The S&P 500 Dividend Aristocrats Index is an index created by the well-known credit rating agency Standard & Poor’s. The index measures the performance of large cap, blue chip companies within the S&P 500 that have followed a policy of increasing dividends every year for at least 25 consecutive years. In total, 51 companies are included in the index and are covered by several exchange traded funds (ETFs). If you have a bit cash on your trading account, you don’t need to look for a cheap index copy via ETF. You can buy these stocks directly and benefit from these wonderful dividend growth stocks for one trading fee.

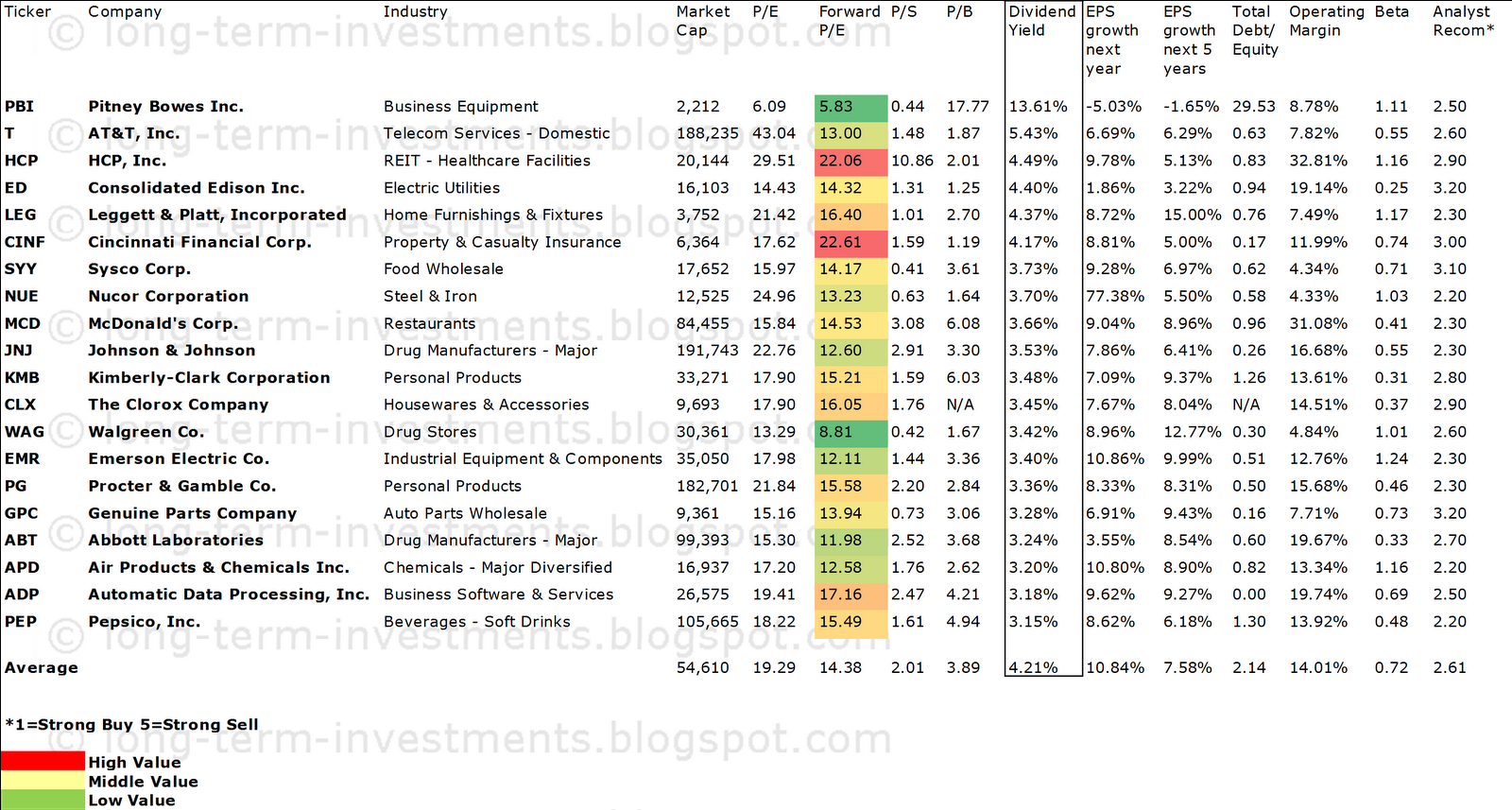

Below is an overview of the 20 best yielding Dividend Aristocrats of which ten are currently recommended to buy.

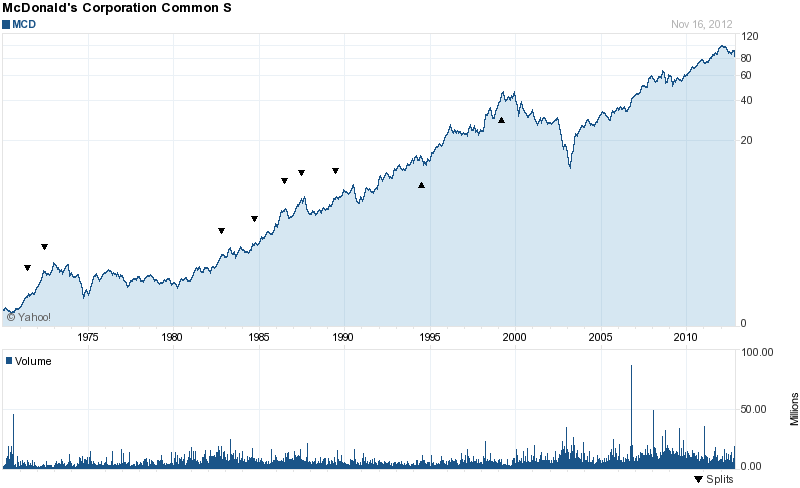

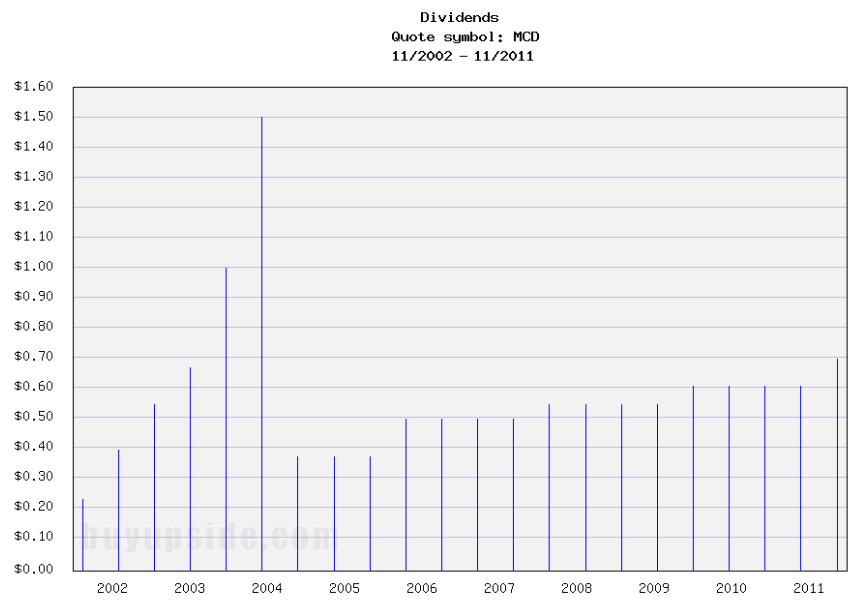

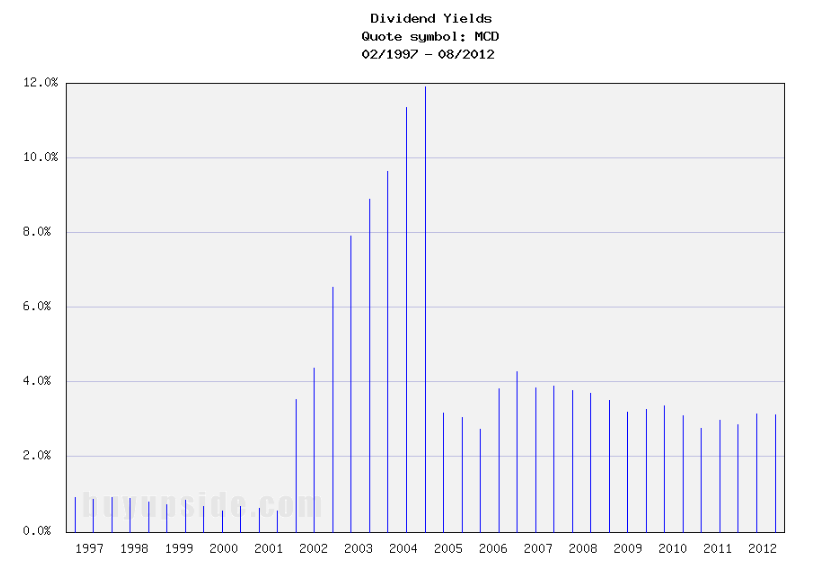

McDonald's (MCD) has a market capitalization of $84.45 billion. The company employs 420,000 people, generates revenue of $27.006 billion and has a net income of $5.503 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $9.766 billion. The EBITDA margin is 36.16 percent (the operating margin is 31.58 percent and the net profit margin 20.38 percent).

Financial Analysis: The total debt represents 37.89 percent of the company’s assets and the total debt in relation to the equity amounts to 86.87 percent. Due to the financial situation, a return on equity of 37.92 percent was realized. Twelve trailing months earnings per share reached a value of $5.31. Last fiscal year, the company paid $2.53 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 15.85, the P/S ratio is 3.13 and the P/B ratio is finally 5.97. The dividend yield amounts to 3.66 percent and the beta ratio has a value of 0.41.

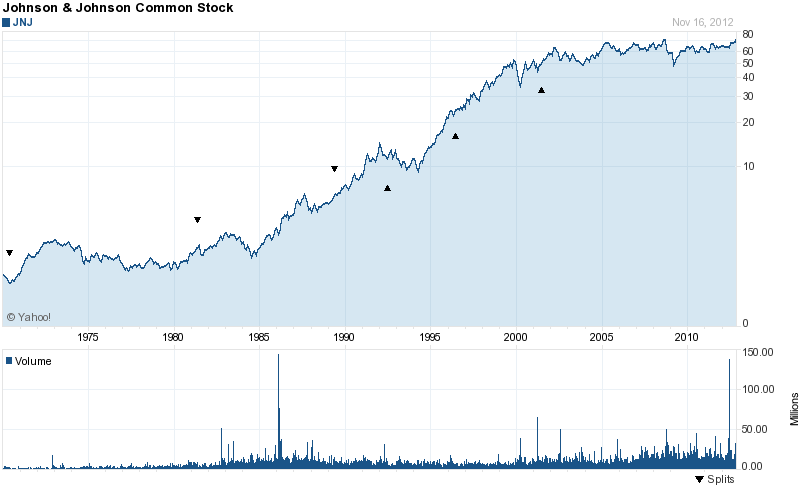

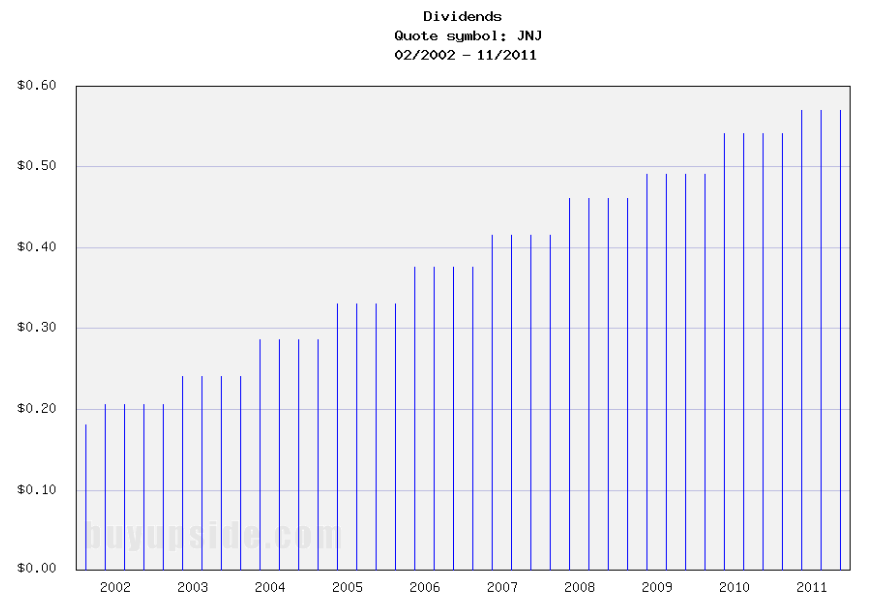

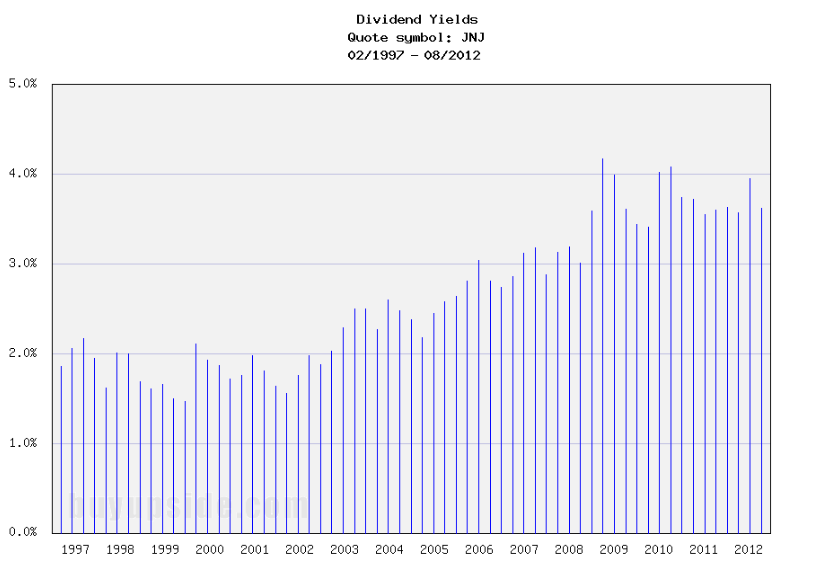

Johnson & Johnson (JNJ) has a market capitalization of $191.74 billion. The company employs 117,900 people, generates revenue of $65.030 billion and has a net income of $9.672 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $15.993 billion. The EBITDA margin is 24.59 percent (the operating margin is 19.01 percent and the net profit margin 14.87 percent).

Financial Analysis: The total debt represents 17.27 percent of the company’s assets and the total debt in relation to the equity amounts to 34.39 percent. Due to the financial situation, a return on equity of 17.02 percent was realized. Twelve trailing months earnings per share reached a value of $3.04. Last fiscal year, the company paid $2.25 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 22.73, the P/S ratio is 2.95 and the P/B ratio is finally 3.30. The dividend yield amounts to 3.53 percent and the beta ratio has a value of 0.55.

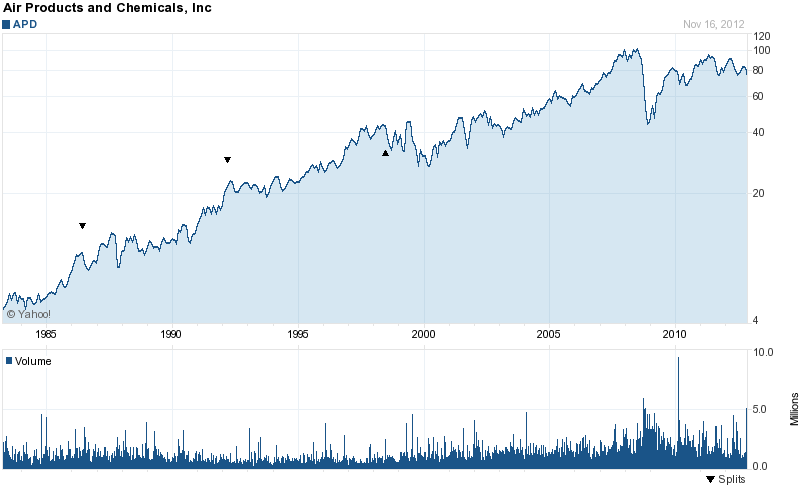

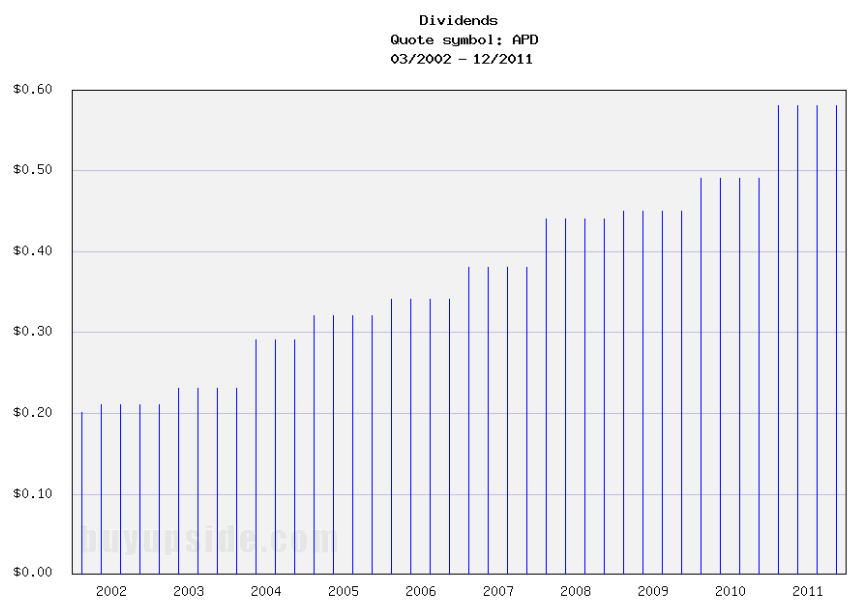

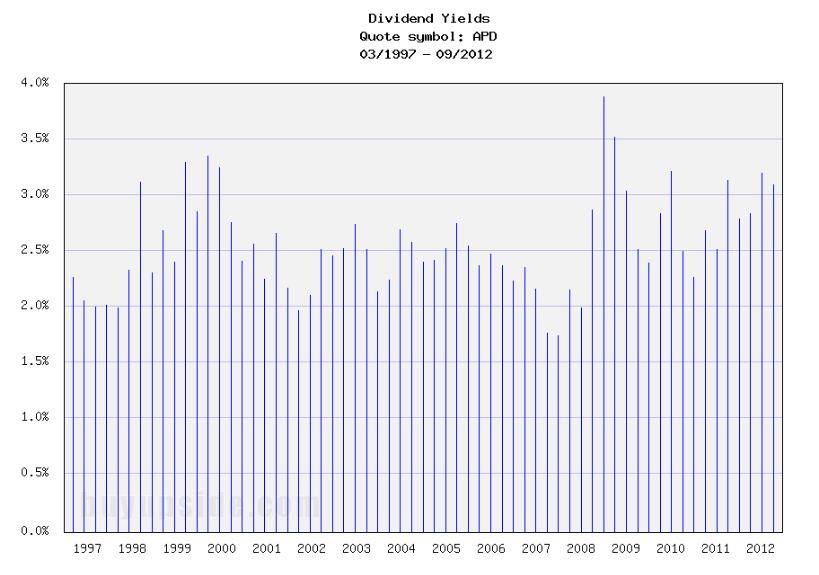

Air Products & Chemicals (APD) has a market capitalization of $16.94 billion. The company employs 18,500 people, generates revenue of $9.611 billion and has a net income of $1.025 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $2.037 billion. The EBITDA margin is 21.20 percent (the operating margin is 13.34 percent and the net profit margin 10.67 percent).

Financial Analysis: The total debt represents 31.23 percent of the company’s assets and the total debt in relation to the equity amounts to 81.83 percent. Due to the financial situation, a return on equity of 16.30 percent was realized. Twelve trailing months earnings per share reached a value of $4.65. Last fiscal year, the company paid $2.50 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 17.19, the P/S ratio is 1.76 and the P/B ratio is finally 2.62. The dividend yield amounts to 3.20 percent and the beta ratio has a value of 1.16.

Take a closer look at the full table of the best yielding Dividend Aristocrats. The average P/E ratio amounts to 19.29 and forward P/E ratio is 14.38. The dividend yield has a value of 4.21 percent. Price to book ratio is 3.89 and price to sales ratio 2.01. The operating margin amounts to 14.01 percent. The average stock has a debt to equity ratio of 0.72.

Here is the full table with some fundamentals (TTM):

Related stock ticker symbols:

PBI, T, HCP, ED, LEG, CINF, SYY, NUE, MCD, JNJ, KMB, CLX, WAG, EMR, PG, GPC, ABT,

APD, ADP, PEP

*I am long SYY, MCD, JNJ, KMB, WAG, PG, PEP. I receive no compensation to write about these specific stocks, sector or theme. I don't plan to increase or decrease positions or obligations within the next 72 hours.

For the other stocks: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I receive no compensation to write about any specific stock, sector or theme.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

20 High Yield S&P 500 Dividend Aristocrats

Published 11/19/2012, 05:21 AM

Updated 07/09/2023, 06:31 AM

20 High Yield S&P 500 Dividend Aristocrats

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.