Why use lots of words when pictures will suffice?

That’s my thinking each Friday when I select a handful of graphics to put important economic and investing news into perspective for you.

This week, I’m serving up some pretty pictures and quick-hit observations on the most obvious bubble in the world – and why not one, but two data sets suggest that it’s (almost) time to back up the truck on stocks.

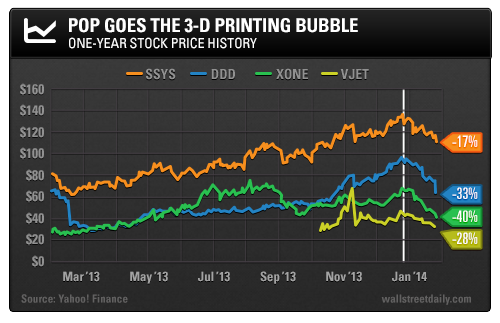

If You Heard a Popping Sound…

It’s because the 3-D printing bubble just burst.

After leading WSD Insiders to triple-digit profits (twice) in 3D Systems (DDD) – before anyone ever heard of the technology, mind you – I began warning about an imminent collapse in the space.

And it hit yesterday.

3D Systems, the biggest company in the sector, warned about future profits – sending the entire sector reeling. Get out while you can!

In other bubble-related news, social media darling, Twitter (TWTR), turned out to be a landmine. It tanked 20% on Thursday after reporting weaker-than-expected user growth.

Both serve as all-too-poignant reminders that we should always buy into out-of-this world fundamentals, not hype.

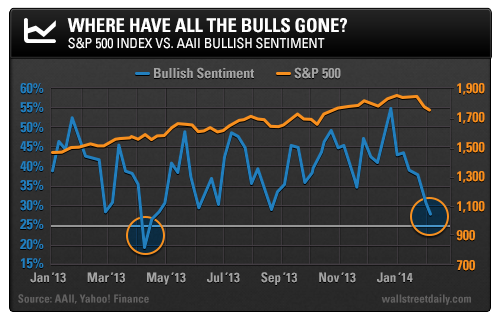

Only Three More Points to Go

On Tuesday, I put you on high alert for the release of this week’s American Association of Individual Investors’ (AAII) bullish sentiment reading. It’s out – and it’s down!

It fell another 4.3 points this week to hit 27.9%.

To think that only six weeks ago, bullish sentiment stood at a lofty 55.06%…

We’re now only 2.9 points away from the scary mathematical certainty I mentioned on Tuesday.

Remember, every time AAII bullish sentiment has dipped below 25% during this bull market, the S&P 500 Index went on to rally over the next six months.

Gas up the truck and get ready to back it up!

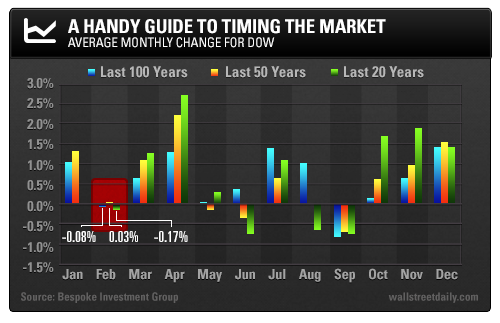

Seasonality Matters

Seasonal trading patterns also point to a contrarian buying opportunity right now.

As you can see, February is the second-worst month for the Dow. However, it’s essentially a flat month, which is followed by two of the most consistently profitable months of the year.

Chew on that before you panic and rush for the exits. You could be exiting right before the next leg higher. And I’d much rather you be counting profits, instead of nursing regret, a couple months from now.