How about two bold election predictions—and two payouts that will thrive regardless of the results?

My first forecast: Americans will still want to eat food after November. Inflation is a hot topic on the campaign trail, but this is not a bad time to be hungry. Grain prices—corn, soybeans and wheat—are as cheap as they have been in years.

As contrarian investors, this commands our attention. Farmers are planting less corn, soybeans and wheat. The acreage is going to more profitable crops. Or, nothing at all.

Remember, the cure for low prices is low prices. Cheap grain squeezes farmers, who plant less. Their smaller harvests reduce supply while the lower prices for grain products increase consumer demand.

That demand drives product prices back up, leading farmers to plant more of the raw material grain. This is why grain—and all commodity—prices are cyclical. They rally high and crash, but rarely stay in either place for long.

1. CF Industries

Fertilizer maker CF Industries (NYSE:CF) will benefit from the upcoming rally in grain prices. CF already forecasts strong global pricing for its nitrogen fertilizers.

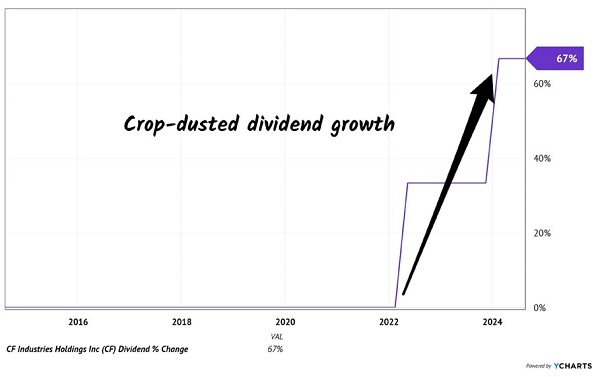

The company believes that fertilizer demand will outpace supply over the next four years. And the turnaround is already reflected in CF’s generous dividend hikes—67% combined the past two years!

A Fertile Dividend

On the surface, CF trades for a reasonable 14-times earnings. However! We know that P/E ratios aren’t real cash life for a company, due to excessive accounting leeway on how the “E” is calculated. We prefer free cash flow (FCF). You can’t fake cash.

CF is a cash cow, generating more cash flow per share than earnings (EPS). Over the past twelve months, CF banked $7.94 in FCF per share versus $5.63 in EPS.

Vanilla investors see the P/E of 14 and shrug. They miss that CF shares trade for less than 10-times FCF. Cheap. Assuming no growth, CF boasts a “free cash payback period” less than 10 years!

Meanwhile, mainstream income investors see only CF’s 2.5% current yield. They see what’s been, not the boom just around the corner.

Grain prices will rally—they always do—and when they pop, CF’s fertilizer prices will skyrocket, too. With all that cash, CF will pay us more and the “dividend magnet” will bring us sweet gains. Let’s make sure we don’t miss the next dividend mega-hike.

Let’s move on to my second post-election prediction. Americans will continue to pop pills.

2. Pfizer

Blue-chip healthcare stock Pfizer (NYSE:PFE) usually goes on sale once in a blue moon. Last time the stock was this cheap? April 2020. And before that, 2009 and 1987.

(Sigh—obligatory when anyone mentions 2020.)

After the stock market crash of 1987, PFE stock was so depressed it yielded 4.3%. Great time to buy!

And March ’09 was another PFE bargain moment. Investors who dumpster-dived locked in an incredible double-digit yield. They also quadrupled their investment over the next 11 years.

Well, here we go again. PFE yields 5.8%. A screaming deal.

PFE peaked in December 2021 during the “peak vaccination” push. Shares fell by half over the next two-and-a-half years after the situation went to normal.

Now, PFE’s long-term turnaround is beginning to pull it off the mat. The company recently bought Seagen’s (SGEN) promising oncology drug portfolio showing why, once again, we don’t worry about dry pipelines in big pharma. When they need drug candidates, these cash cows simply go buy them.

Management intends to add $25 billion in revenue between now and 2030, a 40% increase. The oncology unit is key, as is the new weight-loss treatment. Skinny pills are in, after all.

Plus, there’s Paxlovid, Pfizer’s COVID-19 treatment. The drug is well regarded as taking a significant edge off COVID (my co-author Tom Jacobs can testify to that!)—it may help Pfizer deliver some good earnings ahead.

Pfizer also has another vaccine called ABRYSVO. If you have never had RSV, well, don’t. The first time our kids brought it home from school, my wife and I thought it was a new, nasty form of COVID. Argh.

The US has approved ABRYSVO for older adults and expectant mothers. And the company wants to bring the vaccine to other age groups to target a wider range of customers.

Pfizer is always in the innovative pharma mix, but it is usually not this cheap (paying 5.8%!). This feels like another 1987/2009/2020 historical low and a great time to buy.

How about recession-resistant dividends? If sub-$75 crude oil spooks you a bit, well, I don’t blame you. Cheap oil and rising unemployment are often a one-two set of clues that a recession is here.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI