U.S.-China trade tensions and geopolitical uncertainty has been a boon for gold prices in recent months, and mining shares have benefited from this increased appetite for the safe-haven asset. Two gold stocks in particular that caught our attention are Barrick Gold Corp (NYSE:GOLD) and Eldorado Gold Corp (NYSE:EGO), both of which have been the targets of short sellers in recent months and are trading near new highs -- fuel for more upside.

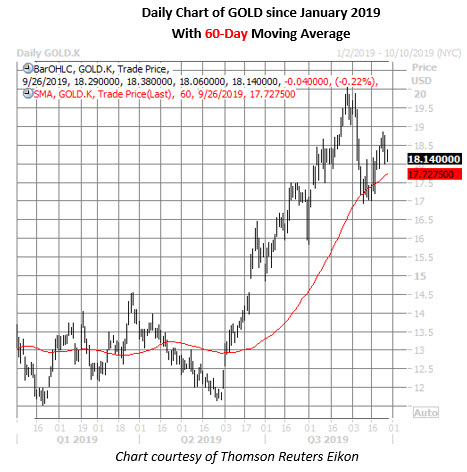

Barrick Gold Shorts Start Covering

Barrick Gold was last seen down 0.2% at $18.14, as a stronger U.S. dollar weighs on gold prices. The shares are still up almost 58% from a late-May bounce near $11.60, and recently found support at their rising 60-day moving average following a brief pullback from their Aug. 28 two-year peak at $20.07.

The gold stock has been burning short sellers during its longer-term climb, too. Short interest on GOLD rose almost 46% between the June 1 and Sept. 1 reporting periods to 32.42 million shares. Some of the weaker bearish hands capitulated to Barrick Gold's burst higher in recent months, though, with short interest down 16.4% in the most recent reporting period. Continued short covering could create tailwinds for the security.

A round of bull notes could draw buyers to Barrick Gold, too. Currently, eight of 13 analysts maintain a lukewarm "hold" rating on the stock, while the average 12-month price target of $19.20 is a slim 6.2% premium to the equity's present perch, leaving the door wide open for upward revisions from the brokerage bunch.

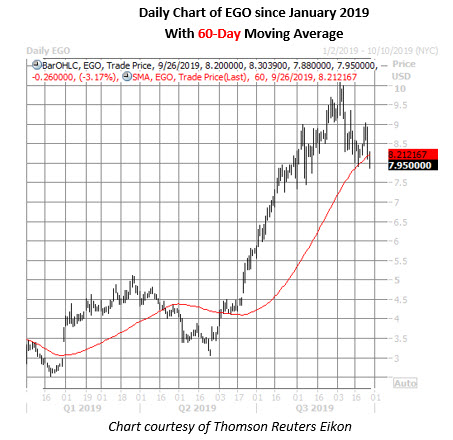

Eldorado Gold Stock is Up 160% Since May

Eldorado Gold, meanwhile, is down 3.2% today at $7.95, testing a recent footing atop its 60-day moving average. The shares were trading just above $3 in late May, but have since surged 160%, and tiptoed into double-digit territory earlier this month for the first time since October 2017.

Short sellers made a beeline for the stock during its summer surge, with short interest more than doubling between the May 15 and July 1 reporting periods. These bearish bets have since been cut in half, but the 3.48 million shares still held by shorts is well above historical lows. EGO stock could be headed higher, should shorts continue to buy back their borrowed shares.

Upgrades are a possibility for EGO stock, as well, especially if it adds to its 174.1% year-to-date gain. Of the nine brokerages covering Eldorado Gold, five maintain a "hold" or worse recommendation.