Investing.com’s stocks of the week

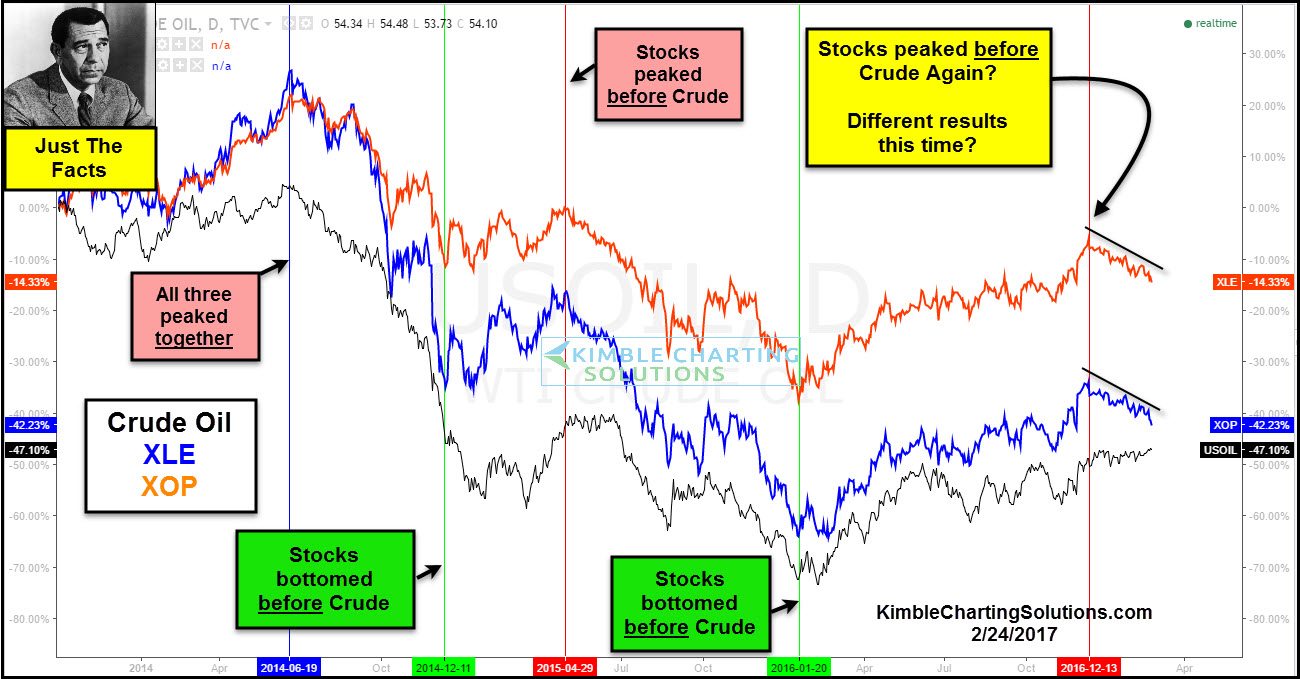

Below looks at the price action of crude oil ETF XLE along with oil and gas ETF XOP over the past three years.

Could energy stocks be pointing toward crude oil's next big move? If so, in which direction are they pointing?

At this point, crude oil's intermediate trend is up, having rallied the past year creating a series of higher lows and higher highs. Since the highs in 2014, crude is at much lower levels.

A majority of the time since 2014, both XLE and XOP have peaked or bottomed BEFORE crude oil. Lately, XLE and XOP have negatively diverged against oil, creating a series of lower highs.

Crude oil could be forming a bullish inverse head-and-shoulders pattern. Maybe that's why crude traders have established the largest bullish trade in the commodity's history. The last time the bullish bet on crude oil was this high was at the highs back in 2014.

The Big Question

Are XLE and XOP giving false signals this time? I humbly believe that crude oil may be one of the most -- if not THE most -- important commodity in the world. Which direction crude takes from its recent narrow-sideways pattern will have a large impact on portfolio construction in numerous sectors.