- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

2 Quick Moves For 18.7% Gains And Tax-Free Income

Right now there are huge deals happening in a place far too few people care to look: municipal bonds.

Now before your eyes glaze over at the sight of the words “municipal bonds,” consider this: this unloved area of the market hands most Americans a shot at tax-free income. Plus, the 2 “muni” funds I’m going to show you below are set to hand us double-digit upside, too, thanks to a ridiculous bargain sale that’s way overdue for some quick “snap back” gains.

But first, let’s look at why now is the perfect time to jump into these unloved assets.

What’s Driving Our Shot at Big Gains and Income

There are two sources of profits from municipal bonds and muni-bond funds: capital gains and income from coupon payments.

The coupon payments are simple enough; the muni-bond is backed either by a municipality (say, the state of New York) or a project run by a municipality (for instance, a new toll bridge in Ohio). When the bonds are first written, the municipality agrees to pay interest payments to bondholders at a steady, consistent interval. These are the coupon payments.

A second, and sometimes more important, source of profits is the price of the bond itself. These bonds, like any asset, can be resold on the secondary market, and sometimes they sell for more or less than the original value of the bond itself—that is, the amount of money the municipality first borrowed. When the bonds trade for more than their original price, they’re trading at a premium (or “above par”); when under, they’re trading at a discount (“below par”).

The best muni-bond funds—like the 2 I’ll introduce in a couple more paragraphs—take advantage of this to buy the right municipal bonds at the right time; that is, when they’re trading at a discount and are set to go up.

In most cases, there are 3 reasons why a bond will trade at a discount: there’s something wrong with the municipality (it’s going bankrupt); its credit rating has been downgraded; or the market is simply panicking and selling off munis. You’re best to avoid the first situation, but the latter two can be opportunities—especially the third one, which is exactly where we are today.

A “Door-Crasher” in Muni-Bond Funds

One big reason for recent weakness in muni bonds is the inevitable increase in interest rates that’s coming in 2018 and beyond. Trouble is, the belief that municipal bonds always go down when rates go higher is just plain false.

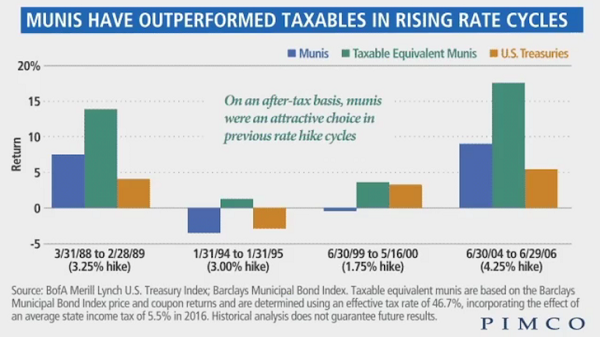

From 2004–06, during the biggest interest-rate hike in a generation, municipal bonds went up nearly 10%; while 1994–95 and 1999–2000, other periods of interest-rate hikes, saw muni bonds fall slightly:

Note also that the interest-rate hikes in the late 1980s and mid-90s were almost identical, yet in the first instance, muni bonds went up over 5%, and in the second, munis went down nearly 5%—although they quickly recovered and were up within two years. Obviously, there’s something else going on.

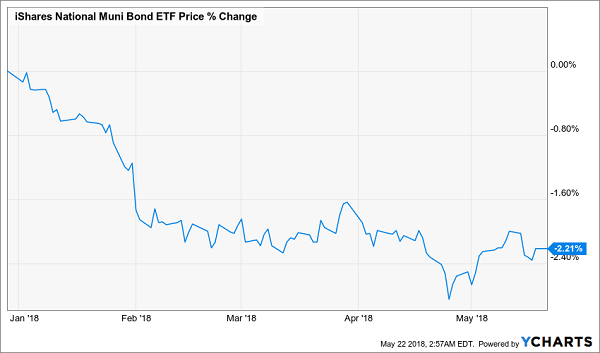

The real truth is that muni bonds go up or down because of many factors. Interest rates are just one—and a much smaller one than many others. Yet the fear of rate hikes has done this to the iShares National AMT-Free Muni Bond (NYSE:MUB):

Snapshot of a Discount

A 2.2% decline in just 2018 is a lot for normally placid munis, especially when we consider that credit ratings for many municipal-bond issuers are rising and the improving economy is boosting revenue for counties and states. Higher corporate profits, lower unemployment and rising wage and economic growth all mean many municipalities are in better financial health than they have been in years. Yet muni bonds have been falling.

That’s our opportunity for a contrarian bet on one of the safest asset classes out there.

2 Quick Buys to Double Your Muni Gains

The best news is that there’s a way to supercharge our contrarian bet on oversold muni bonds: muni-bond closed-end funds (CEFs).

Specifically, what we want to do is find CEFs whose market price has fallen faster than their net asset value (NAV), or the actual market price of the fund’s underlying portfolio holdings. Since CEFs are often priced differently than their portfolio value, unlike ETFs and mutual funds, this is pretty easy to do.

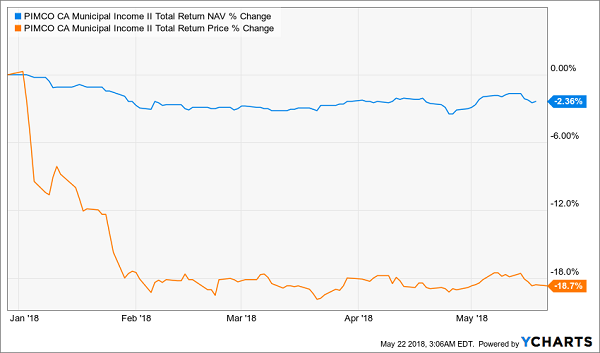

For instance, look at the PIMCO California Municipal Income Fund II (NYSE:PCK), a 5.2% yielder that has seen its portfolio fall 2.4% on a total-return basis—while its market price has fallen a whopping 18.7%:

PCK Is Absurdly Oversold

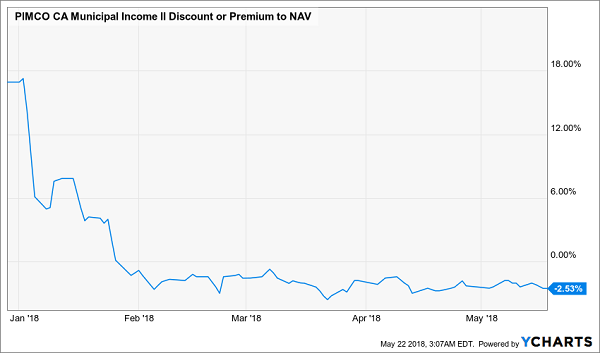

This is a prime example of the market overselling a solid fund, creating a rare buying opportunity. The result is a fund that is trading at a discount to its NAV, even though it started the year trading at a 17% premium!

A Quick Drop in Market Price

This is an opportunity to buy a great-performing fund at a rare discount.

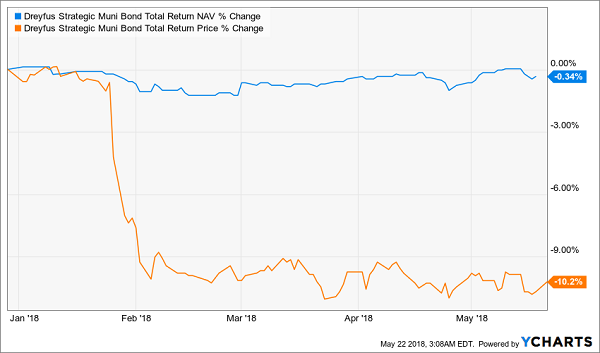

The same goes for the Dreyfus Strategic Municipal Bond Closed Fund (NYSE:DSM), although the story isn’t as extreme here. This fund is down 10.2% on the market, even though the fund’s portfolio is roughly flat for the year:

Why the Fast Selloff?

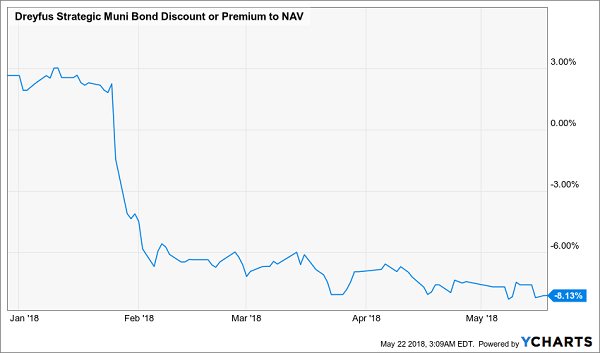

Such a violent selloff is a buying opportunity! That means this is a great play on the coming municipal-bond recovery, especially since it means DSM’s 2.8% premium to NAV has fallen to a discount of over 8% in 2018 alone:

A Sudden Discount to Jump On

With PCK’s 5.2% tax-free dividend yield and DSM’s 5.6% yield, also tax-free, you can create a mini-muni portfolio of these two funds to get a dividend yield that’s almost impossible to find in the stock market. And that’s before you even include the fact that your stock dividends are taxed, while muni income isn’t for most Americans.

And these dividends are stable because muni bonds almost never default (the default rate is less than 0.01%) and the creditworthiness of many municipalities is going up.

Revealed: My 4 Top Picks for 8% Dividends and Quick 20%+ Upside

The 2 funds above are perfectly positioned to gain as municipal bonds snap back, but you can bank even higher yields and bigger upside in the next 12 months with 4 other funds my proprietary 5-point CEF-picking system just released.

One of these incredible income plays even hands you an 8.1% dividend yield!

And before you ask, yes, this payout is safe, easily covered by the gains and income this off-the-radar fund’s portfolio is throwing off.

In fact, this cash machine is one of the lowest-risk investments I’ve ever seen.

Here’s why: let’s say you buy $100,000 worth of this rock-solid pick today. By spring 2019, you’ll be sitting on a nice $8,100 in dividends alone.

Sure, the income is great, but that high yield also gives you extra insurance because it means you’ll have already recouped 8.1% of your original buy in cash! In 12 years, those outsized dividends will have handed you your complete investment back in full.

That’s to say nothing of the gains you’ll get from this blockbuster fund and the 3 other picks my proven system just released. I’ll share the names and all my research on all 4 of these stout dividend plays with you when you click here.

Because thanks to each of these funds’ outsized discounts to NAV, I’ve got each one pegged for easy 20% price upside in the next 12 months—including that incredible 8.1% yielder I just mentioned.

That means our hypothetical investor above would already have a nice $28,100 in gains and income on this one fund alone by the time next spring rolls in!

Don’t miss out on this incredible profit opportunity. Click here to get the full story—names, tickers, buy-under prices and everything you need to know before you buy—on all 4 of these off-the-radar cash machines now.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.