Alphabet (NASDAQ:GOOGL)

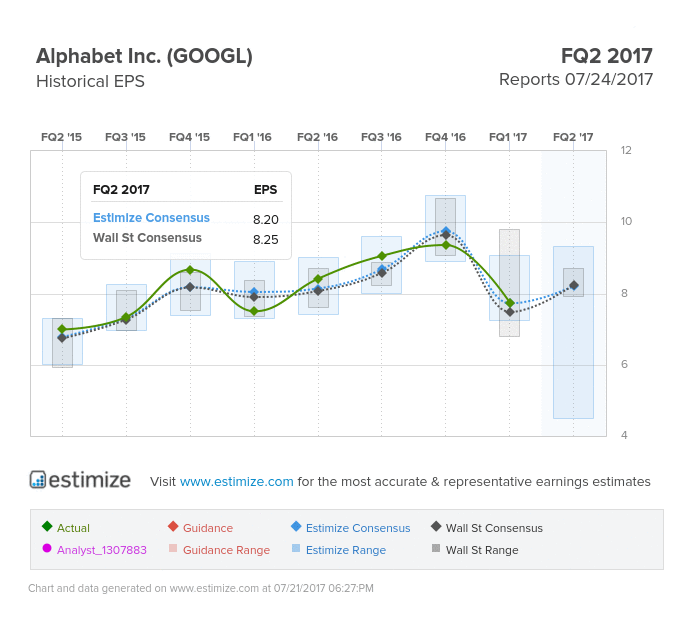

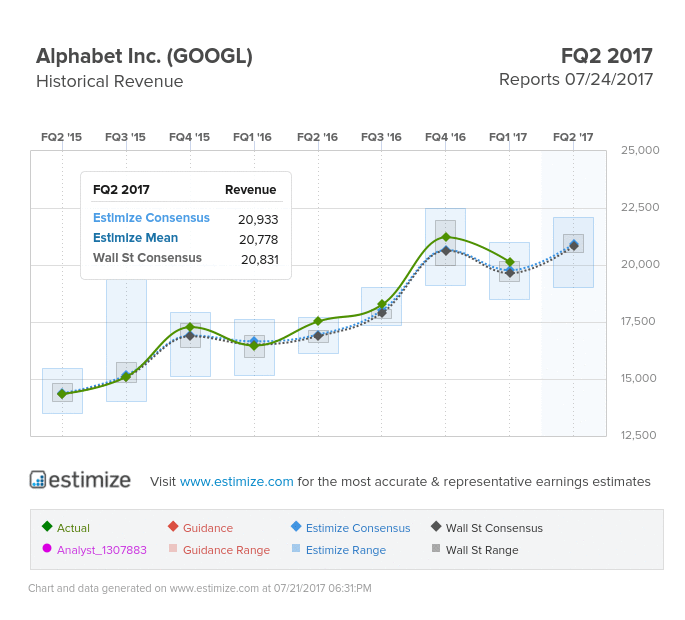

Estimize is predicting GOOGL EPS to be $8.19 a share and The Street is coming in at $7.91, a 3% difference between the two. On the contrary, revenues for both are roughly in-line, with Estimize calling for $20.902B and Wall Street at $20.831B. According to the Estimize community, EPS is projected to decrease 3% YoY. However, revenue is projected to grow roughly 19% YoY. Historically, Alphabet has beaten Estimize EPS 52% of time and Wall Street EPS 70%.

Alphabet has many interesting projects going on, not just in tech but also in medicine and environmental projects. Verily, a subsidiary of GOOGL, has just been approved to conduct their new study, Debug Fresno. They plan to release 1 million male, sterilized mosquitoes into the Fresno population in an effort to decrease the overall mosquito population in the area and the transmission of Zika virus. Since females are the only ones that bite, when they try to mate with sterilized male mosquitoes, the population will inevitably decrease. Likewise, Alphabet has decided to potentially relaunch Google Glass, but this time in a new environment; factory floors. The company has announced they feel the product can maximize efficiency of the workers working on complex manual projects by displaying step by step instructions, photographs or aiding them in choosing the right tools.

Hasbro Inc. (NASDAQ:HAS)

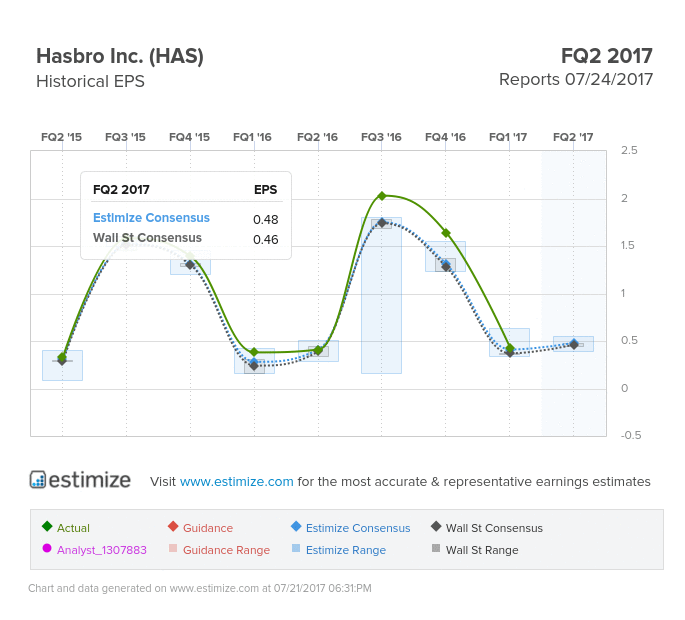

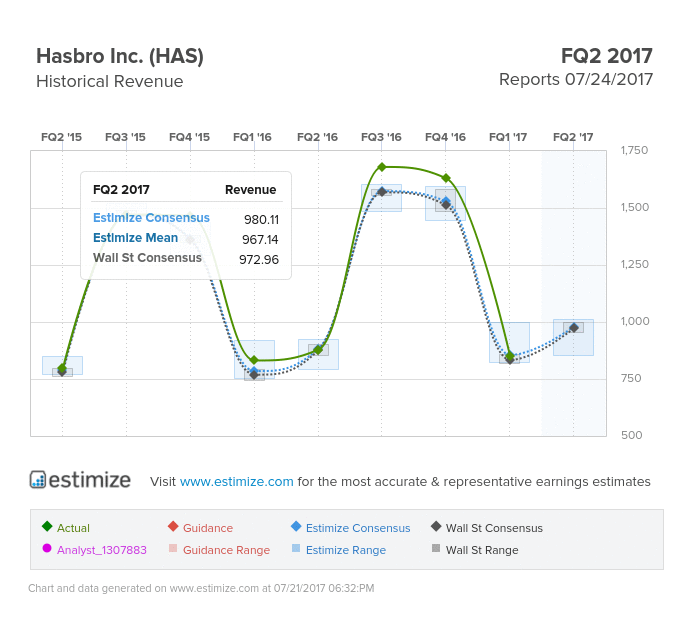

Many analysts are predicting a strong quarter for Hasbro. The Estimize community is estimating the EPS this quarter to come in at $0.48, while Wall Street is estimating $0.46. For revenue, Estimize is predicting $980.53M and Wall Street is at $972.96M. EPS is projected to have YoY growth of 17% and revenue is projected to grow 12% YoY; pretty appealing numbers. Hasbro has beaten Estimize EPS 68% of the time historically and Wall Street EPS 67% of the time and revenues 57% of the time.

Hasbro Inc. showed off a 16.2% earnings surprise last quarter, and has surpassed the Wall Street consensus in the last four quarters. As previously mentioned, many analysts are expecting HAS to have a strong quarter once again and it is easy to see why. Due to the popularity of action movies such as “SpiderMan” and “Transformers”, the toy markets and their sales will see a direct, positive correlation. Some analysts are expecting that franchised brand toy sales will make up approximately 47% of their total sales. Likewise, an increase in investments in digital initiatives and programs such as Hasbro Gaming Crate, a delivery system that delivers new board games right to people’s houses every 3 months, are all expected to increase the company’s results this quarter.

Happy Gaming and place your bets!