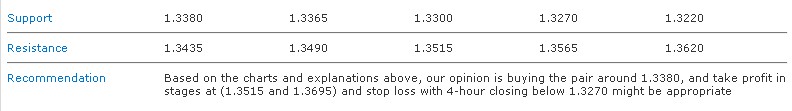

EUR/USD

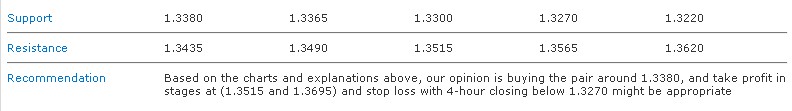

The pair traded within narrow levels during the Asian session today and also during yesterday’s session, where the pair is stable in areas around 78.6% Fibonacci correction of the upside wave, which started from the bottom of 1.3145 and ended at the top of 1.4247. We still expect an upside move today, but 4-hour closing above 1.3435 is required. A breach of 1.3270 and 4-hour closing below it could be sufficient to negate the upside move over intraday basis.

The trading range for today is among the major support at 1.3080 and the major resistance at 1.3620.

The short-term trend is to the upside with steady daily closing above 1.2795 targeting 1.5135

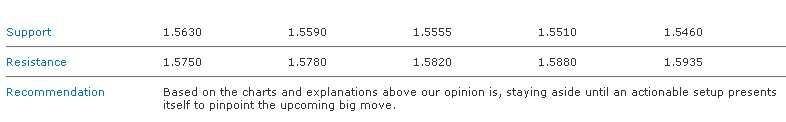

GBP/USD

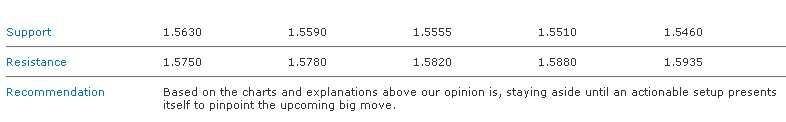

Cable has moved clearly upwards after touching the pivotal support of 1.5590 where it succeeded in achieving a daily closing above SMA 20 -colored in green- but SMA 50 continued covering the pair's trading as seen on the provided daily graph. In the interim, Stochastic overlapped positively but the solidity proved by 38.2% Fibonacci of the downside wave from 1.6615 to 1.5270 prevents us from suggesting more upside movement. Consequently, we prefer staying aside over intraday basis; noting that coming back below 1.5590 will bring the negative picture back into focus.

The trading range for today is among key support at 1.5420 and key resistance at 1.5935.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 areas remain intact.

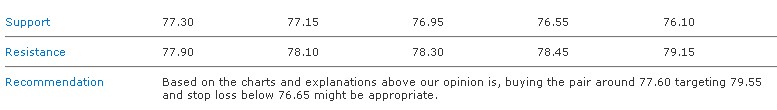

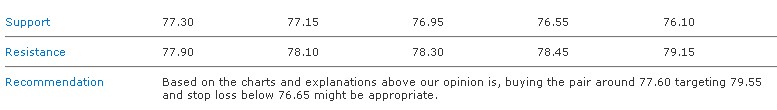

USD/JPY

The pair is still trapped within a very tight range since the opening of this week and it couldn't show any big move since yesterday. Despite being covered by SMA 50 -colored in red- but it succeeded in stabilizing above 50% Fibonacci of the entire upside rally from 75.50 to 79.50. Furthermore, Stochastic is on its way to confirm a potential positive divergence; thus, the bullishness remains in favor over intraday basis so long as areas of 76.55 remain intact.

The trading range for today is among key support at 76.55 and key resistance now at 79.15.

The general trend over short term basis is to the upside targeting 87.45 as far as areas of 75.20 remain intact.

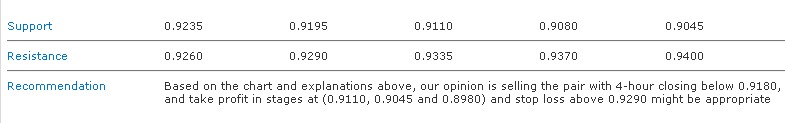

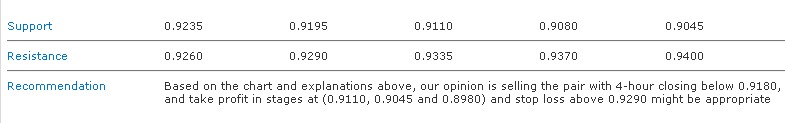

USD/CHF

The pair failed to settle above 0.9290, and returned to trade in areas around 0.9235. The Butterfly harmonic pattern is still valid, while the pattern should remain effective as long as the pair is stable below the top of point (D) at the resistance level of 0.9335, in the time the pattern will become significantly effective with consolidation below 0.9235. Therefore, we expect a downside movement today supported by the mentioned harmonic pattern.

The trading range for today is among the major support at 0.8980 and the major resistance at 0.9400.

The short-term trend is to the upside with steady weekly closing above 0.8020 targeting 0.9400.

USD/CAD

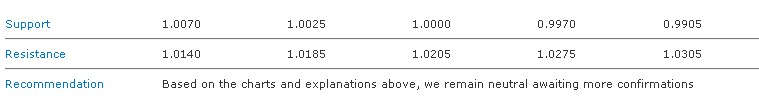

The pair is still stable in areas below the ascending support level, which stopped the pair’s positive momentum yesterday. At the same time, the pair is still stable above 23.6% Fibonacci correction at 1.0070. Therefore, the pair is still facing critical levels now, where the breach of the ascending main support level should be confirmed through breaching the mentioned Fibonacci correction, or trading above 1.0185 to confirm the return of the upside move. Therefore, we remain neutral today.

The trading range for today is among the major support at 0.9865 and the major resistance at 1.0275.

The short-term trend is to the downside as far as 1.0665 remains intact targeting 0.9000.

The pair traded within narrow levels during the Asian session today and also during yesterday’s session, where the pair is stable in areas around 78.6% Fibonacci correction of the upside wave, which started from the bottom of 1.3145 and ended at the top of 1.4247. We still expect an upside move today, but 4-hour closing above 1.3435 is required. A breach of 1.3270 and 4-hour closing below it could be sufficient to negate the upside move over intraday basis.

The trading range for today is among the major support at 1.3080 and the major resistance at 1.3620.

The short-term trend is to the upside with steady daily closing above 1.2795 targeting 1.5135

GBP/USD

Cable has moved clearly upwards after touching the pivotal support of 1.5590 where it succeeded in achieving a daily closing above SMA 20 -colored in green- but SMA 50 continued covering the pair's trading as seen on the provided daily graph. In the interim, Stochastic overlapped positively but the solidity proved by 38.2% Fibonacci of the downside wave from 1.6615 to 1.5270 prevents us from suggesting more upside movement. Consequently, we prefer staying aside over intraday basis; noting that coming back below 1.5590 will bring the negative picture back into focus.

The trading range for today is among key support at 1.5420 and key resistance at 1.5935.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 areas remain intact.

USD/JPY

The pair is still trapped within a very tight range since the opening of this week and it couldn't show any big move since yesterday. Despite being covered by SMA 50 -colored in red- but it succeeded in stabilizing above 50% Fibonacci of the entire upside rally from 75.50 to 79.50. Furthermore, Stochastic is on its way to confirm a potential positive divergence; thus, the bullishness remains in favor over intraday basis so long as areas of 76.55 remain intact.

The trading range for today is among key support at 76.55 and key resistance now at 79.15.

The general trend over short term basis is to the upside targeting 87.45 as far as areas of 75.20 remain intact.

USD/CHF

The pair failed to settle above 0.9290, and returned to trade in areas around 0.9235. The Butterfly harmonic pattern is still valid, while the pattern should remain effective as long as the pair is stable below the top of point (D) at the resistance level of 0.9335, in the time the pattern will become significantly effective with consolidation below 0.9235. Therefore, we expect a downside movement today supported by the mentioned harmonic pattern.

The trading range for today is among the major support at 0.8980 and the major resistance at 0.9400.

The short-term trend is to the upside with steady weekly closing above 0.8020 targeting 0.9400.

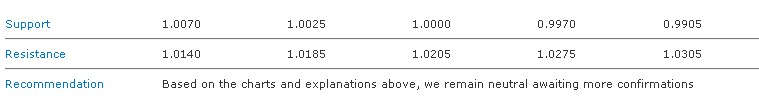

USD/CAD

The pair is still stable in areas below the ascending support level, which stopped the pair’s positive momentum yesterday. At the same time, the pair is still stable above 23.6% Fibonacci correction at 1.0070. Therefore, the pair is still facing critical levels now, where the breach of the ascending main support level should be confirmed through breaching the mentioned Fibonacci correction, or trading above 1.0185 to confirm the return of the upside move. Therefore, we remain neutral today.

The trading range for today is among the major support at 0.9865 and the major resistance at 1.0275.

The short-term trend is to the downside as far as 1.0665 remains intact targeting 0.9000.