Buffalo Wild Wings Inc (NASDAQ:BWLD) Consumer Discretionary - Hotels, Restaurants and Leisure | Reports April 26, After Market Closes

Key Takeaways

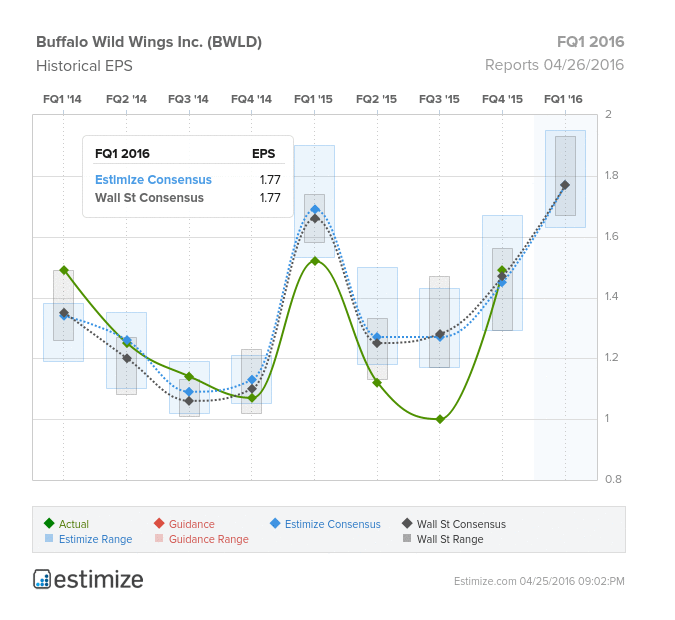

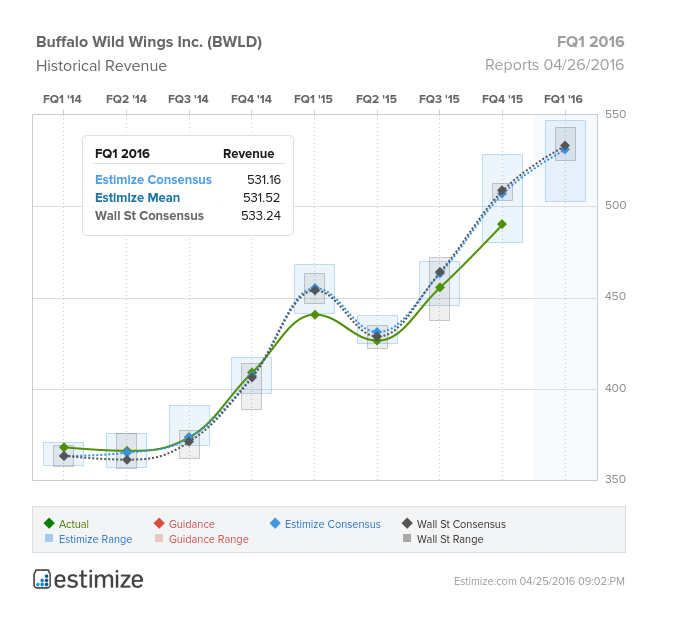

- The Estimize consensus is calling for EPS of $1.77 and revenue expectations of $531.16, right in line with Wall Street on the bottom line and $2 million below on the top

- Buffalo Wild Wings faces risks from volatile chicken prices, currency headwinds and increasing labor costs

- Despite steadily increasing earnings, Buffalo Wild Wings has not grown at the rate that investors and the company were accustomed to in the past

- What are you expecting for BWLD?

Buffalo Wild Wings (BWLD), or B-Dubs for short, is scheduled to report fiscal first quarter earnings Tuesday, after the closing bell. Though the bar and grill has posted positive comps over the past year, growth has been relatively sluggish compared to years past. Meanwhile, earnings missed in every quarter of fiscal 2015. Last quarter was highlighted by ups and down in many key metrics including strong revenue and earnings offset by weak franchise owned sales and cash on hand. Given the restaurant’s recent history, it’s not surprising the stock has declined 20% in the past 12 month. This quarter expectations have fallen in line with past performance, which could cause shares to drop even further.

The Estimize consensus is calling for EPS of $1.77 and revenue expectations of $531.16, right in line with Wall Street on the bottom line and $2 million below on the top. Compared to a year earlier, this predicts as a 18% increase on the bottom line while sales could rise as much as 21%. On average, the stock stays relatively flat through earnings season. However, in the 30 days following an earnings report, shares typically increase 5%.

The company is constantly testing and implementing new strategies to regain its past growth rates. Lately, they have been investing heavily in new technologies, expanding globally and introducing a loyalty based program. In general, technology has boosted revenues and built customer loyalty in the restaurant space, and will hopefully help Buffalo Wild Wings as well.

Unfortunately, Buffalo Wild Wings faces some tough obstacles this quarter, including currency headwinds, increasing labor costs, and volatile commodities prices. As a result, same store sales have decelerated primarily due to weakness from dinner-time traffic. Meanwhile, the company has been under pressure to increases wages while chicken prices remain in flux.

Do you think BWLD can beat estimates?