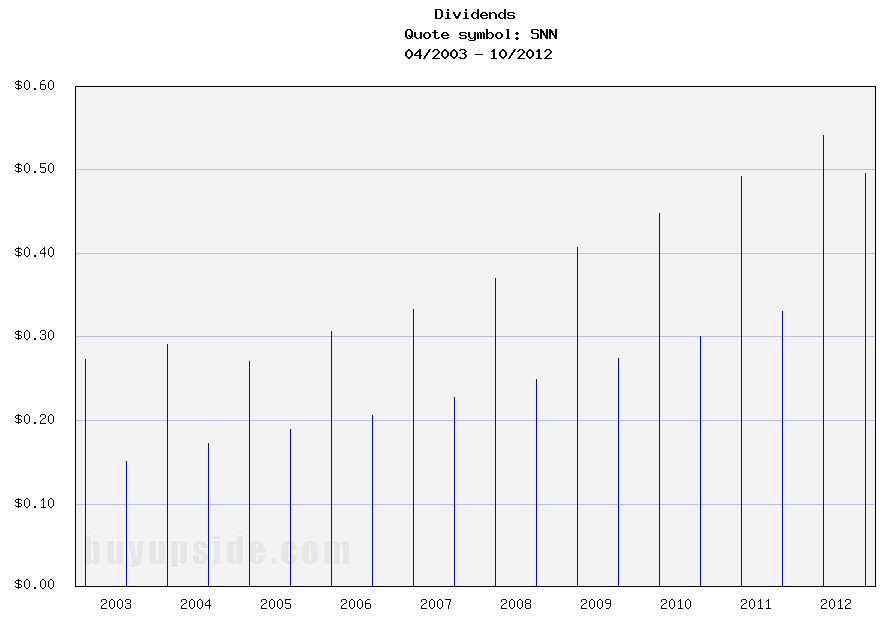

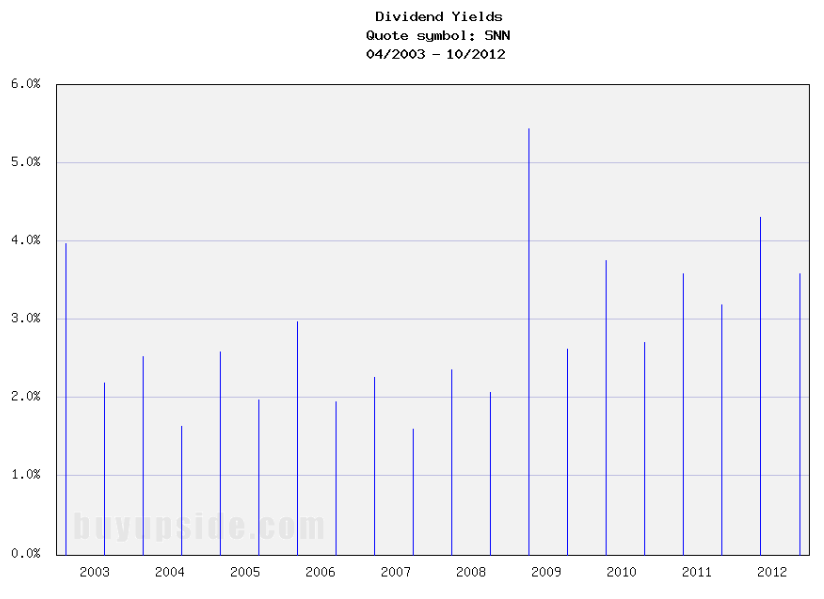

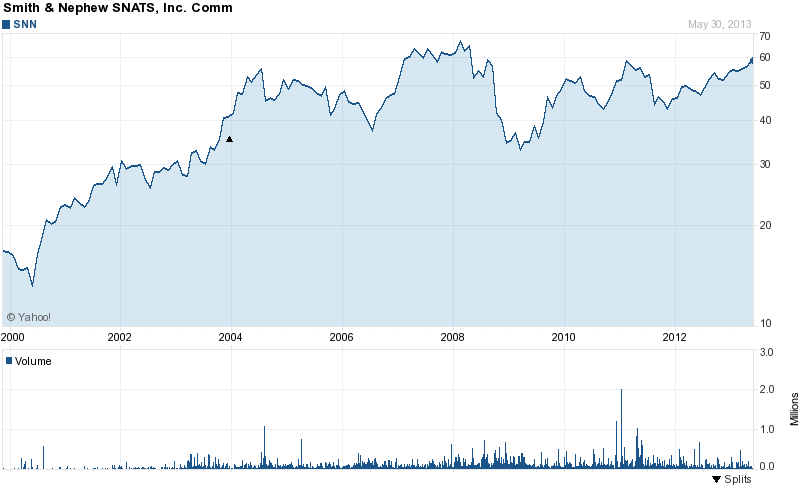

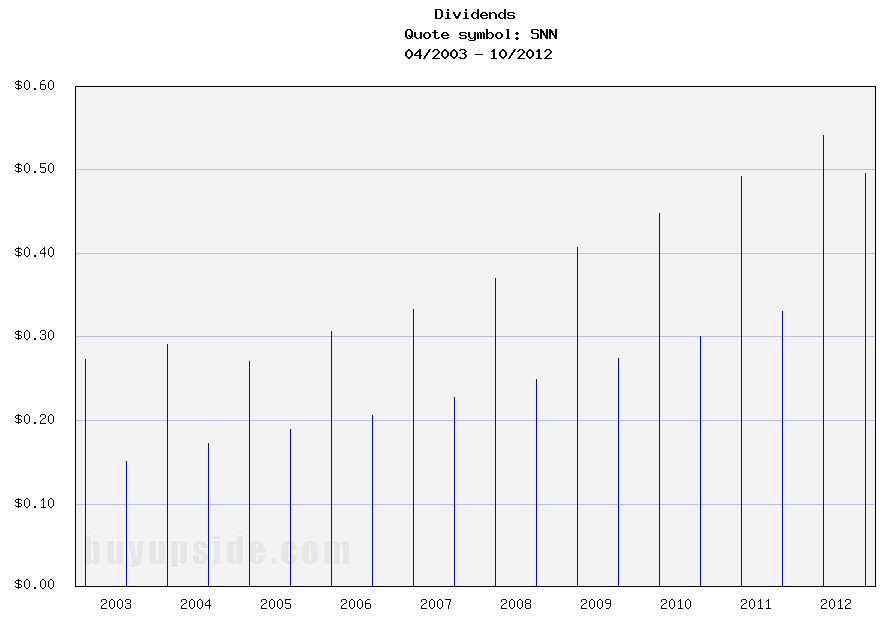

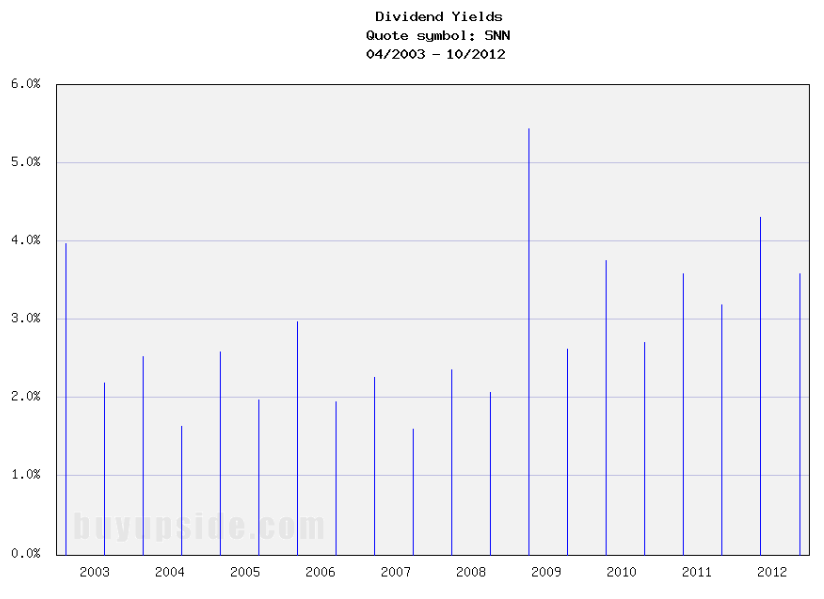

Smith & Nephew (SNN) has a market capitalization of $10.68 billion. The company employs 10,477 people, generates revenue of $4.137 billion and has a net income of $729.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1.242 billion. The EBITDA margin is 30.02 percent (the operating margin is 20.45 percent and the net profit margin 17.62 percent).

Financial Analysis: The total debt represents 8.29 percent of the company’s assets and the total debt in relation to the equity amounts to 12.05 percent. Due to the financial situation, a return on equity of 20.62 percent was realized. Twelve trailing months earnings per share reached a value of $3.94. Last fiscal year, the company paid $1.30 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 14.96, the P/S ratio is 2.54 and the P/B ratio is finally 2.72. The dividend yield amounts to 2.24 percent and the beta ratio has a value of 0.65.

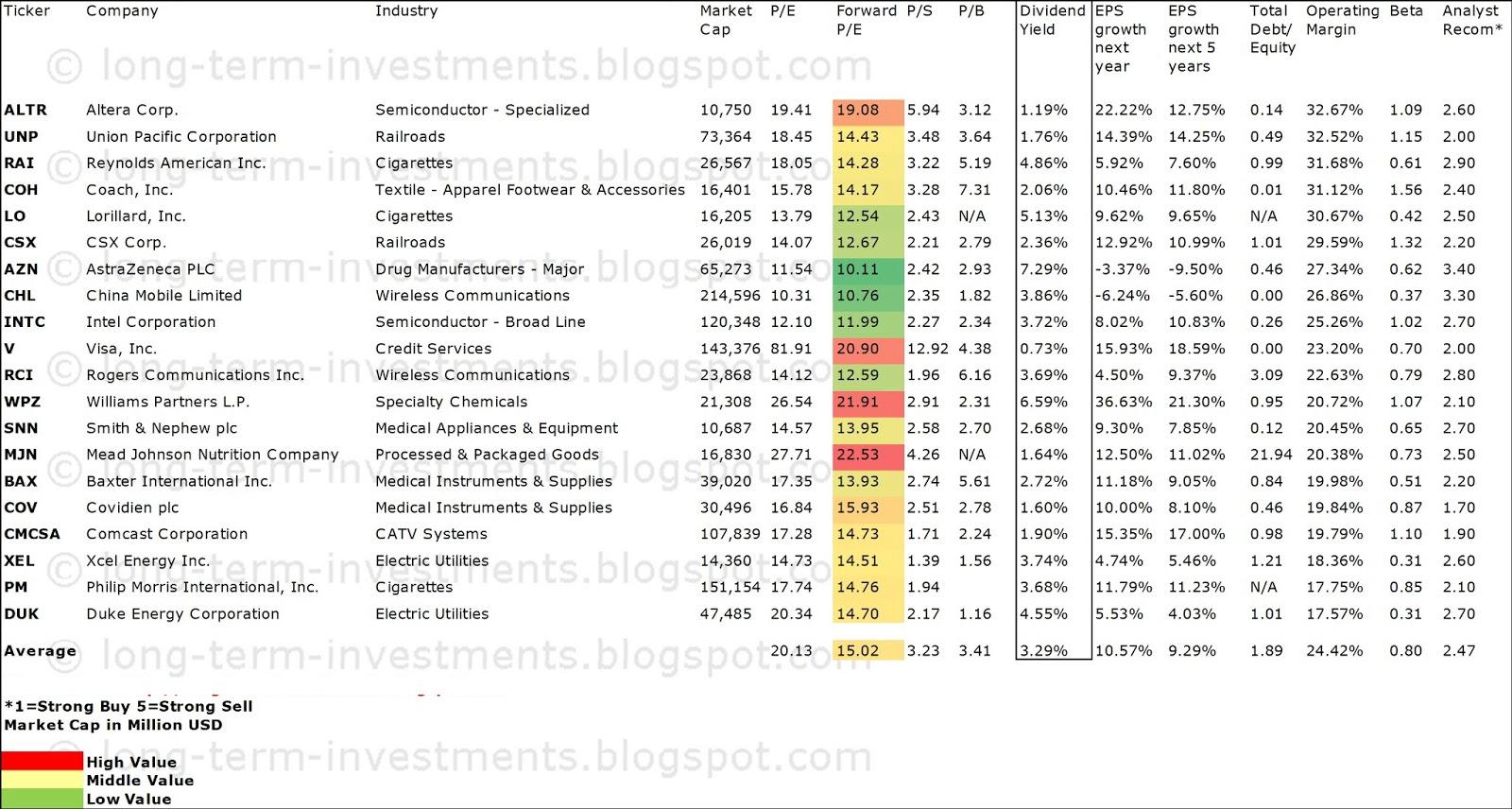

Take a closer look at the full list of the 20 most profitable Dividend Challengers. The average P/E ratio amounts to 20.13 and forward P/E ratio is 15.02. The dividend yield has a value of 3.29 percent. Price to book ratio is 3.41 and price to sales ratio 3.23. The operating margin amounts to 24.42 percent and the beta ratio is 0.80. Stocks from the list have an average debt to equity ratio of 1.89.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

ALTR, UNP, RAI, COH, LO, CSX, AZN, CHL, INTC, V, RCI, WPZ, SNN, MJN, BAX, COV,

CMCSA, XEL, PM, DUK

Disclosure: I am long LO, AZN, INTC, SNN, BAX, PM. I receive no compensation to write about these specific stocks, sector or theme. I don't plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.

The results show the top 20 companies with margins between 17.57 percent and 32.67 percent. Eleven of the results have a current buy or better recommendation.

Union Pacific (UNP) has a market capitalization of $73.36 billion. The company employs 46,437 people, generates revenue of $20.926 billion and has a net income of $3.943 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $8.505 billion. The EBITDA margin is 40.64 percent (the operating margin is 32.20 percent and the net profit margin 18.84 percent).

Financial Analysis: The total debt represents 19.08 percent of the company’s assets and the total debt in relation to the equity amounts to 45.26 percent. Due to the financial situation, a return on equity of 20.51 percent was realized. Twelve trailing months earnings per share reached a value of $8.52. Last fiscal year, the company paid $2.49 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 18.45, the P/S ratio is 3.48 and the P/B ratio is finally 3.69. The dividend yield amounts to 1.77 percent and the beta ratio has a value of 1.15.

Intel Corporation (INTC) has a market capitalization of $120.35 billion. The company employs 105,400 people, generates revenue of $53.341 billion and has a net income of $11.005 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $22.160 billion. The EBITDA margin is 41.54 percent (the operating margin is 27.44 percent and the net profit margin 20.63 percent).

Financial Analysis: The total debt represents 15.94 percent of the company’s assets and the total debt in relation to the equity amounts to 26.26 percent. Due to the financial situation, a return on equity of 22.66 percent was realized. Twelve trailing months earnings per share reached a value of $2.00. Last fiscal year, the company paid $0.87 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 12.09, the P/S ratio is 2.26 and the P/B ratio is finally 2.34. The dividend yield amounts to 3.71 percent and the beta ratio has a value of 1.02.

Smith & Nephew (SNN) has a market capitalization of $10.68 billion. The company employs 10,477 people, generates revenue of $4.137 billion and has a net income of $729.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1.242 billion. The EBITDA margin is 30.02 percent (the operating margin is 20.45 percent and the net profit margin 17.62 percent).

Financial Analysis: The total debt represents 8.29 percent of the company’s assets and the total debt in relation to the equity amounts to 12.05 percent. Due to the financial situation, a return on equity of 20.62 percent was realized. Twelve trailing months earnings per share reached a value of $3.94. Last fiscal year, the company paid $1.30 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 14.96, the P/S ratio is 2.54 and the P/B ratio is finally 2.72. The dividend yield amounts to 2.24 percent and the beta ratio has a value of 0.65.

Take a closer look at the full list of the 20 most profitable Dividend Challengers. The average P/E ratio amounts to 20.13 and forward P/E ratio is 15.02. The dividend yield has a value of 3.29 percent. Price to book ratio is 3.41 and price to sales ratio 3.23. The operating margin amounts to 24.42 percent and the beta ratio is 0.80. Stocks from the list have an average debt to equity ratio of 1.89.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

ALTR, UNP, RAI, COH, LO, CSX, AZN, CHL, INTC, V, RCI, WPZ, SNN, MJN, BAX, COV,

CMCSA, XEL, PM, DUK

Disclosure: I am long LO, AZN, INTC, SNN, BAX, PM. I receive no compensation to write about these specific stocks, sector or theme. I don't plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.