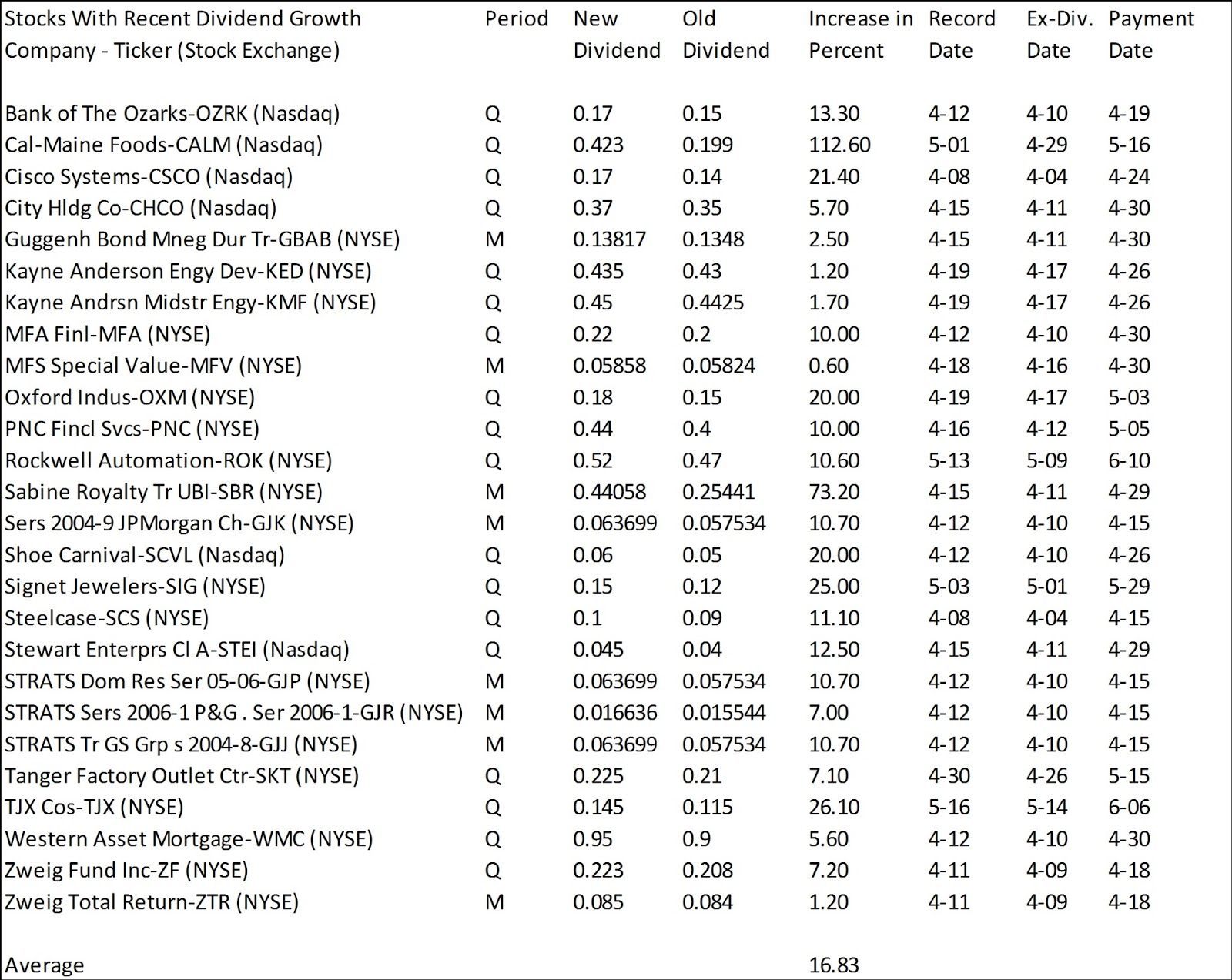

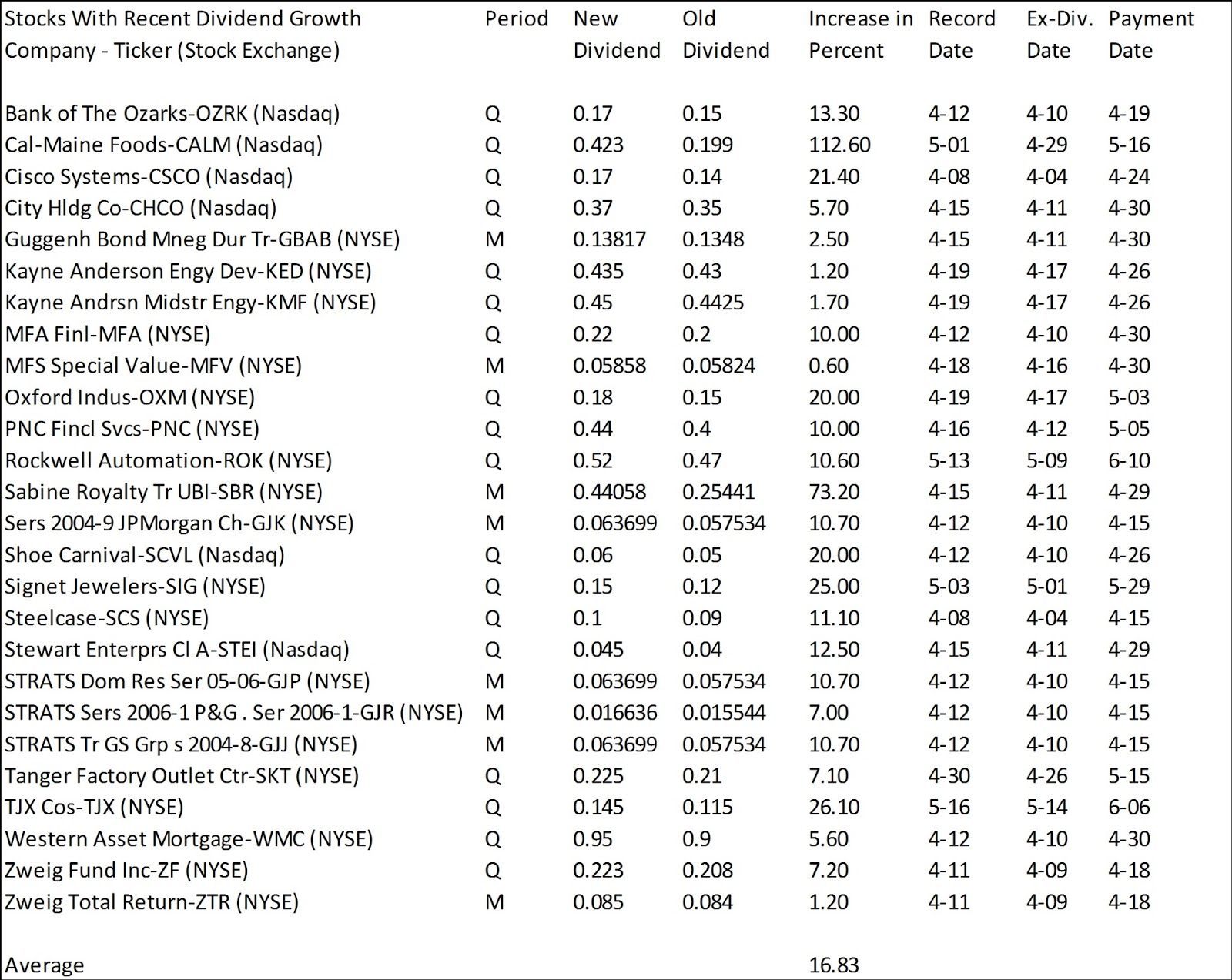

19 companies increased dividend payments last week and an additional 7 other vehicles such as funds boosted dividends to new levels.

The retailer TJX Companies (TJX) announced they were raising their dividend by 26.1 percent. The PNC Financial Services Group announced a dividend raise of 10 percent.

In total, 26 stocks and fund vehicles increased dividend payments last week of which 6 are high-yielders and 10 are currently recommended to buy. The average dividend growth amounts to 16.83 percent.

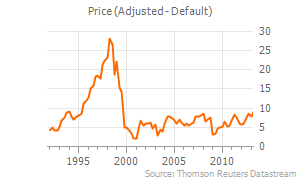

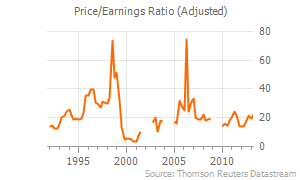

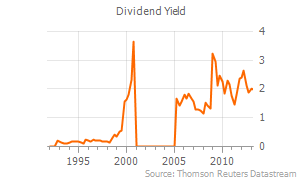

Stewart Enterprises (STEI) has a market capitalization of $775.33 million. The company employs 3,700 people, generates revenue of $516.10 million and has a net income of $37.48 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $105.84 million. The EBITDA margin is 20.51 percent (the operating margin is 15.39 percent and the net profit margin 7.26 percent).

Financial Analysis: The total debt represents 14.49 percent of the company’s assets and the total debt in relation to the equity amounts to 75.86 percent. Due to the financial situation, a return on equity of 8.74 percent was realized. Twelve trailing months earnings per share reached a value of $0.51. Last fiscal year, the company paid $0.20 in the form of dividends to shareholders.

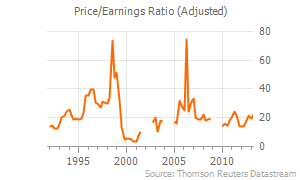

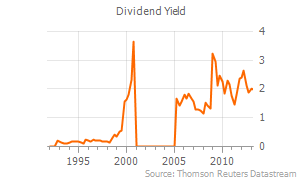

Market Valuation: Here are the price ratios of the company: The P/E ratio is 17.73, the P/S ratio is 1.50 and the P/B ratio is finally 1.82. The dividend yield amounts to 1.98 percent and the beta ratio has a value of 1.64.

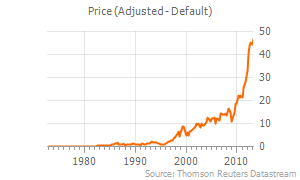

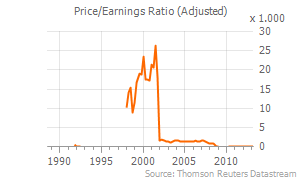

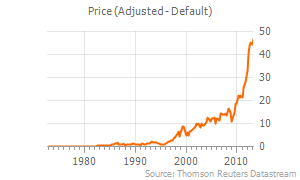

The TJX Companies (TJX) has a market capitalization of $34.12 billion. The company employs 179,000 people, generates revenue of $25.878 billion and has a net income of $1.906 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $3.615 billion. The EBITDA margin is 13.97 percent (the operating margin is 11.89 percent and the net profit margin 7.37 percent).

Financial Analysis: The total debt represents 8.14 percent of the company’s assets and the total debt in relation to the equity amounts to 21.13 percent. Due to the financial situation, a return on equity of 55.47 percent was realized. Twelve trailing months earnings per share reached a value of $2.55. Last fiscal year, the company paid $0.46 in the form of dividends to shareholders.

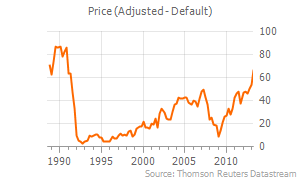

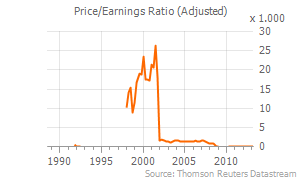

Market Valuation: Here are the price ratios of the company: The P/E ratio is 18.46, the P/S ratio is 1.32 and the P/B ratio is finally 9.31. The dividend yield amounts to 1.23 percent and the beta ratio has a value of 0.66.

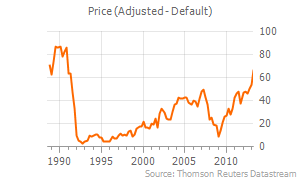

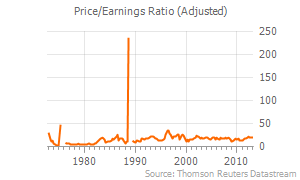

Signet Jewelers (SIG) has a market capitalization of $5.43 billion. The company employs 16,555 people, generates revenue of $3.749 billion and has a net income of $324.40 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $474.40 million. The EBITDA margin is 12.65 percent (the operating margin is 13.53 percent and the net profit margin 8.65 percent).

Financial Analysis: The total debt represents 0.00 percent of the company’s assets and the total debt in relation to the equity amounts to 0.00 percent. Due to the financial situation, a return on equity of 15.38 percent was realized. Twelve trailing months earnings per share reached a value of $4.03. Last fiscal year, the company paid $0.20 in the form of dividends to shareholders.

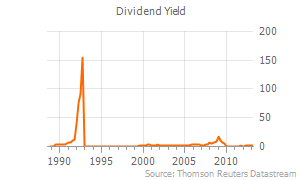

Market Valuation: Here are the price ratios of the company: The P/E ratio is 16.64, the P/S ratio is 1.45 and the P/B ratio is finally 2.55. The dividend yield amounts to 0.89 percent and the beta ratio has a value of 2.06.

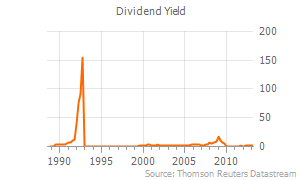

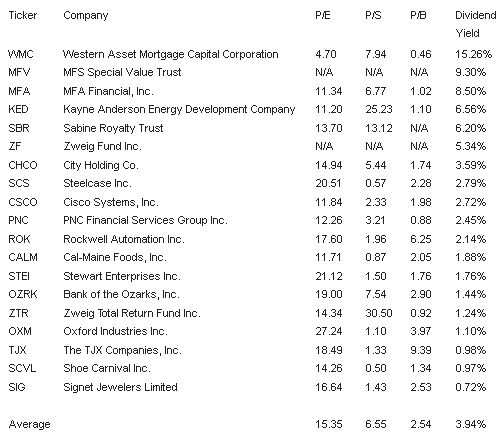

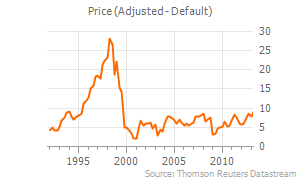

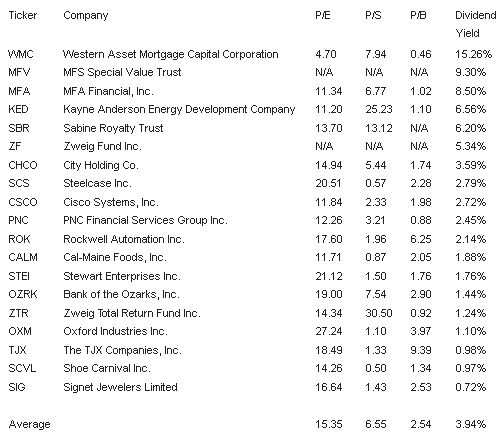

Take a closer look at the full table of stocks with recent dividend hikes. The average dividend growth amounts to 16.83 percent and the average dividend yield amounts to 3.94 percent. Stocks from the sheet are valuated with a P/E ratio of 15.35.The average P/S ratio is 6.55 and P/B 2.54.

Here are the dividend growth stocks:

Here are the market price ratios:

Related Stock Ticker:

OZRK, CALM, CSCO, CHCO, GBAB, KED, KMF, MFA, MFV, OXM, PNC, ROK, SBR,

GJK, SCVL, SIG, SCS, STEI, GJP, GJR, GJJ, TJX, WMC, ZF, ZTR

The retailer TJX Companies (TJX) announced they were raising their dividend by 26.1 percent. The PNC Financial Services Group announced a dividend raise of 10 percent.

In total, 26 stocks and fund vehicles increased dividend payments last week of which 6 are high-yielders and 10 are currently recommended to buy. The average dividend growth amounts to 16.83 percent.

Stewart Enterprises (STEI) has a market capitalization of $775.33 million. The company employs 3,700 people, generates revenue of $516.10 million and has a net income of $37.48 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $105.84 million. The EBITDA margin is 20.51 percent (the operating margin is 15.39 percent and the net profit margin 7.26 percent).

Financial Analysis: The total debt represents 14.49 percent of the company’s assets and the total debt in relation to the equity amounts to 75.86 percent. Due to the financial situation, a return on equity of 8.74 percent was realized. Twelve trailing months earnings per share reached a value of $0.51. Last fiscal year, the company paid $0.20 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 17.73, the P/S ratio is 1.50 and the P/B ratio is finally 1.82. The dividend yield amounts to 1.98 percent and the beta ratio has a value of 1.64.

The TJX Companies (TJX) has a market capitalization of $34.12 billion. The company employs 179,000 people, generates revenue of $25.878 billion and has a net income of $1.906 billion. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $3.615 billion. The EBITDA margin is 13.97 percent (the operating margin is 11.89 percent and the net profit margin 7.37 percent).

Financial Analysis: The total debt represents 8.14 percent of the company’s assets and the total debt in relation to the equity amounts to 21.13 percent. Due to the financial situation, a return on equity of 55.47 percent was realized. Twelve trailing months earnings per share reached a value of $2.55. Last fiscal year, the company paid $0.46 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 18.46, the P/S ratio is 1.32 and the P/B ratio is finally 9.31. The dividend yield amounts to 1.23 percent and the beta ratio has a value of 0.66.

Signet Jewelers (SIG) has a market capitalization of $5.43 billion. The company employs 16,555 people, generates revenue of $3.749 billion and has a net income of $324.40 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $474.40 million. The EBITDA margin is 12.65 percent (the operating margin is 13.53 percent and the net profit margin 8.65 percent).

Financial Analysis: The total debt represents 0.00 percent of the company’s assets and the total debt in relation to the equity amounts to 0.00 percent. Due to the financial situation, a return on equity of 15.38 percent was realized. Twelve trailing months earnings per share reached a value of $4.03. Last fiscal year, the company paid $0.20 in the form of dividends to shareholders.

Market Valuation: Here are the price ratios of the company: The P/E ratio is 16.64, the P/S ratio is 1.45 and the P/B ratio is finally 2.55. The dividend yield amounts to 0.89 percent and the beta ratio has a value of 2.06.

Take a closer look at the full table of stocks with recent dividend hikes. The average dividend growth amounts to 16.83 percent and the average dividend yield amounts to 3.94 percent. Stocks from the sheet are valuated with a P/E ratio of 15.35.The average P/S ratio is 6.55 and P/B 2.54.

Here are the dividend growth stocks:

Here are the market price ratios:

Related Stock Ticker:

OZRK, CALM, CSCO, CHCO, GBAB, KED, KMF, MFA, MFV, OXM, PNC, ROK, SBR,

GJK, SCVL, SIG, SCS, STEI, GJP, GJR, GJJ, TJX, WMC, ZF, ZTR