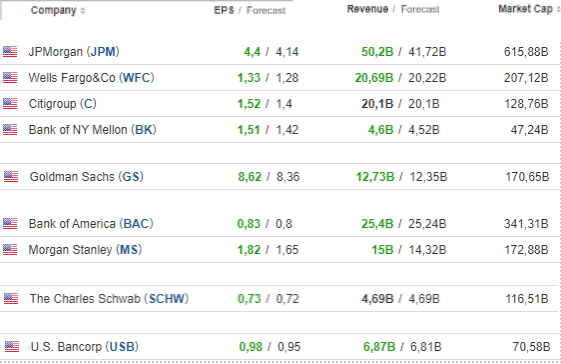

- Major US banks' earnings are now behind us.

- The decline in interest income is a common denominator despite the positive performance.

- In this piece, we identify two bank stocks that have great upside potential.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

The Q2 earnings season kicked off with a bang, with most major banks exceeding analyst expectations for both earnings per share and revenue. This positive performance has the potential to extend the sector's upward trend.

However, a cause for concern in the time ahead is the decline in interest income. This drop stems from a combination of factors: fewer loans granted due to rising interest rates, persistently high deposit rates, and increasing non-interest expenses.

A 50 bp rate cut this year could significantly benefit the banking sector by boosting lending activity. With inflation potentially trending downwards, the possibility of a Fed pivot as early as September becomes increasingly likely, potentially paving the way for a supportive interest rate environment.

With that in mind, and with most major bank earnings already behind us, let's take a look at 2 bank stocks that have the highest upside potential based on the earnings and analyst consensus.

1. Bank of New York Mellon

Bank of New York Mellon (NYSE:BK) stock surged to record highs above $65 per share after beating analyst expectations for earnings and revenue in its latest quarterly results, released on July 12th.

This 7% jump extended the stock's upward trend. However, a potential correction may be brewing, with the first price target around $61 supported by the upward trend line.

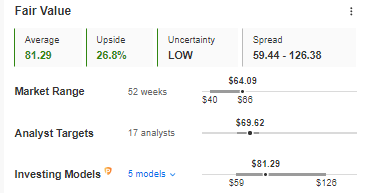

This pullback could present a buying opportunity for investors seeking a better entry point. InvestingPro's fair value index of 26.8% suggests further upside potential for BK stock.

The rebound should be a good opportunity to connect to the uptrend at a better price due to the continued upside potential suggested by InvestingPro's fair value index at 26.8%.

Source: InvestingPro

For dividend-seeking investors, time is running out. The ex-dividend date is July 22nd, so you must purchase shares before then to be eligible for the next quarterly payout.

2. Bank of America

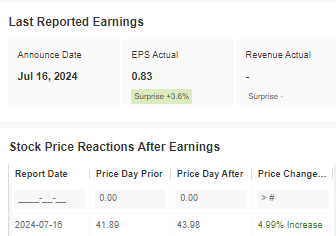

Following BNY Mellon's positive surprise, Bank of America Corp (NYSE:BAC) also impressed investors with key metrics and a 5% surge in demand.

The market cheered news of higher-than-expected income net of interest expense ($25.38 billion vs. $25.27 billion) and investment banking income ($1.56 billion vs. $1.45 billion).

Source: InvestingPro

The market was particularly optimistic on the news of higher-than-expected income net of interest expense ($25.38 billion vs. $25.27 billion) and higher investment banking income ($1.56 billion vs. $1.45 billion)

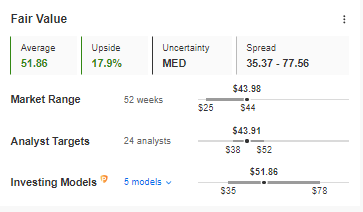

In the case of BofA, the potential for a continuation of the northward movement is also maintained, and implies an approach at least in the vicinity of $52, which would mean breaking out of new historical maximums.

Source: InvestingPro

Analysts see continued upside for BofA, with a potential climb toward $52, which would break new historical highs. The fair value index also supports this bullish outlook.

Considering these factors, the most likely scenario for the coming weeks is a continuation of the current upward trend, potentially leading to an attack on those historical highs. This assumes the status quo is maintained and the Fed implements the expected interest rate cuts in September.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.