Investors in electric vehicle heavyweight Tesla (NASDAQ:TSLA) saw solid returns in October. Now, November has also started on a strong note. TSLA stock is up about 55% over the past month and 70% so far this year.

The 52-week range for Tesla has been $392.30 - $1,209.7, while the market capitalization stands at well above $1.15 trillion. Given the recent rapid run-up in price, many investors wonder if there could be short-term profit-taking in Tesla stock.

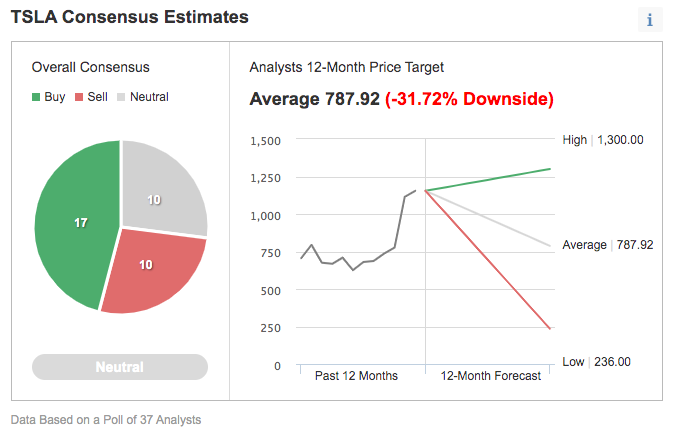

In fact, among 37 analysts polled by Investing.com, the stock has a neutral rating. Shares have a 12-month price target of $787.92, implying a decrease of about 30% from current levels. And the 12-month price range currently stands between $236 and $1,300.

We previously covered Tesla (here, here, and here) as well as several exchange-traded funds (ETFs) that have TSLA as a main top holding. Today, we introduce two more funds. They could appeal to investors who would like some exposure to the car manufacturer but do not necessarily want the short-term volatility that comes with the shares.

1. ARK Autonomous Technology & Robotics ETF

- Current Price: $87.42

- 52-Week Range: $57.93 - $101.11

- Expense Ratio: 0.75 % per year

The ARK Autonomous Technology & Robotics ETF (NYSE:ARKQ) invests in leading businesses in autonomous transportation, automation, robotics, energy storage, 3D printing, as well as space exploration. Since its inception in September 2014, net assets have reached $2.5 billion.

ARKQ, an actively-managed ETF, currently has 38 holdings. The top 10 names account for about 55% of the fund. Tesla has the highest weighting, with 12.83%.

Next in line are Trimble (NASDAQ:TRMB), which provides positioning products to governments and enterprises, software group Uipath (NYSE:PATH), which focuses on robotic process automation, Kratos Defense & Security Solutions (NASDAQ:KTOS), which is known for its military drones among other products, and Unity Software (NYSE:U), which offers a platform for creating 3D content.

ARKQ is up more than 15% YTD and 50% in the past 12 months. After hitting a record high in mid-February, the names in the fund have come under pressure. On Oct. 4, it saw a multi-month low of $75.89. But since then the ETF has gained more than 14%.

Many of the firms in ARKQ are regarded as those at the forefront of the Fourth Industrial Revolution, which is “characterized by a fusion of technologies that is blurring the lines between the physical, digital and biological spheres… [and covering] fields such as artificial intelligence, robotics, the Internet of Things, autonomous vehicles, 3-D printing, nanotechnology, biotechnology, materials science, energy storage and quantum computing.”

Therefore, we’re likely to hear more about these companies in the future. Interested readers could regard potential declines in the fund as an opportunity to invest in a range of stocks that includes Tesla.

2. First Trust NASDAQ Global Auto Index Fund ETF

- Current Price: $64.78

- 52-Week Range: $40.51 - $65.00

- Dividend Yield: 0.72%

- Expense Ratio: 0.70% per year

The First Trust NASDAQ Global Auto Index Fund (NASDAQ:CARZ) invests in global automobile manufacturers. They include traditional car makers as well as those that are investing heavily in electric and self-driven vehicles. The fund started trading in May 2011, and has around $74.5 million in assets, making it much smaller than ARKQ.

CARZ, which has 34 holdings, tracks the returns of the NASDAQ OMX Global Auto Index. Japanese car manufacturers have the largest slice, with 31.37%. They are followed by automakers from the U.S. (20.99%), Germany (20.33%), China (9.75%) and South Korea (7.45%).

As the top 10 names comprise 63% of the ETF, it is a top heavy fund. Once again, Tesla has the Number One spot, with 11.88%. Daimler (OTC:DDAIF), General Motors (NYSE:GM), Toyota Motor (NYSE:TM), Honda Motor (NYSE:HMC), and Ford Motor (NYSE:F) are the other leading names on the roster.

Over the past year, the fund is up about 60%, and returned 25.5% in 2021. It hit an all-time high in recent days. Readers looking for a pure-play ETF in the automotive sector might want to research CARZ further.