“Even castles made of sand, fall into the sea, eventually.” Jimi Hendrix

Another amazing weekend in the books, with stocks continuing to setup and work their way higher.

We should have right at 2 weeks of strength left in this move before we see a deeper correction, if my day count tool is going to work, but so far it appears to be working well.

Many patterns are set to breakout shortly, which would give us about a week of solid upward action where I can look to lock in some or all of my gains.

We may see quiet trading until the Fed speech Friday, and that would be about the right time to see a strong breakout higher which could take us into the end of this current run, which should be followed by a rest of 6 to 8 weeks.

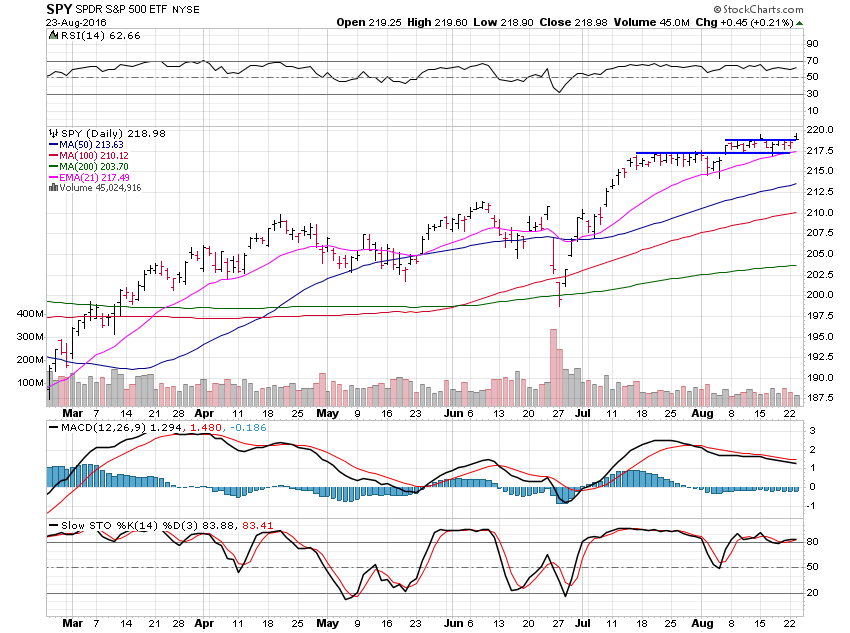

SPDR S&P 500 (NYSE:SPY) is trying to breakout of this flat channel but may stay put until Friday when Yellen speaks.

I’ve got a 10% weighting still from 202.

I’ll keep stops at the 217.50 area for now.